Defrocking the New York Times -

US said planning to hold Netanyahu responsible for actions of far-right ministers - TOI

It is in America’s interest to end the war in Ukraine - INN

Judge Rules Heart of Lake's Lawsuit Will Go Forward - Voting Machines and Ballot Custody at Center of Case - RB

We all get heavier as we get older, because there's a lot more information in our heads. That's my story and I'm sticking to it

+++

John Bolton Says Biden’s Prisoner Swap Is “Surrender”

(NewsGlobal.com)- On Thursday, former ambassador John Bolton claimed that the prisoner swap that President Joe Biden’s administration negotiated to free WNBA star Brittney Griner was a grave error and a gift to Vladimir Putin of Russia.

In the dead of night, the administration announced that a deal had been reached with Russia in which Viktor Bout, a convicted international arms dealer, would be handed over in exchange for Griner’s release. Though many had hoped for it, the agreement did not include the release of former US Marine Paul Whelan, who is currently being held in Russia as a hostage on false spying charges.

John Bolton, who served as the National Security Adviser for the entirety of the Trump administration, was interviewed by hosts Anne-Marie Green and Vladimir Duthiers in a weighty discussion that lasted more than ten minutes and aired on CBS News Streaming Network (CBSN) on Thursday.

Bolton was asked first by Duthiers for his opinion and an explanation of how negotiations proceed in such circumstances. Bolton denounced the swap, labeling the administration’s efforts to make a deal “desperate.” Duthiers also questioned Bolton about his response and an explanation of how negotiations function in such circumstances.

Bolton stated that while getting Griner released undoubtedly evokes a great deal of human emotion that is entirely understandable, the Biden administration made a terrible error.

This was not a good deal, he said. It was not “a swap,” he declared emphatically. “This is a surrender.”

He claimed that terrorists and rogue states worldwide would take note of this, putting other Americans in danger and making them targets for those who don’t share our values and moral principles.

When questioned about Bout, Bolton declined to discuss specifics about the arms dealer but gave a sober assessment of how risky the trade might be. He also claimed that while he was in the White House, there was a chance of trading Bout for Whelan, but the deal “wasn’t made for very good reasons.” Bolton declined to get into the specifics of the failed deal.

“This is a great triumph for Moscow over Washington,” Bolton said in closing.

+++++++++++++++++++++

One of my largest holdings.

+++

Kinder Morgan: A Solid Stock For Dividend Investors

Summary

The demand for new energy facilities along the Gulf Coast will be the main driver for the company’s growth.

The company has reduced its debt significantly since 2016, while growing cash flows.

The stock offers an attractive yield of 6.3% that looks sustainable.

Kinder Morgan Terminal

Investment Rationale

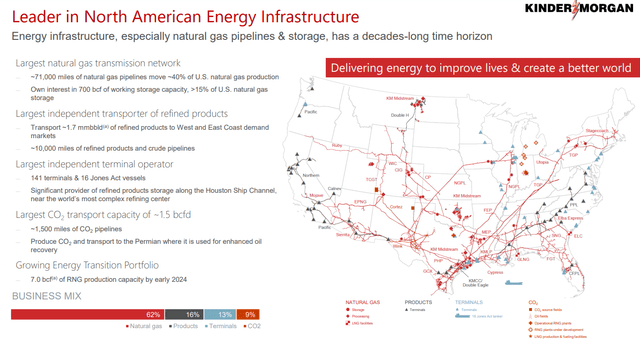

Kinder Morgan (NYSE:KMI) is a leading player in the U.S. energy infrastructure market and has great opportunities yet to be captured in the LNG space. The demand for new energy facilities along the Gulf Coast is the main driver for the company’s growth. Robust expansion of its current extensive energy pipeline is expected to help the company generate more cash flows, fueling growing returns to shareholders in the form of dividends.

