---

"A Conservative Capitalist Offers: Eleven Lessons and a Bonus Lesson for Raising America's Youth Born and Yet To Be Born"

By Dick Berkowitz - Non Expert

I wrote this booklet because I believe a strong country must rest on a solid family unit.Brokaw's "Greatest Generation" has morphed into "A Confused, Dependent and Compromised Generation."

I hope this booklet will provide a guide to alter this trend.

Please Buy My Booklet - Half The Proceeds Go To "The Wounded Warrior Project!"

You can now order a .pdf version from www.brokerberko.com/book that you can download and read on your computer, or even print out if you want.

The booklet only costs $5.99.

Also feel free to forward this to anyone on your own e mail list and encourage others to order a copy.

Tom Sowell is one of me heroes. He makes sense to those with sense!

---

---

Wake up America - quit being Chicken! What is going on to destroy free speech, to pit citizen against citizen is serious and will destroy our nation.

Withdrawal, sucking up to Islamist radicals is not the road to take. It might have appeal because we are focused on our problems at home but vacuums get filled and the consequences are unpleasant.

If you think I am kidding, take the time to read these satirical responses to the desire on the part of some dangerous and dumb mayors, starting with Obama's former Chief of Staff who just got whacked by the teacher unions and who caved so as not to embarrass his former boss.

Yes, that's the same boss who believes he is entitled to another four years because of his superior achievements and because he has the time and opportunity to put the last nail in our coffin.

Then go back to the Sowell commentary above and below and connect the dots!

.

.

---

More commentary from my hero who makes sense to those with sense

---

Wake up America - quit being Chicken! What is going on to destroy free speech, to pit citizen against citizen is serious and will destroy our nation.

Withdrawal, sucking up to Islamist radicals is not the road to take. It might have appeal because we are focused on our problems at home but vacuums get filled and the consequences are unpleasant.

If you think I am kidding, take the time to read these satirical responses to the desire on the part of some dangerous and dumb mayors, starting with Obama's former Chief of Staff who just got whacked by the teacher unions and who caved so as not to embarrass his former boss.

Yes, that's the same boss who believes he is entitled to another four years because of his superior achievements and because he has the time and opportunity to put the last nail in our coffin.

Then go back to the Sowell commentary above and below and connect the dots!

.

.---

More commentary from my hero who makes sense to those with sense

---

Time running out for Europe? What about America? You decide (See 1 below.)

---

What if The Fed is wrong? (See 2 below.)

---

It is down to the wire time and Romney had better get kicking! Not too late but he must build that bridge for the disaffected Hope and Change crowd still residing on Shore Obama! They want to come over to Shore Romney but will not ford the river unless given sound reasons to do so. They are stuck with the devil they know. (See 3 below.)

---

Dick

----------------------------------------------------------------------------------------------------------

1)Nobel Winner Stiglitz: Time Running Out for Europe

European nations must share past debts to lift the burden of high interest rates on Spain and Greece and implement a banking union with deposit insurance to prevent capital flight, said Nobel Prize-winning economist Joseph Stiglitz.

“If you don’t do that, you have this adverse dynamic: the weak countries get weaker and the whole system falls apart,” Stiglitz said Monday in an interview in Geneva.

“And this has to be done fairly quickly” because in a couple of years, “there won’t be any money in Spanish banks.”

Europe is facing a crisis-fighting stalemate amid discord over a banking union, Greece’s debate on how to meet bailout commitments and foot-dragging by Spain on a possible aid bid.

European Union President Herman Van Rompuy warned against “a tendency of losing the sense of urgency” in fighting the debt crisis three years after it erupted in Greece.

“You have to have some form of mutualization of past debts,” said Stiglitz, 69, who served as chairman of President Bill Clinton’s Council of Economic Advisers from 1995 to 1997.

Delaying the implementation of a banking framework will see the situation in Europe deteriorate, he said.

“The Spanish banks will be very weak if you wait that long,” he said. “The system may fail completely or lending will become so constrained that the economy will go further down and you’re involved in a vicious downward spiral. Things are bad now, and they’re going to be getting worse.”

Failure to act will produce “uncertain political consequences,” according to Stiglitz, author of a new book entitled, “The Price of Inequality: How Today’s Divided Society Endangers Our Future.”

