I still maintain Romney can beat Obama with his own lies!http://www.youtube.com/watch?v=UErR7i2onW0&sns=em

The problem is, Obama participates in a bear hug the nation loves while Romney remains aloof and often above the fray.

Would it not be nice if Obama had the b---- to bear hug Iran!

Maybe he would but Obama is too busy bear hugging our own nation and squeezing the life out of it so his radical policies can be adopted. (See 1 below.)

---

An interesting perspective. (See 2 below.)

---

Sent to me by a former associate of my firm..

In essence we have learned very little over the last 100 years. Intervention by government, as Reagan told us, often creates more problems than a solutions. Our economy is/was more than capable of healing itself but politicians cannot stand idly by and Obama, in particular. So he reacted and wound up creating the mess he now would like to blame on GW. However, after three years of doing so that dog no longer hunts. So what to do? Do as Clinton did and say no president, not even he, could have done any better.

Consequently, re-elect Obama for another four years on the hope he will do better. (See 3 below.)

---

This from a friend and fellow memo reader, Her take on Obama and the bear hug! "I thought it made him look small & weak. And cocky. Couldn't even show warmth & embrace the guy back."

---

From my friend Stella Paul who believes what she wrote a year ago remains relevant. (See 4 below.)

---

Obama declines opportunity for Netanyahu to sit with him but rather offers an empty chair. (See 5 below.)

----

Dick

---------------------------------------------------------------------------------------------------------------------

1)Barack Obama Vs. Mitt Romney: 10 Big Differences Going "Forward"

By John Hawkins

Forward is not a destination. If you'd asked Hitler, Stalin, Pol Pot or their supporters if they were taking their nations forward, they'd have undoubtedly said "yes." Mussolini? Forward. Napoleon? Forward. Genghis Khan? Forward. Of course, Churchill, Thatcher, and Reagan would have said "forward" as well. So, that's why it's important to ask what difference it would make if we go forward for four years under Mitt Romney as opposed to going forward for another four years under Barack Obama.

1) Mitt Romney would try to reduce tax rates for the wealthy and corporations to spur economic growth. On the other hand, Barack Obama is likely to try to raise taxes not just on the rich and corporations, but on the middle class. He really wouldn't have much choice. Despite the class warfare rhetoric you're hearing, there is far more money that can be confiscated from the vast middle class than there is to be plundered from the relatively thin ranks of the wealthy. If you believe tax increases are the answer, then you go after the middle class for the same reason Willie Sutton said he robbed banks: "because that's where the money is."

2) Barack Obama has run trillion dollar plus deficits every year he's been in office and given that everything he wants to do comes with a large price tag attached, there's no reason to think the next four years would be any different than the last four years. At a minimum, that would mean further downgrades of our nation's credit rating, but it's possible it could precipitate a full-on Greek style financial crisis if investors conclude their money isn't safe here. On the other hand, Mitt Romney would be under tremendous pressure from his right to reduce the deficit and a further credit downgrade on his watch would be a devastating political blow that he'd be highly motivated to avoid. Romney wouldn't have it easy since Obama would be leaving him a full-on budgetary disaster to deal with, but he'd have little choice other than to make cuts if he wants to be reelected in 2016.

3) Barack Obama has made encouraging dependence part of his electoral strategy. The more Americans that are dependent on the government for unemployment insurance, food stamps, and welfare, the more votes he believes the Democrats will get. In order to swell the welfare rolls, he’s no longer demanding that welfare recipients work for their handout. Mitt Romney opposes that change and would put the work requirements back into welfare.

4) If Barack Obama is reelected, we should expect no serious attempts at entitlement reform in the next four years. That's very problematic because nobody wants to cut a deal that impacts current retirees which means any change will impact people 55 and younger. So every year we wait, we end up with more Americans in an unsustainable system. The longer we go without making a change, the more likely it becomes that we'll be forced, under financial duress of the sort Greece is facing, to dramatically cut benefits for people who already rely on the program. Of course, there are no guarantees Mitt Romney could reach a deal with Democrats in Congress, but he will at least try to make it happen. Barack Obama won’t.

