China's Evergrande Crisis Is Just The Tip Of The Iceberg

Summary

- Financial assets crashed worldwide on Monday as the second-largest property developer Evergrande collapsed.

- China has been in a property bubble for years, with home price-to-income ratios over 30X and the development of numerous vacant cities around the country.

- The PBOC already has cut bank reserve ratios many times to avoid a systemic collapse of its property bubble and has limited liquidity creation avenues left.

- Evergrande's collapse has spread to another developer, Sinic Holdings, and others may follow suit due to massive debt levels across China's real estate industry.

- The unwinding of China's property bubble may catalyze a crash in the U.S. equity market due to numerous risks facing the U.S. financial system.

Global financial markets suffered a tumultuous day on Monday as the Chinese Evergrande crisis made mainstream headlines. While Evergrande has been collapsing for weeks, the firm is nearing key default dates, which may spur a more significant liquidity crisis. Indeed, given the immense increase in the interdependence between China, the U.S, and other nations, it seems possible this crisis could have a domino effect across the world.

I have been keeping a close eye on the Chinese property market for some time. In 2018, I wrote "The $42 Trillion Bubble," which covered the immense property bubble in China. The value of all Chinese real estate has since climbed to some level above $52 trillion. For years, the question has not been whether or not the Chinese property market is in a bubble (as it is pretty obvious looking at all statistics), but when it will burst. While most Chinese equities have declined in value since 2018, the country's property bubble has only continued to mount as the PBOC has continued to push liquidity into the country to stave off a major unwind. Most importantly, how China's leadership will react to such an unwind and whether or not its effects will spread to the United States. All of these critical questions may be answered over the coming weeks.

How Large The Evergrande Crisis Truly Is

Evergrande Group (OTCPK:EGRNF) was, up until recently, China's second-largest property developer with total debt above $300 billion. The company's crisis began as the Chinese government tightened leverage restrictions on its exuberant property market. The second causal factor has been an immense increase in construction material costs due to global inflation and supply shortages. Chinese property developers have thin profit margins and use tremendous debt, so any surprise increases to supply prices make it nearly impossible for them to break even.

Evergrande lacks the liquidity to pay suppliers, contractors, and debt investors and is attempting to offer physical assets instead of cash. However, retail investors in China, which have not experienced a financial shock of this magnitude in decades, remain upset and held Evergrande management employees hostage in their offices earlier this week. This led to a crash in the company's credit risk tolerance, causing a slew of legal cases from companies and individuals purchasing assets developed by the company.

Thus far, the property crisis in China is playing out quite similar to that of the U.S around 2007-2008. Real estate has been the go-to investment for retail investors in China for decades. Chinese investors put very little wealth into equities and nearly 70% in real estate. There's a cultural basis for this as it's a historical custom that men in China should own a home before they are married, hence the country boasts an impressive 90% homeownership rate. However, this has caused immense increases to property valuations in China which carry an estimated average price-to-income ratio of 27X (27 years of household income). This can be compared to the U.S, which, despite having peak home prices, has a property market with an average price-to-income ratio of ~4X. In major cities like Shenzhen and Hong Kong, this figure is above 46X, and rental yields are below 2%, giving those properties negative-carry costs after mortgage rates and taxes.

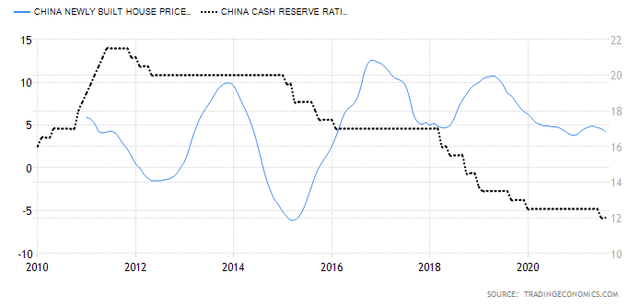

Real estate is a big business in China as most individual wealth is wrapped up in the property market, with many owning more than one apartment. Chinese people save nearly 40% of their annual income to invest in these costly properties (Americans generally save less than 8%). This exuberance has led to the development of countless nearly empty "ghost cities" and a startling vacancy rate of around 22% (vacancies are typically around 5% in the rest of the world). However, whenever property prices have declined, the People Bank of China has been quick to lower bank reserve requirements to boost liquidity. See below:

The truth is that Chinese properties were technically overvalued a decade ago. However, most of the country's wealth depends on the property market, so the government has been quick to relax bank lending requirements to allow developers and homebuyers more capital. To many investors, this has made it seem that the country's property market is "rock solid" and "will never crash," but this capital leniency also has created tremendous debt growth of over 300% of China's GDP.

While it's virtually guaranteed that China's leadership will take all possible actions to ward off a massive potential liquidity crisis, the Wizard of Oz is merely human. The fact is that all possible actions only exacerbate an already giant bubble. At this point, it seems unlikely that the PBOC will allow the country's bank reserve ratio requirement to decline too much further. The government has injected ~$14B via reserve-repo agreements into its financial system, but far more will likely be needed to stop a hundred-billion+ debt risk. The entire debt risk is so considerable that the country may experience hyperinflation if the PBOC becomes too dovish.