He isn’t optimistic because Europe’s policy makers lack urgency and continue to focus on austerity.

“I haven’t heard from the critical people in Germany and France that, no, austerity isn’t going to work, that we need a new strategy, that we need a political settlement,” he said.

Stiglitz said the one thing that gave him hope was policy makers’ repeated commitment to the euro.

--------------------------------------------------------------------------------------------------------------

2)What If the Fed Has It All Wrong?

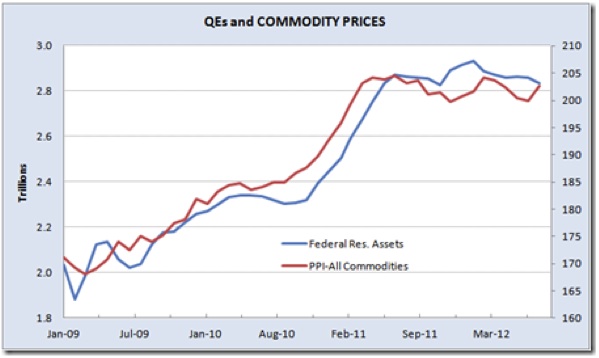

This is the 4th major intervention from the Fed since 2009, each one apparentlyinflating asset prices without having a definitive impact on the economy other than, most importantly, preventing a lethal debt-deflation spiral.

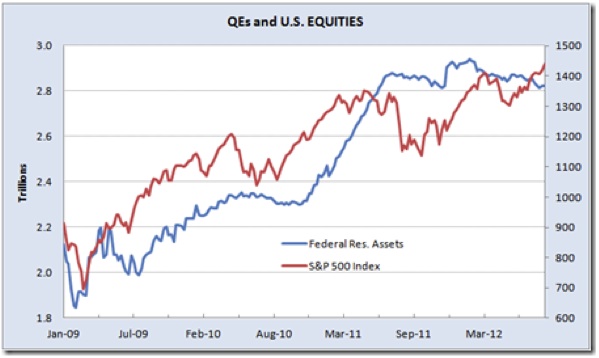

The chart above is used extensively to illustrate the close relationship between QEs and equity prices. Hence investors' Pavlovian reaction to last week's FOMC announcement of an open-ended and unlimited money printing program. Virtually every asset class rose, giving credence to Ben Bernanke's attempt to create a stimulating wealth effect.

What if the Fed has it all wrong?

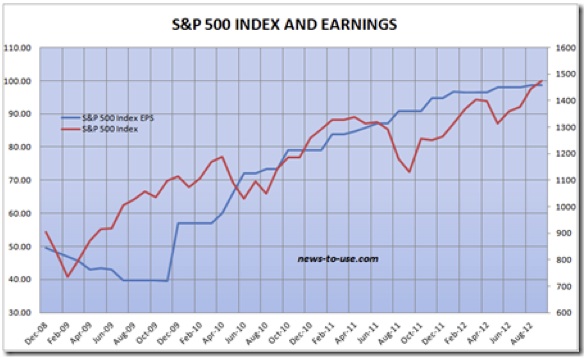

Correlation does not imply causation. Could there be another reason for the spectacular rise in equity prices since 2009? Let's try earnings, just in case that intuitive, time-tested, relationship might still be working:

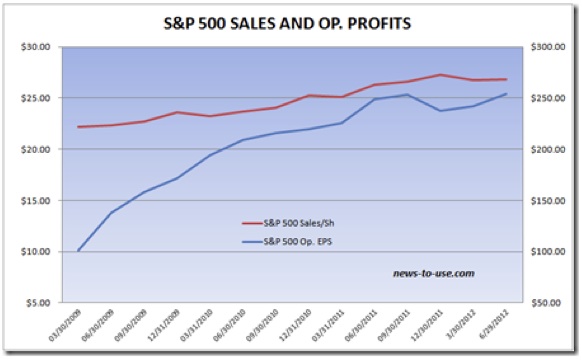

If there were a direct link between QEs and corporate profits, it should be apparent in S&P 500 company revenues. Yet, Index sales have only grown 16.5% during the last 3.5 years, nothing close to the 60% jump in Fed assets. Given that the Fed is now totally focused on growing employment, I doubt that it would take credit for the spectacular jump in profit margins since 2009, since most of it emanated from cost cutting (mostly labor) and rising productivity.