5) The Supreme Court currently has four doctrinaire liberal justices (Kagan, Sotomayor, Ginsburg, and Breyer), three conservative originalist justices (Alito, Thomas, Scalia) and two right leaning moderates (Roberts, Kennedy). Four of the justices, Ginsburg (79), Scalia (76), Kennedy (75), and Breyer (73) are over 70. Given the ideological split of the SCOTUS and the ages of the judges, the next President may have an opportunity to create a historic shift on the Court. Replacing a single justice with an ideological opposite could be a decisive factor on cases from Roe v. Wade to Citizens United v. Federal Election Commission.

6) We currently have a de facto amnesty for illegal aliens who haven't committed a felony in the United States. All they have to do is claim that they went to school here and they're automatically released without verification. If that continues for another four years, millions more illegals will pour into the United States and Obama will encourage them to settle in for the long haul. On the other hand, Mitt Romney would be likely to continue to improve border security and deport illegal aliens who are captured. In fact, his supporters during the primary, like Ann Coulter, were touting him as the toughest GOP candidate on illegal immigration.

7) Obama has taken over the student loan program, frittered away billions in bad loans to companies like Solyndra, and proudly proclaims his partial takeover of GM and Chevrolet to be a success despite the fact the taxpayers lost 25 billion on the deal. If Barack Obama is reelected, expect more government takeovers and bailouts. In fact, Dodd-Frank, which Obama supports and Romney opposes, has bank bailouts built into the law. If Romney can, he will repeal Dodd-Frank, he won't be interested in any more government takeovers of industry, and the Tea Partiers in his base would so adamantly oppose any more bailouts that going down that path would probably make him unelectable.

8) The housing market was terrible when Barack Obama came into office and not only has he done little to improve the situation for people who currently own homes, the root causes of the crash are still in place. The government is still demanding that loans be given to people who can't afford them. Fannie and Freddie are still handling 90% of all new mortgages. Mitt Romney will make it easier for people with good credit to get homes, will stop applying pressure to give loans to poor risks, and will force Freddie and Fannie to slowly and responsibly reduce the number of home mortgages they're covering so that if, God forbid, there's another crash one day, taxpayers don't get stuck with the bill.

9) If Barack Obama is reelected, Obamacare will go into effect in 2014 and many companies will stop offering insurance, it will be harder to find a doctor, the quality of medical care will drop, costs will explode, and death panels, along with the IRS, will become permanently involved in your health care. If Mitt Romney is elected, this won't happen. Romney would also try to push through a replacement plan for Obamacare, but chances are Democrats would block it.

10) At some point, you have to expect that the natural vitality of the economy will reassert itself no matter who's in the White House. However, it is also entirely possible that the hostile, unpredictable business environment created by the Obama Administration could keep the economy just as stagnant for the next four years as it has been for the last four. Romney's pro-business administration along with his attempts to cut taxes and regulations will encourage growth and put Americans back to work. What would we rather have? Four years of hate, demonization, and class warfare aimed at small business owners because they'll never be able to do their "fair share" in Barack Obama's eyes or would we rather have a growing, thriving economy again?

--------------------------------------------------------------------------------------------------------------------------------------

2)A Decade of Volatility: Demographics, Debt, and Deflation

By John Mauldin

Harry Dent gave a speech I listened to a while back, and I got him to transcribe it for this week's Outside the Box. One thing about Harry is, you are never left wondering what he thinks about a topic. He sees inevitable demography-caused deflation in our future and makes some very intriguing arguments that deserve pondering.

A Decade of Volatility: Demographics, Debt, and Deflation

Most of you reading this expect inflation in the years ahead, right? Well, I don't. In fact, I am firmly in the deflation camp.

Just think about it. What has happened after every major debt bubble in history? What happened after the 1873-74 bubble? Or after the 1929-32 bubble? Did prices inflate or deflate?

We got deflation in prices… every time.