About the Company

Kinder Morgan operates around 83,000 miles of pipelines and 141 terminals in North America. The company’s pipelines transport natural gas, gasoline, crude oil, carbon dioxide, and more. The terminals store and handle renewable fuels, petroleum products, chemicals, vegetable oils, and other products.

pipelines

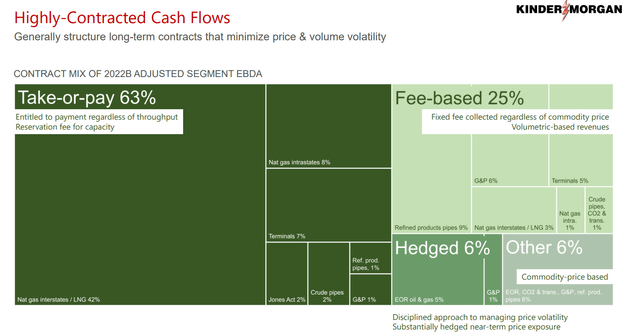

The majority of Kinder Morgan’s business is fee-based. Hence, demand plays a bigger role than commodity prices. Midstream oil & gas businesses don’t suffer as much during a crash in oil & gas prices, as they contract their assets through long-term and fixed-fee contracts which give steady cash flows irrespective of the market cycle. Likewise, these businesses don’t outperform much in an upward cycle as their potential is also capped by long-term contracts.

fee based contracts

Robust Cash Flow Generation

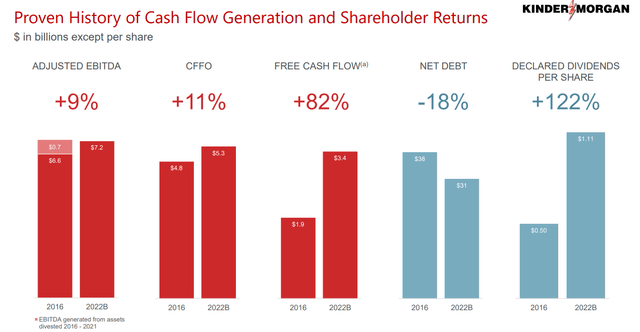

From 2016 to 2022, Kinder Morgan has generated healthy cash flows. The following image throws light upon the EBITDA, CFFO, Free Cash Flow, and Net Debt changes over five years.

Kinder Morgan

cash flow growth

The positive growth in both operating cash flows as well as free cash flow has continued for 10 years, as seen in the below chart.

The net profit margin, as well as the return on equity and return on invested capital ratios for Kinder Morgan were substantially hit by the 2020 pandemic. Currently, they are on an upward trajectory. Revival in the company’s operations is gradually expected to improve the ratios over the coming years.

Rewarding shareholders handsomely

In the third quarter of 2022, Kinder Morgan reported a distributable cash flow of $1,122 million, decently above the $1,013 million recorded in the third quarter of 2021. Adjusted Earnings reported were $575 million for the quarter as compared to $505 million in the third quarter of 2021. The company generated earnings per share of $0.25, up 14%, and DCF per share of $0.49, 10.76% up on a YoY basis. In Q4, through October 20, 2022, Kinder Morgan has repurchased about 2 million of its shares for $34 million. On a YTD basis, the company has repurchased around 21.7 million shares.

Kinder Morgan’s third-quarter performance included positive growth in revenue numbers compared to 2021 from all segments, except the product pipelines segment. Natural Gas pipelines performance was boosted by continued strong demand for transport and storage services. Terminals segment earnings increases were driven by gains in the bulk business due to continued strength in both handling rates and volumes for export coal and petroleum coke. The CO2 segment earnings improved on account of higher realized crude, natural gas liquids, and CO2 prices. The contributions from the Products Pipelines contracted due to a decline in commodity prices that impacted inventory values on the company’s transmix and crude and condensate assets.

After slashing the dividend in 2016 due to high debt, Kinder Morgan has been consistently offering growing dividend to its shareholders. The company’s DCF per share stands at $0.49 whereas its dividend per share is $0.278 which indicates that dividend is covered 1.76 times by DCF.

Focus on Renewable Energy

Along with reporting strong performance for the third quarter of 2022, Kinder Morgan is also focusing on adding renewable energy gas assets through acquisition. In August 2022, the company acquired North American Natural Resources and related companies for $135 million. This addition includes landfill-to-gas power facilities which are going to be converted by Kinder Morgan to renewable natural gas by 2024. Earlier this year, Kinder Morgan had announced a $355 million acquisition of Mas CanAm which included purchasing landfill assets comprising an RNG facility in Texas and medium-Btu RNG facilities in Texas and Louisiana.