Some recent facts point to weaker earnings ahead:

• Quarterly sales and earnings have peaked in the last 9-12 months.

• Corporate profit margins are at an all-time high.

It is therefore dangerous to assume that margins will expand any further. From now on, corporations need to increase sales in order to grow their earnings. Unfortunately, demand is waning.

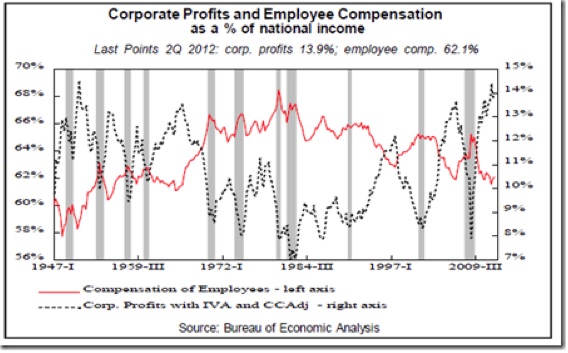

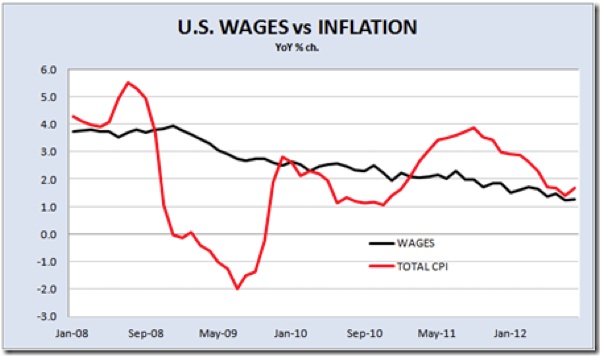

American wages, currently at a 50-year low as a percentage of GDP, are rising very slowly, so slowly that it is hampering consumer spending and the overall economy. At the time of previous QEs, also designed to create a wealth effect, wages were rising at a much faster clip than today. Furthermore, real wages were rising during 2009 and 2010, partly offsetting slow employment growth.

Today, employment growth remains below 1.5% YoY, a rate insufficient to reduce unemployment. Nominal wages are growing 1.2% while inflation is 1.7% and threatens to accelerate, in large part due to the impact that the Fed's actions are having on commodity prices, particularly oil prices.

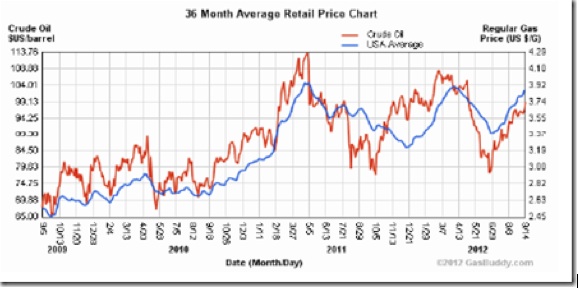

The US economy got lucky in 2011, when gasoline prices dropped 18% to $3.20/gal. just in time for the back-to-school season and Christmas. It's luck extended into 2012, when the U.S. experienced an extraordinarily warm winter. Unless something else extraordinary happens soon (SPR releases?), the exact opposite will happen to oil prices. Gasoline has jumped 16% since July, adding to the squeeze just as we enter the most important shopping period of the year (chart below from gasbuddy.com).

The following chart plots the Fed's printing with commodity prices. Unlike the relationship with equity prices, it is difficult to find anything other than excess financial liquidity to explain the spectacular rise in commodity prices. Considering how world economies have been doing lately, why is it that commodity prices have not declined significantly?

The Fed's balance sheet is set to grow another $800 billion by the end of 2013, the same amount it has increased since 2009, a period during which commodity prices jumped 20%.

The Fed wants to grow employment faster, but jobs don't grow out of thin air. Corporations create jobs when they have the means, they see a need, and there is visibility to commit. Needless to say, the last two conditions are far from being met these days. The Fed can't offset negative US politics, the European mess, nor the Chinese slowdown.

Bringing mortgage rates down further might help the slowly recovering housing sector and restart construction employment, but low wages and rising inflation remain a problem that might be perversely aggravated by the very actions the Fed is taking.