This time around, with the latest bubble peaking in 2007/08, the outcome will be exactly the same. There is deflation ahead. Expect it. Prepare for it.

But the bubble-bust cycle that history has allowed us to see is not the only reason I'm so certain we're heading for deflation and a great crash ahead. I have other, irrefutable evidence…

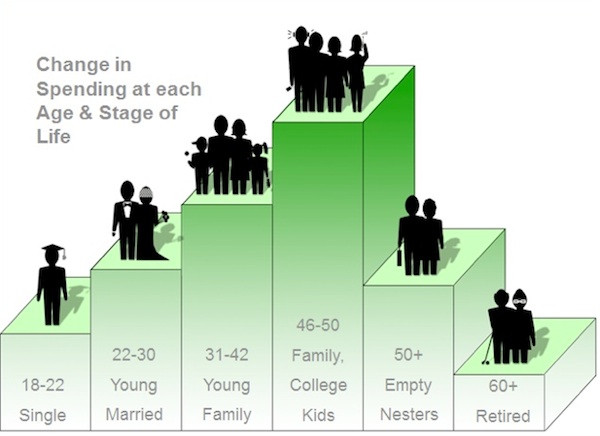

For one, there is the most powerful economic force on Earth: demographics. More specifically, the power of the number 46. You see, that's the age at which the average household peaks in spending.

When the average kid is born, the average parent is 28. They buy their first home when they're 31… after they had those kids. When the kids age into nasty teenagers, the parents buy a bigger house so they can have space. They do this between the ages of 37 and 42. Their mortgage debt peaks at age 41. And like I said, their spending peaks at around 46.

From cradle to grave, people do predictable things… and we can see these trends clearly in different sectors of our economy, from housing to investing, borrowing and spending, decades in advance.

This demographic cycle made the crash in the '30s and the slowdown in the '70s unavoidable. Now it is happening again... with the biggest generation in history – the Baby Boomers.

Consumer spending makes up more than two-thirds of our gross domestic product (GDP). So knowing when people are going to spend more or less is an incredibly powerful tool to have. It tells you, with uncanny accuracy, when economies will grow or slow.

Why Deflation Is the Endgame

Think of it this way: the government is hellbent on inflating. It's doing so by creating debt through its quantitative easing programs (just for starters). But what's the private sector doing? It's deflating.

And the private sector is definitely the elephant in the room. How much private debt did we have at the top of the bubble? $42 trillion. How much public debt did we have back then? $14 trillion.

That looks like a no-brainer to me. Private outweighs public three to one. And the private sector is deleveraging as fast as it can, just like what happened in the 1870s and 1930s. History shows us that the private sector always ends up winning the inflation-deflation fight.

Now, I will concede that this is an unprecedented time. Today governments around the world have both the tools and the determination to fight deflation. And they are desperate to keep it at bay because they know how nasty it is (they, too, are students of history).

How bad is it? Think of deflation like what your body would do with bad sushi. It would flush it out as fast as possible. That's what our system is trying to do with all the debt we accumulated during the boom years. It's what the system did in the 1930s. Back then we went from almost 200% debt-to-GDP to just 50% in three years. It hurt like hell. The government doesn't want this painful deleveraging.

The problem is, the longer the government tries to fight this bad sushi, the sicklier the system becomes. I know this because it's what happened to Japan…

Japan's bubble peaked in the '80s. When the unavoidable deleveraging process began, the country did everything in its power to stop it. How is Japan doing today, 20 years after its crash? It is still at rock bottom. Its stock market is still down 75%.

Japan has gone through everything we'll go through in the next few years. Does Japan have an inflation problem? That's a rhetorical question. Did its central bank stimulate frantically? Also a rhetorical question.

Think of it another way: what is the biggest single cost of living today? Is it gold? Oil? Food? It's none of these. It is housing. And what is housing doing? Dropping like a rock. It can't muster a bounce, despite the lowest mortgage rates in history and the strongest stimulus programs anywhere… ever.

The Fed is fighting deflation purposely. It will fail.