In the third quarter, Kinder Morgan also sold off a 25.5% stake in its Elba LNG terminals to an undisclosed buyer for $565 million.

Growing Demand for LNG in the U.S.

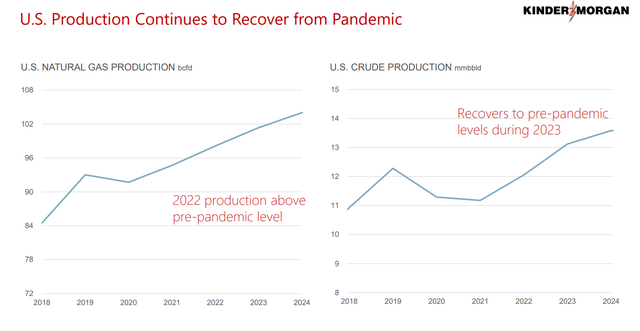

Demand for LNG is expected to rise as summer heat is rising and winter temperatures have been falling in recent years. Besides, the United States is limiting the use of coal plants to emphasize more on cleaner energy. Due to the Russia-Ukraine war, Europe is likely to turn towards the U.S. for its demand for LNG, which will boost U.S. exports. Countries in Asia like China, India, and South Korea are reducing coal consumption and are expected to incline towards more LNG consumption through this decade. The following image shows the recovering production of natural gas and crude in the U.S., as well as expected production in 2023 and 2024.

oil and gas production

Kinder Morgan owns a major portion of the natural gas pipeline infrastructure in Texas and Louisiana. Most of its demand throughput is located there. The growth in end users as well as the LNG export facilities are likely to fuel rising demand in that region in the coming years. The company currently moves about 50% of the gas consumed by the LNG facilities. This indicates that the company will continue to invest in expanding its infrastructure to cater to the increasing demand.

The company also has several projects aiding the growing LNG demand. Kinder Morgan has approved a 550 million cubic feet per day expansion of its Permian Highway Pipeline to improve the movement of natural gas from the Permian Basin to the Gulf Coast. The company is also working with other LNG developers to build pipelines connecting interstate systems to their export facilities.

LNG

reasonable Valuation

According to Price to Free Cash Flows, forward EV to EBITDA, and EV to Free Cash Flow ratios, Kinder Morgan is trading at a reasonable valuation as compared to its peer companies as seen in the below charts

The higher enterprise value multiples are a result of some major acquisitions executed by Kinder Morgan in 2022 to expand its footprint in the LNG market.

Seeking Alpha’s proprietary Quant Ratings rate Kinder Morgan as “hold.” The stock is rated low on growth but high on profitability factor.

Risks

On a TTM basis, Kinder Morgan’s Financial debt to EBITDA ratio is more than 5. Even though the ratio has been decreasing over the past three years, it is slightly higher as compared to its peer companies as seen in the below chart.

I think a debt to EBITDA ratio below 4 is considered to be reasonable. Kinder Morgan has a Financial Debt to EBITDA ratio of 5.3 which is slightly higher. If the company’s expansion plans and cash flow generation continue well, the debt can be a manageable risk, otherwise, the risk of permanent loss of capital might be increased by this debt.

Conclusion

Overall, Kinder Morgan is less risky from the perspective of exposure to a risk of a crash in oil prices as compared to the upstream and downstream companies. A key advantage is the company’s long-term fixed-price contracts. The company’s dividend coverage is strong and it is returning value to its shareholders through stock repurchases and dividend growth. Kinder Morgan’s healthy balance sheet, robust cash flow generation, improved earnings per share, focus on efficient capital allocation, steps taken towards utilizing the LNG opportunities, decent performance in equity markets, and a reasonable valuation make it attractive for dividend investors.

We provide end-to-end financial research services across asset classes. We are passionate about stocks and investments. We take pride in providing invaluable investing insights in an easy-to-understand way. .Chandan Khandelwal leads RCK, as its co-founder & CEO. He is a Chartered Accountant and Financial Consultant with more than 15 years of experience in Finance, Stock Market, Assurance and Business Advisory.

Show more

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

+++++++++++++++++++++++++

More BS destruction of our military.

https://americanmilitarynews.c

+++

Bibi forms his government.