Wages are not about to accelerate, but inflation and taxation are problematic. If the American consumer can't spend, who will provide the needed spark?

Higher P/E Ratios to the Rescue?

Earnings have stalled, corporations are cutting guidance, and analysts are busy revising their estimates downward. Q3'12 estimates have been cut 8% since March and are now below Q2 earnings, which are themselves coming in much lower than originally expected. Q3 earnings are now seen down YoY.

If so, trailing 12-month EPS peaked last quarter and will decline in Q3. The earnings tailwind has disappeared.

There have been eight periods since 1935 when equities have risen in the face of declining earnings (see Banking [Betting] On Bankers?). In all cases, inflation declined along with earnings.

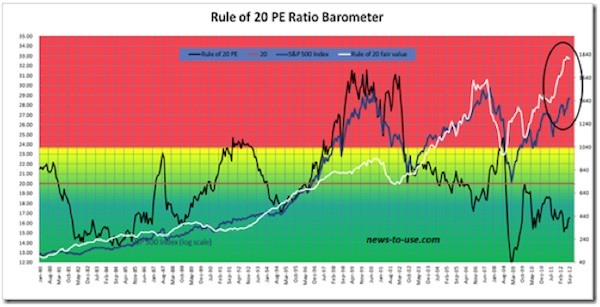

The dependable Rule of 20 says that "Fair trailing P/E = 20 minus inflation." Lower inflation begets higher P/Es. A fair P/E is thus 18.3 at the current 1.7% inflation level, 23% above the current 14.8x P/E, pointing to 1800 as fair value on the S&P 500, based on trailing EPS of $98.69. If this undervaluation is narrowed by the liquidity pumped out by the Fed, could it create enough wealth effect to push US consumers into a spending spree, in spite of negative real labor income growth?

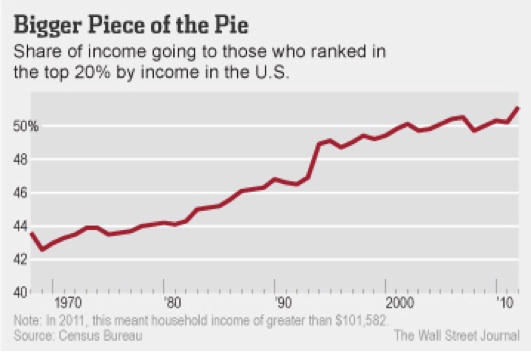

The problem with Bernanke's wealth effect thesis lies with the new reality in America. Income and assets have lately been so significantly redistributed that only a tiny few actually feel a wealth effect from rising equity prices. Here are some sad facts:

• Last year, the top 20% of households took in 51.1% of all income in 2011, up from 50.2% in 2010 and the highest share since at least 1967, according to the Census Bureau. After the top, each quintile of income earners saw their share of income decrease, with the biggest drop among middle-income earners. The middle fifth of households took in 14.3% of all income last year. (WSJ)

• In 2007, the top 20% of income earners had 53% of their financial holdings in stocks (directly and indirectly), down from 59% in 2001. Middle-income earners had 38% of their financial assets in stocks in 2007, down spectacularly from 47% in 2001.

• Stock holdings have obviously declined since 2007:

• US house values remain 30% below their 2006 peak level and now match their 2003 level.

• Total residential mortgage debt has only declined 7.5% since 2008. Some 1.5 million homes are in foreclosure, but 10.8 million homes remain in negative equity.

The "wealthy few" may feel wealthier if stocks advance, but they could nevertheless have much less after-tax income to spend when politicians finally address the looming fiscal cliff nestled within the rapidly growing mountain of debt.

Keep in mind that it is these wealthy people who run American corporations, keeping them lean and mean and flush with cash. They remember how profits literally disappeared in 18 months in 2007-08. They remember how financial markets totally froze in 2008. They see the humongous budget deficits and the debt piling on, and the not-so-distant day of reckoning. They realize that all the Qes in the world can't offset inept and irresponsible politicians on either side of the Atlantic. Yet, they are the ones targeted by the so-called wealth effect!

Call that pushing on a golden string.

Meanwhile, the less affluent, the other 80% – some 250 million people – are little concerned by an eventual wealth effect but highly, directly, and immediately impacted by the side effects of all these QEs, namely rising commodity prices and near-zero interest rates. Consider that:

• 15% of the US population lives in poverty.