Why the Fed Will Fail in All Its Efforts

There is simply no way the Fed can win the battle it's currently waging against deflation, because there are 76 million Baby Boomers who increasingly want to save, not spend. Old people don't buy houses!

At the top of the housing boom in recent years, we had the typical upper-middle-class family living in a 4,000-square-foot McMansion. About ten years from now, what will they do? They'll downsize to a 2,000-square-foot townhouse. What do they need all those bedrooms for? The kids are gone. They don't visit anymore. Ten years after that, where are they? They're in 200-square-foot nursing home. Ten years later, where are they? They're in a 20-square-foot grave plot.

That's the future of real estate. That's why real estate has not bounced in Japan after 21 years. That's why it won't bounce here in the US either. For every young couple that gets married, has babies, and buys a house, there's an older couple moving into a nursing home or dying.

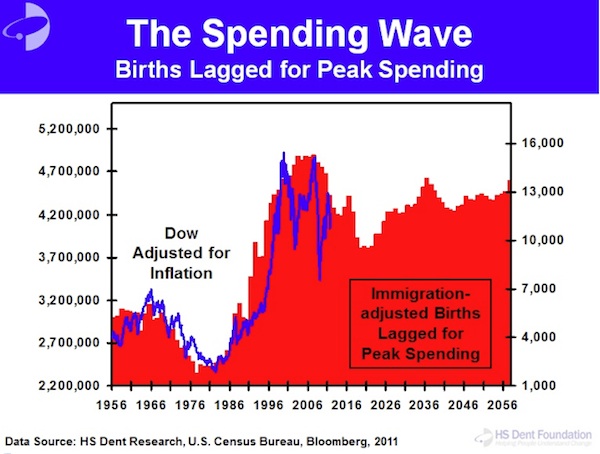

I watch this same demographic force move through and affect every other sector of the economy. The tool I use to do so is my Spending Wave. This is a 46-year leading indicator with a predictable peak in spending of the average household.

Here's how it works: the red background in the chart above is the Dow, adjusted for inflation. The blue line is the spending wave, including immigration-adjusted births and lagged by 46 years to indicate peak spending. If you ask me, that correlation is striking.

The Baby Boom birth index above started to rise in 1937. It continued to rise until 1961 before it fell. Add 46 to 1937, and you get a boom that starts in 1983. Add 46 to 61, and you get a boom that ends in 2007.

Today demographics matters more than ever because of the 76 million Baby Boomers moving through the economy. That's why I don't watch governments until they start reacting in desperation. Then I adjust my forecasts accordingly.

Don't Hold Your Breath for the Echo Boomer Generation

But all this talk about Baby Boomers inevitably births the question: "Surely the Echo Boom generation is coming up right behind their parents. They'll fill the holes, right?"

Let me make this clear. If I hear one more nutcase on CNBC say, "The Echo Boom generation is bigger than the Baby Boom," I might go ballistic. They are wrong. The Echo Boomer generation is NOT bigger than the Baby Boom generation. In fact, it's the first generation in history that's not larger than its predecessor is, even when accounting for immigrants.

It's not all doom and gloom, though. We will see another boom around 2020-23. But for now, all the Western countries will slow, thanks to the downward demographic trend sweeping the world. Some are slowing faster than others are. For example, Japan is slowing the fastest (it actually committed demographic kamikaze, but that's a discussion for another day). Southern Europe is next along in its decline. Eastern Europe, Russia, and Asia are following quickly behind.

Which brings me back to my point: there is no threat of serious inflation ahead. Rather, deflation is the order of the day. The Fed thinks it can prevent a crash by getting people to spend. To that I say, "Good luck." Old people don't spend money. They bribe the grandkids, and they go on cruises where they just stuff themselves with food and booze.

Do you know how to tell if you're buying a car from an older person? It's going to be ten years old and have only 40,000 miles on it. They drive 4,000 miles a year. They just go down the street to get a Starbucks coffee and a newspaper. Then they go back home. How do you know you're buying a car from a soccer mom? It's driven 20,000 miles a year, carting the kids around all day… to school, soccer practice, whatever. This is the power of demographics.

