+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Two of Kim Strassel's delightful kids catch their first King Salmon.

+++++++++++++++++++++++++++++++++++++++++

I took a day off from the beach and listened to Agent Strzok’s testimony and have several comments:

First, rather than receiving a Purple Heart, which, in my humble opinion, would demean the heroism of millions of American military personnel; I could easily envision a call to central casting asking for an officer in Himmler's SS and it would produce another Strzok. His close cropped hair, his arrogant smirk and, worst of all, his espousal of his brand of patriotism, his belief that everyone in The FBI is so perfectly trained and supervised they are untouchables, beyond reproach.

He basically suggested FBI employees are so high minded and ethical, love this nation beyond ordinary citizens and are so curbed by rules and regulations they are all super heroes and thus, bias could not possibly impact his testimony notwithstanding his despicable e-mails to his paramour., Lisa Page.

Perhaps Strzok is correct. FBI Agents are so Godly they are not human and we should not hold them to human standards beginning with truthfulness.

Second, Democrats on the committee were not seeking facts and/or revelations that would help the public to learn what happened and what went wrong. It is pretty evident, Strzok lives in his own world and testified in a manner that leaves one believing we owe him a debt of gratitude for wanting to save the union from a duly elected man named Donald Trump. One has to wonder where his horse was parked while he was testifying.

Third, by his testifying before his paramour Page, she might now testify knowing what her lover said so she can shape her testimony accordingly.

I seriously doubt Americans feel better about Congress and The FBI after this hearing because Democrats are not interested in anything’s beyond protecting and/or perpetuating what they want us to believe, ie.Russia was involved in our election and Trump is guilty of collusion. ( Yet, we all heard Obama whisper 'tell Putin I can be more flexible after the election.')

Obstruction is the goal of the Democrats and finding truth is the last thing they want because it actually leads to their own doorstep in the guise of a document called the Steele Dossier paid for by Clinton and the DNC.

As for Republicans they engaged in some tough badgering of Prince Charming but he deserved as much because he did everything in his power, and quite effectively I must add, to paint himself as the unblemished hero.

I am not demeaning the intent of those who serve in The FBI . However, if they are all Strzok's, America is in real trouble.(See 1 below.)

++++++++++++++++++++++++++++++++++

We all know Putin is a barrel chested KGB thug and our president, according to Democrats, Maxine Waters and our unbiased FBI, is no match. Donald Trump is a playboy real estate casino gambling mogul who has an emotional thing for Putin. Perhaps they are secret lovers or, even worse. Perhaps Putin knows Trump slept with all of his pageant contestants when he was in Russia. What we do know is Jack Kennedy was involved with a Russian spy during his presidency and it drove J Edgar nuts when he wasn't busy cross dressing. (See 2 below.)

++++++++++++++++++++++++++++++++++++

John Mauldin is correct about the wheels coming off due to mounting world indebtedness. This has been a concern of mine for years and was heightened by Obama's 8 years and debt continuance under Trump, partly because Democrats held him hostage tregarding his desired spending.

The issue that no one can predict is when. One day our government will seek buyers for bonds and no one will show up to bid. (See 3 below in an abbreviated form.)

++++++++++++++++++++++++++++++++++++

Hamas keeps hammering away at Israel and soon the IDF will have no alternative but to take their hammer away and nail them.IlLong for that day. The Europeans and fellow hangers on in our country will rise in rage, The U.N will attack Israel for an imbalanced response and , well, you know the script. We have seen it so many times it no longer produces more than biased headlines. (See 4 below.)

++++++++++++++++++++++++++++++++

John Mauldin is correct about the wheels coming off due to mounting world indebtedness. This has been a concern of mine for years and was heightened by Obama's 8 years and debt continuance under Trump, partly because Democrats held him hostage tregarding his desired spending.

The issue that no one can predict is when. One day our government will seek buyers for bonds and no one will show up to bid. (See 3 below in an abbreviated form.)

++++++++++++++++++++++++++++++++++++

Hamas keeps hammering away at Israel and soon the IDF will have no alternative but to take their hammer away and nail them.IlLong for that day. The Europeans and fellow hangers on in our country will rise in rage, The U.N will attack Israel for an imbalanced response and , well, you know the script. We have seen it so many times it no longer produces more than biased headlines. (See 4 below.)

++++++++++++++++++++++++++++++++

Dick

++++++++++++++++++++++++++++++++++++++++++1) After the Strzok Stonewall

Here’s what Trump should declassify if he wants the truth known.