At this point, I believe the Chinese government can do very little besides calling a spade a spade. The PBOC already has lowered reserve requirements to low levels to stave off the crisis in the past. There's also nothing large enough that the Chinese government can do to limit the physical shortage of commodities, leading to higher costs for developers and consumers alike. The genie is already out of the bottle as Chinese retail property investors are finally becoming aware of the immense and immediate risks facing their wealth. As protests grow, the Chinese government is likely to become more concerned about limiting civil unrest than trying to continue to stop the inevitable popping of its property bubble.

The Evergrande Collapse Is Already Spreading

Today, there's still immense shock and disbelief in China and around the world. At this point, it seems most investors and analysts are focused mainly on Evergrande and not the much wider property bubble in China. The fact is that, while Evergrande has high debt, other developers like Country Garden (OTCPK:CTRYF) also carry $300B+ USD in total liabilities. Country Garden's stock is now starting to rapidly crater too (CTRYF is down 20% this month and over 40% this year) and, given its many similarities to Evergrande, may soon follow in its footsteps.

The smaller U.S listed Xinyuan Real Estate (XIN) is following a similar pattern as well. I covered the stock last year in "Xinyuan Real Estate: Expect A Dividend Cut (And Possibly Default)," which detailed the immense default risk facing the firm. After in-depth research on that firm, it became apparent that its accounts payable was skyrocketing while its cash was flat- a tell-tale sign that its "earnings" were not backed by real liquidity. This often occurs when customers struggle to meet obligations, causing the company to be owed money it may never receive. Xinyuan has also been borrowing immense amounts in order to finance hardly profitable development projects.

While this data cannot be found for most Chinese developers not listed in the U.S, I believe there's now sufficient evidence that these issues are systemic across China. Later on Monday, Shanghai-based developer Sinic Holdings Group crashed 87% and trading halted. China's credit default swaps and junk bond yields have also risen dramatically, a factor that's likely to exacerbate systemic credit risks across the Chinese market as it becomes harder for all borrowers to obtain financing.

While significant developers like Evergrande are struggling, we have still yet to see extreme declines in property prices in China. I suspect this will occur over the coming months as more Chinese people look to sell now that they realize their property investments are far from safe. As that happens and more developers struggle with default risk, Chinese banks such as the massive China Construction Bank (OTCPK:CICHY) will likely experience difficulty. Real estate loans currently make up nearly 30% of total loans in China. Chinese banks make up four out of the five largest banks globally, with the "big four" having around $14T in total assets. Evergrande's shock is significant, but it pales in comparison to the total amount of potential debt implosion we may soon see across China's highly intertwined real estate and banking industry.

The Shock Is Likely To Go Global

While properties may seem expensive in the U.S following last year's surge, they're far more costly in China. As such, Chinese buyers have led foreign investments in U.S homes over the past decade. Research from the University of Pennsylvania indicates that this has contributed to the disconnect between home price growth and wage growth in many U.S cities (particularly in California). More recently, Chinese firms have been aggressively buying U.S farmland, an issue that has stoked bipartisan legislative backlash. On the other hand, U.S investors are significant buyers of Chinese equities with roughly $1T in combined assets. However, U.S investors cannot truly own any Chinese firms, and the CCP is now making efforts to curb foreign investment.

Due to trade flows, issues in the U.S economy are more likely to hurt the Chinese economy than vice versa. Even still, there are significant interconnections between China, the U.S, and other country's financial systems. Of course, the U.S financial system has its issues. U.S risk factors include: Near-record equity valuations, minimal remaining individual investor "sidelined cash," goods and labor shortages, immense recent corporate debt growth, record (yet slipping) investor margin debt, and falling expected economic growth. All that's missing is a catalyst that will bring these issues to light. In my view, the problems facing China's property sector are large enough to do so, as implied by the widespread declines on Monday.

It's A Good Time To Reduce Risk Exposure

Many investors today have become highly complacent with the expectation that government actions will always stave off crises. Government stimulus has been a significant factor in both China and the U.S for the last decade, but it appears that repeated capital infusions have only exacerbated long-term risks. At some point, I believe these issues will become large enough that a crisis is entirely unavoidable. Indeed, many trends suggest we may be reaching that point today.

It's difficult for many to confront facts that seem alarming, but that does not mean those risk factors should be sugar-coated or disregarded. Despite everything, U.S households have never had so much of their wealth wrapped up in corporate equities, even despite low investor sentiment. As such, I believe it's an opportune time to reduce risk by increasing cash reserves. There may be a time to buy the dip, but with equity valuations where they are and the magnitude of catalyzing systemic risks in both China and the U.S, I do not believe it will be for some time.

Harrison is a financial analyst who has been writing on Seeking Alpha since 2018 and has closely followed the market for over a decade. He has professional experience in the private equity, real estate, and economic research industry. Harrison also has an academic background in financial econometrics, economic forecasting, and global monetary economics.

His promise to readers is that he will tell the truth as best he can see it, with no sugar coating and no hype - even if his view disagrees with the popular narrative (which it usually does these days).

++++++++++++++++++++++++++++++++++++++++++++++++++++

+

No comments:

Post a Comment