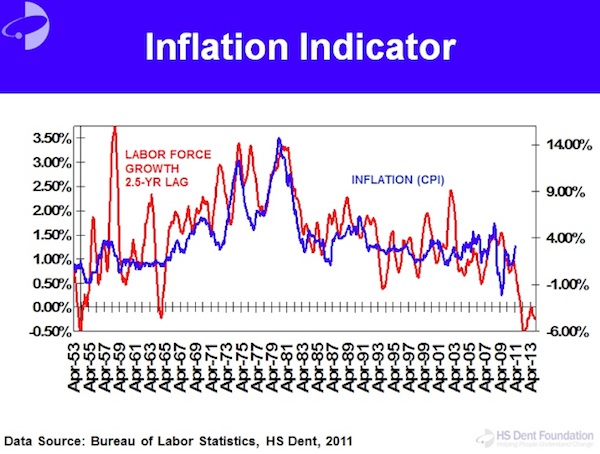

So let me tell you what causes inflation. It's young people. Young people cause inflation. They cost everything and produce nothing. That's inflation in people terms.

Why did we have high inflation in the '70s? Because Baby Boomers were in school, drinking, spending their parents' money. While this was going on, we experienced the lowest-productivity decade in the last century.

Do you remember the 1970s? We had worsening recessions as the old Bob Hope generation began to save more while the Baby Boomers entered the economy en masse… at great expense. It costs a lot of money to incorporate young people, raise them, and put them into the workforce.

Then suddenly, in the early '80s, like some political genius did something brilliant, the economy started growing like crazy, and inflation fell. You know what that was? That was the largest generation in history transitioning en masse from being expensive, rebellious, young people to highly productive yuppies with young new families. It was the move from cocaine to Rogaine.

The correlation between labor force growth and inflation is crystal clear…

When lots of young people come into the labor force, it's inflationary. When lots of old people move out of the labor force and into retirement, it's deflationary. Right now, where is the highest inflation in the world? It's in emerging countries. Do they have more old people or young people? They have more young people.

We saw it in the 1970s, we see it in emerging markets, and we'll see it ahead as the Baby Boomers head off into the sunset. First, there was inflation. Ahead is deflation. No doubt about it.

---------------------------------------------------------------------------------------------------------------------

3) Monday Morning Outlook

Better Policy, Better Recovery

Brian S. Wesbury - Chief Economist Bob Stein, CFA - Senior Economist

Politicians always shift the blame. So, hearing them say that “no one” could have cleaned up the so-called mess and fixed the economy in just a few years is not surprising.

What else do you say when after three years of recovery the unemployment rate is still at 8.1% -- down only 1.9 points since the peak almost three years ago – and real economic growth has averaged a tepid 2.2% for three years of economic recovery?

Surely, the last recession was a brutal one, which included a nasty financial crisis and a huge decline in housing prices. But the economy has been in the same or worse shape in the past and still rebounded sharply.

The bank crisis of the early 1980s was arguably more severe than in 2008 – the entire S&L industry had negative capital, oil and farm loan losses were massive and default by Latin American countries impaired large bank capital more than during the subprime crisis. Luckily, we did not have strict mark-to-market accounting back then, so multitudes of banks that were technically insolvent did not have to fail all at once.

Unemployment peaked at 10.8%. The US had double-digit inflation and interest rates. Oil prices spiked and energy was a larger share of family budgets. “Real” household income was lower in 1983 than 1969. Adjusted for inflation, the S&P 500 fell back to where it was in the early 1950s. Pension funds were in deep trouble. In other words, it’s not true that everything about the current financial and economic troubles is the “worst ever.”

What is true is that policy-makers in the 1980s acted differently. In the 1980s, the US responded to a nasty recession by trimming non-military spending, cutting marginal tax rates, holding the line on the minimum wage, de-regulating energy markets, and creating no new entitlements. In the past few years, we have gone in the exact opposite direction. Federal spending has been increased, regulations have multiplied, and government has grown. So far, tax rates have not been hiked, but everyone knows that if entitlements aren’t trimmed, higher tax rates are eventually on the way.