By The Editorial Board

FBI agent Peter Strzok’s appearance before Congress Thursday was a predictable political circus, and here’s what we learned: President Trump will have to declassify a host of documents if he wants Americans to learn. Mr. Strzok was combative, and he pointed to an FBI lawyer in the room as reason not to disclose much of anything about his investigation into the Russia connections of the Trump campaign. Under pressure from Ohio’s Jim Jordan, Mr. Strzok did reveal that Justice Department official Bruce Ohr acted as a channel between the opposition-research firm Fusion GPS and the FBI in 2016. We already knew that Mr. Ohr’s wife Nellie worked for Fusion.

This means that Fusion, an outfit on the payroll of the Clinton campaign, had a messenger on the government payroll to deliver its anti-Trump documents to the FBI. This confirms that the FBI relied on politically motivated sources as part of its probe, even as Mr. Strzok insists he showed no political bias in his investigating decisions.

Yet if this is the most Congress could pry out of the FBI’s lead Russia investigator over 10 hours, legislative oversight won’t discover the truth. Mr. Trump will have to help Congress by ordering Justice and the FBI to declassify the relevant documents. Consistent with protecting legitimate sources and methods, here is the document list Mr. Trump should want released:

• The FISA applications. Justice and the FBI made one application and three renewals for warrants against former Trump campaign aide Carter Page. The text of those applications would show the degree to which the FBI relied on the dossier compiled by Christopher Steele at the request of Fusion GPS. They would also show how honest FBI and Justice were with the Foreign Intelligence Surveillance Court that approves warrants.

• Woods procedures documents. The FBI is required to vet and support the facts its presents to a FISA court when it seeks a warrant to eavesdrop on a U.S. citizen. These rules are known as Woods procedures, and releasing sections of this Woods file would show the extent to which the FBI verified the dossier or other evidence it used as its justification to listen to Trump campaign aides. More broadly, Mr. Trump should declassify any document that demonstrates what the FBI and Justice knew about the provenance and accuracy of the Fusion-Steele dossier.

• The 302s. These forms include information taken from the notes FBI agents make while interviewing a source or subject. Senate Judiciary Chairman Chuck Grassley last week asked Justice to declassify the 302s for 12 separate FBI interviews with Mr. Ohr concerning his contacts with Mr. Steele. Declassifying other 302s related to the subjects in this probe (including former Trump aides George Papadopoulos, Michael Flynn ) would reveal what the FBI was told, who provided what information, and how much came from politically motivated sources.

• The 1023s. These are the equivalent of 302s for counterintelligence, and they document FBI debriefings with informants or sources. Mr. Trump should declassify these and other documents showing interaction between the FBI and Mr. Steele, Fusion GPS founder Glenn Simpson, Fusion backer Dan Jones, informant Stefan Halper, or anyone the FBI used to keep tabs on the Trump campaign. These documents would reveal the extent and dates of the FBI investigation of the Trump campaign.

Mr. Trump is undoubtedly being told that declassifying these documents would set a bad precedent, or risk accusations that he is undermining special counsel Bob Mueller’s investigation. But the worst precedent would be letting mistrust and partisan suspicion persist over how law enforcement behaved during a presidential campaign.

Mr. Mueller’s probe is also moving ahead without interference, as his indictment Friday of a dozen Russian agents for hacking Democratic National Committee computers shows. But indictments of Russians who will never see a U.S. courtroom don’t tell us anywhere near the complete story. That duty falls to Congress, not to a special counsel whose job is deciding whether or not to prosecute crimes.

Mr. Trump is going to be attacked no matter what he does. He should declassify these records or stop complaining about his Justice Department’s lack of cooperation.

+++++++++++++++++++++++++++++++++++++++++++

2) What Putin Wants From Trump

The U.S. President wants better relations. The price will be high.

The Editorial Board

Donald Trump meets Vladimir Putin Monday in Helsinki, and if the U.S. President has an agenda beyond dominating the headlines and taunting his domestic opponents, it isn’t apparent. That won’t be the case with Mr. Putin, who has spent 18 months sizing up the American President and will be looking to get the most out of a weak Russian hand.

In 18 years running Russia, Mr. Putin has outfoxed two previous U.S. Presidents who sought better relations. The Russian makes promises to win concessions but then typically reneges or moves to exploit what he perceives as U.S. weakness. George W. Bush at least negotiated the end of the Anti-Ballistic Missile Treaty that stifled missile defenses, but Mr. Putin rolled over Barack Obama like T-14 tanks in a Ukrainian corn field.