• 44% of those 46.2 million poor Americans are in "deep poverty," which is half the level of the poverty line, defined as $22,811 for a family of four.

• More than 45 million Americans are in the food-stamps program, which is 15% of the population, compared with the 7.9% participation from 1970-2000. Food-stamps enrollment has been rising at a rate of 400,000 per month over the past four years. Just last month (August), nearly twice as many people went on the food-stamps program (173,000) than managed to find a new job (96,000).

• More than 11 million Americans are collecting federal disability checks.

• 11.2% of the labor force is out of work, if we include the 7 million people no longer seeking employment. This number (over 17 million workers) is unchanged since 2009.

• Full-time employment remains 1.4 million below its 2009 level. Needless to say, part-timers earn and spend considerably less.

• Most of the 43.5 million American retirees must cope with nominal interest rates, near zero through 2015, when inflation is around 2.0%.

Call that pushing on a chafed string.

Betting on Bankers?

Now that US and European central banks have delivered the financial heroin needed to compensate for inept and irresponsible politicians, should we jump back in equities?

Will professional investors drive equities higher?

The risk here is that, much like businesspeople, investors may remain cautious, given the numerous and highly complex difficulties the US and the world are facing. They will also consider that, at the time of previous QE program launches, equity markets were similarly undervalued, but many economic trends were then more positive:

• Earnings were in a strong uptrend on rising margins.

• Oil prices were much lower.

• US real wages were rising (not in 2011).

• The 2011-12 winter was one of the mildest on record in the US.

• Europe was not in recession.

• China was still growing strongly.

Interestingly, the undervaluation of equities, as measured by the Rule of 20, narrowed from 40% to 0% during QE1, from 23% to 7% during QE2, and from 19% to 14% during Operation Twist (see the black line in chart below). The recent rally has narrowed the undervaluation from 27% to 19%. It would be very surprising if we got near fair value anytime soon. If 10% undervaluation (average of QE2 and OT) is the best we can hope for, the resulting 16.5 P/E (90% of 20 minus 1.7% inflation) brings the S&P 500 to 1625, just about 10% above current levels.

That assumes that inflation stays constant at 1.7% YoY. However, gasoline prices are +7% YoY in September, after rising 1.8% in August.. If they remain unchanged until year-end, gas prices will be +18% YoY. Not only would that considerably disrupt Christmas sales, it would also help raise inflation (gasoline is 5.5% of the CPI, energy is 9.7%). If inflation rises to 2.0%, a 10% undervaluation would get the S&P 500 Index to 1565, a mere 6% above current levels.

If the Fed has it all wrong, simply pushing on golden or chafed strings, and the only effect of QE3 is to boost inflation, only God(ot) knows what will happen.

While the Fed waits for the wealth effect to take effect, the European Central Bank is also waiting for its own Godot, following Draghi's magic with the ECB rules and regulations. Super Mario's "whatever it takes" promise is powerful but not without pitfalls:

• When, if ever, will the eurozone achieve the necessary banking and fiscal unions?

• Will Spain and Italy surrender before it is too late?

• Will ever more austerity finally work?

• When will the debt spiral stop?

• How much longer will the Germans put up with the situation, accepting that the ECB ruins its balance sheet by taking on unlimited risk on behalf of the German taxpayers, risking their fiscal sovereignty to save the "reckless Southerners"?

• How much longer will the hordes of unemployed young Europeans put up with the situation?

Central bankers have indeed delivered. In truth however, they are merely experimenting with totally unproven ways and means, hoping to gain enough time until more responsible politicians emerge. Given the significant risks still facing us until Godot shows up, investors should await more evidence that either earnings will resume their uptrend or some kind of miracle will happen.

Equity holdings should be trimmed to conservative levels. Sustainable income should be favored. Cash earns essentially nothing but is safe for now. Gold remains attractive for many, many obvious reasons.

--------------------------------------------------------------------------------------------------------------

3)With Everything at Stake, Where's Mitt?

A look at the Republican presidential candidate's schedule of public events shows a remarkably relaxed pace for a man who says this election is critical to America's future. Here's what Mitt Romney did on the trail in mid-September:

No comments:

Post a Comment