The differences between the two policy responses are clear. And, so are the results. Three decades ago, the economy skyrocketed into recovery. Real GDP grew at a 6.6% annual rate in 1983-84 and the jobless rate fell 3.5 points in only 21 months. This time…well…family incomes are still falling and the recovery has been tepid.

Not long ago, we would have argued that the US had learned its lesson – that the problems of the 1970s were caused by too much government – and it wouldn’t happen again. But, today, voters stand at the same fork in the road all over again. They must decide what they think of the claim that “no one” could have fixed the economy in the past few years and whether it’s appropriate for politicians to diminish our expectations. Which path will they choose? It is hugely important for the economy and financial markets.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

4)Obama and Our 9/11 Trauma

Where did the idea of Obama come from? Let's examine an obvious, yet overlooked source: the rubble of the Twin Towers. 9/11 was the most traumatic day in American history, and its horrors left deep gashes in our national soul. We stumbled around in pain and confusion for years, groping for a magical salve to heal our wounds -- and there, suddenly, was Barack Hussein Obama.

As we turn our gaze from our current Obama-induced agonies to remember the terror attacks ten years ago, let's do ourselves the favor of honesty and admit how tightly the two are connected.

On that fatal Tuesday, as the World Trade Center and Pentagon lay in ruins, President George Bush spoke to the American people, with simple words that pierced the heart of our new situation: "Freedom itself was attacked this morning... And freedom will be defended."

But as it turned out, millions of Americans were not ready to defend freedom. Despite the "United We Stand" posters plastered everywhere, Americans almost immediately divided into two irreconcilable camps: those willing to understand the nature of our enemy and those who wanted to deny it, at all cost.

Within days of the attacks, a friend coolly informed me, "the people in the Twin Towers deserved it." Still reeling from that shock, I almost lost it when another friend admiringly compared bin Laden to George Washington. Soon thereafter, a well-known academic in my circle complained that the sudden outpouring of patriotism made her sick.

This utter madness, which I thought would be confined to the fringe, rapidly spread to every corner of elite society. The more we learned about the savagery of the Islamist world, the more our moral and cultural superiors turned their wrath on us, instead of the enemy.

As headlines blared the almost surrealistic brutality of Al Qaeda, Senator Patty Murray told a group of high school honor students that Osama bin Laden was popular in poor countries because he paid for day care centers. "We haven't done that," Murray said. "How would they look at us today if we had been there helping them with some of that rather than just being the people who are going to bomb in Iraq and go to Afghanistan?"

While patriotic Americans were learning that Saddam Hussein used poison gas on his own people and gave his psychotic sons "rape rooms," American college students were learning enemy propaganda. On the eve of the Iraq war, ProfessorNicholas de Genova of Columbia University convened an anti-war teach-in and proclaimed to the students, "The only true heroes are those who find ways that help defeat the U.S. military. I personally would like to see a million Mogadishus." Despite his public yearning for the mutilation of the American soldiers who'd volunteered to defend his worthless derriere, de Genova went on to a distinguished career at Columbia and the University of Chicago.

And so it went: The more evil the enemy committed, the more hysterical grew the attacks on us by our own elites. Wall Street reporter Daniel Pearl was beheaded by Al Qaeda operatives, who filmed the procedure and proudly put it online. Al Qaeda agent Richard Reid tried to blow up a plane headed to Miami with explosives hidden in his shoe. Jihadis in Spain blew up the morning commuter trains in Madrid, killing 191 people.

Meanwhile, Majority Leader Tom Daschle brought every Democratic Senator to the premiere of Fahrenheit 9/11, Michael Moore's viciously dishonest smear job of America and its president, and led the standing ovation. The Democrats then honored Moore with a seat next to Jimmy Carter at the Democratic National Convention, serenely untroubled by Moore's gushing comparison of Saddam's armies to America's Minutemen.