+++

Mission accomplished: Netanyahu to proclaim success in forming a government later today

Compromises abound but at least one statement of principles will be signed today, sources say

As his mandate to form a government expires, Likud party head Benjamin Netanyahu is expected to notify President Isaac Herzog by telephone on Wednesday that he has succeeded in crafting a coalition.

According to a report on Kan News, the Likud plans to sign at least one agreement detailing the incoming government's principles with the other coalition parties at some point during the day.

For the time being, the Likud and haredi party representatives have decided to postpone their signing of an agreement on the specifics of the Draft Law until after the establishment of the government. As such, the principles underlying the law will not be specified in the coalition agreement; instead, a few sentences will be included, highlighting the importance of Torah study and the need to ensure that Torah scholars can continue to study. The agreement will also include a commitment to legislate a Basic Law: Torah study, parallel to the Draft Law.

During the next few days prior to the swearing-in of the new government, Prime Minister-designate Netanyahu will be attending to the distribution of portfolios to the members of his own party.

According to the Maariv newspaper, Netanyahu is considering creative solutions in order to solve the thorny question of how to satisfy the demands and expectations of numerous veteran Likud politicians with only a few significant portfolios available. According to sources within the Likud, several days ago MK Yisrael Katz received an unofficial offer to serve as Foreign Minister in a rotation with MK Amir Ohana, with Katz serving in the position for the first two years of the term.

The sources say that the "rotation solution" is likely to be extensively used in the incoming government, given the large number of experienced Likud politicians expecting to be granted a seat around the cabinet table.

++++++++++++++

It is a crime that there is so much crime in Chicago. How do you learn to duck bullets?

+++

Chicago News Is Nothing but Crime

By Joseph Epstein

Some years ago I stopped reading either of Chicago’s two local papers, the Tribune and the Sun-Times, those other vehicles of local news. Each paper grows thinner and thinner and, I am told by their readers, dimmer and dimmer. Local news isn’t readily available online. What brings me back time and again to local television is my continued interest in sports. Local stations provide scores, news of injuries, trades and the rest along with the weather, though I can get the latter, minus all the unnecessary flashy graphics, from my lady friend Alexa.

I long ago ceased to look to the nightly news for pleasing items (“Boy Rescues Dog,” “Stradivarius Found,” “Cookie Sale Planned”), which seem to have mostly disappeared. One of my local stations does feature an occasional segment called “Making Chicago Proud.” It spotlights people who supply meals or books or winter coats to families in poor neighborhoods. This segment scarcely offers any counterbalance to the ones Making Chicago Dreary.

So rampant has crime in all its varieties become that no neighborhood in Chicago is free from it. Owing to local television news, I learn about gang murders where stray bullets kill innocent victims (often children) on the city’s South and West sides, but now also carjackings and other robberies in the once-safe neighborhood where I grew up. Retail stores on plush Michigan Avenue have been ransacked. Formerly serene suburbs have experienced murders. Two people were killed recently near a restaurant I frequent. All this is brought home to me nightly by local television news.

At the end of a report on a crime, more often than not the reporter will say, “No suspect is in custody.” Not reassuring, that. Saddest of all perhaps are the interviews with victims or, if they are no longer alive, their families and friends, who tearfully beseech the criminals to turn themselves in, so justice can be done for the deceased. Yeah, right.

In connection with all this crime, local news in Chicago will often feature interviews with Cook County prosecutor Kim Foxx, Chicago Mayor Lori Lightfoot or police chief David Brown. In their rather pathetic attempts to maintain that everything is under control, the appearance of all three only provides additional discouragement. In her various pronunciamentos, Ms. Lightfoot is especially adept at self-righteously conveying a sense of hopelessness.

The local news anchors do their best to keep up a cheerful mien. But the gloom of what they have to report only makes these attempts seem foolish. “Elderly woman beaten, killed in carjacking.” Not many laughs there.

Is turning my back on all the wretched news on local television uncitizenly, which is to say irresponsible? Is it even safe? Shouldn’t I know how bad things have become in the city? Can I live without local television news? Or, quite as much to the point, can I continue to live with it?

Mr. Epstein is author, most recently, of “Gallimaufry: A Collection of Essays, Reviews, Bits.”

%20(1)%20(4)%20(1)%20(1).jpg)

No comments:

Post a Comment