The yellow brick road to Obama was paved with febrile insanity, a self-induced blindness that staunchly refused to see the massacres unfolding before our eyes. In 2005, the same year that homegrown Islamic terrorists blew up London's busses and subways, Democratic presidential candidate John Kerry went on Sunday morning television and said, "And there is no reason, Bob, that young American soldiers need to be going into the homes of Iraqis in the dead of night, terrorizing kids and children, you know, women."

A little-known incident in New York crystallized for me the obnoxious lunacy of our times. To the world, New York symbolizes the Ground Zero of pain, sacrifice and loss. Yet, New York almost immediately succumbed to self-hating delirium, desperate for vengeance against its greatest enemy: America's Commander-in-Chief. In 2006, New York State Comptroller Alan Hevesi spoke at the graduation ceremony of Queens College, a public university. Here's how heintroduced New York's Senator Charles Schumer to the fresh-faced graduates: "The man who, how do I phrase this diplomatically, who will put a bullet between the president's eyes if he could get away with it."

And thus, from the ashes of the World Trade Center arose Barack Hussein Obama -- the One who would redeem us, floating above the world like a multicultural Messiah. He bore a miraculous name, redolent of our two worst enemies, which seemed to promise some sort of divine intervention. He offered us the Muslim heritage of his father as a magical shield, deflecting the homicidal rage of seething hordes in scary, far-off places, and preserving our peace with no price to pay. His jutting jaw, tilted upwards a la Mussolini, would be our amulet, as all the world marveled at the Lightworker, the brilliant new god America had made.

The hysteria that accompanied Obama's campaign -- the fainting at his rallies, the Il Duce-like graphics, the Styrofoam Greek columns, the singing of his praises by glassy-eyed students led by enraptured cadres of apparatchik teachers -- bore no resemblance to anything that had ever happened in mainstream American politics. We tried to create a god to defend our freedom, because it was easier than the hard work needed to defend it ourselves.

Alas, the destruction that Obama wrought may ultimately dwarf the wreckage of 9/11. As we are now relearning, there are no man-made gods; only the All Mighty who never tires of teaching us that the road to freedom has no shortcuts.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

5)White House declines Netanyahu request to meet with Obama

The White House's response marks a new low in relations between Netanyahu and Obama, underscored by the fact that this is the first time Netanyahu will visit the U.S. as prime minister without meeting Obama.

The White House's response marks a new low in relations between Netanyahu and Obama, underscored by the fact that this is the first time Netanyahu will visit the U.S. as prime minister without meeting the president.

Defense Minister Ehud Barak tried to ease the tension on Tuesday, saying that the differences between the U.S. and Israel should be ironed out "but behind closed doors."

"We must not forget that the U.S. is Israel's most important source of support in terms of security," he said in a statement.

Earlier on Tuesday, Netanyahu launched an unprecedented verbal attack on the U.S. government over its stance on the Iranian nuclear program.

"The world tells Israel 'wait, there's still time'. And I say, 'Wait for what? Wait until when?' Those in the international community who refuse to put red lines before Iran don't have a moral right to place a red light before Israel," Netanyahu told reporters on Tuesday.

"Now if Iran knows that there is no red line. If Iran knows that there is no deadline, what will it do? Exactly what it's doing. It's continuing, without any interference, towards obtaining nuclear weapons capability and from there, nuclear bombs," he said.

U.S. Department of State spokeswoman Victoria Nuland stressed again on Tuesday that the U.S. administration doesn't see public discussion of Iranian nuclear program and red lines as useful. "We don't think it's particularly useful to have those conversations in public. It doesn't help the process and it doesn't help the integrity of the diplomacy. To be standing here at the podium parsing the details of the Iranian nuclear program is not helpful to getting where we want to go," she said, briefing the media.

Also on Tuesday, U.S. Defense Secretary Leon Panetta said that if Iran decides to make a nuclear weapon, the United States would have a little more than a year to act to stop it."

------------------------------------------------------------------------------------------------------------

|

No comments:

Post a Comment