So let’s assess the summit in advance by what Mr. Putin wants now from Mr. Trump. The U.S. President considers himself a shrewd negotiator, so we can measure the results by how much of the Putin agenda the former KGB operative gets Mr. Trump to concede.

• Prestige. Mr. Putin’s top priority at all times is shoring up his political standing at home, where he lacks democratic legitimacy. This means striding the world stage as if Russia is again a global power, and Mr. Trump is helping Mr. Putin on this score merely by meeting him on equal terms. The Russian will also want Mr. Trump to endorse Mr. Putin’s denials about meddling in the 2016 election—which he will advertise as official absolution.

Mr. Putin has been persona non grata in Europe since he invaded Crimea in 2014, and he wants Mr. Trump’s help with rehabilitation. Expect Mr. Putin to flatter Mr. Trump for his willingness to disrupt global norms. He’ll also want Mr. Trump to repeat his recent comments that Mr. Putin should rejoin the G-7.

• Syria. Mr. Putin has accomplished what he sought when he barged into Syria in 2015. He’s saved Bashar Assad, fortified long-term military bases, and replaced the U.S. as chief power broker in the region. He wants Mr. Trump to validate these gains and withdraw U.S. troops from eastern Syria.

In return Mr. Putin may promise to help the U.S. contain Iran’s presence in Syria, though there’s no guarantee he can do so, given Iran’s investment in Mr. Assad. The Russian knows Mr. Trump is eager to bring U.S. troops home and might rely on assurances on Iran the way he did on the “de-escalation” zone in southwestern Syria. Mr. Putin has helped Mr. Assad bomb the opposition in that part of Syria despite the Russian’s assurances.

• Ukraine. Mr. Putin wants Mr. Trump to accept his Crimea annexation, perhaps in return for recommitting to the Minsk negotiation process for eastern Ukraine, where Russian forces started another illegal war. Mr. Trump has already blamed Barack Obama for losing Crimea, essentially a unilateral concession that Mr. Putin will pocket. The Russian will also try to get Mr. Trump to stop providing Kiev with lethal weapons.

• Lifting sanctions. This is Mr. Putin’s top near-term priority. He needs to be able to enrich his cronies, and U.S. and European sanctions have become a major problem. The Russian will play to Mr. Trump’s dislike for the European Union by suggesting Mr. Trump can come to an independent deal over Ukraine, Syria and sanctions. Mr. Putin knows that the Italian, Hungarian and Greek governments are wobbly on sanctions, and he’d like Mr. Trump to stir more dissension in the EU.

• The trans-Atlantic alliance. Mr. Putin knows that the stronger NATO is as a military force, the riskier it is for him to engage in foreign adventurism. The Russian’s long-term goal is to erode the West’s political will to add to its capabilities as the memories of Crimea fade. Mr. Putin will do whatever he can in Helsinki to underscore Mr. Trump’s frustration with Europe that was on display this week at the NATO summit, planting the seeds of future discord.

• Arms control. Mr. Trump has been floating the idea of new arms talks with Russia, though over what isn’t clear. No doubt Mr. Putin’s spies have told him that Mr. Trump wants to be known as a nuclear peacemaker. And Mr. Putin may try to exploit that desire by offering a new round of talks to reduce the U.S. and Russian nuclear arsenals.

The problem here is that the Pentagon believes Mr. Putin is violating his current arms treaties with the U.S. This includes deploying intermediate-range cruise missiles in Europe that are banned under the 1987 INF Treaty. But that might not stop Mr. Trump from thinking he can change Mr. Putin’s behavior.

***

Mr. Trump clearly believes that Mr. Putin’s Russia is not the security threat that the Pentagon does, and he’s intent on showing that the two countries can get along. The wily Russian knows that too, which is why we should watch what he gains for smiling across the table.

++++++++++++++++++++++++++++++++++++++++++++++++

3)

Source: McKinsey Global Institute

Source: McKinsey Global Institute

Source: Moody’s Investor’s Service

Source: Peter G. Peterson Foundation

++++++++++++++++++++++++++++++++++++++++++++

4)

3)

The Debt Train Will Crash

By John Mauldin

We are approaching the end of the debt Train Wreck series. I’ve spent several weeks explaining why I think excessive debt is dragging the world economy toward an epic crash. The tracks ahead are clear for now but will not remain so. The end probably won’t be pretty. But there’s good news, too: we have time to get our portfolios, our businesses, and our families prepared.

Today, we’ll look at some new numbers on just how big the problem is, then I’ll recap the various angles we’ve discussed. This problem is so big that we easily overlook key points. I hope that listing them all in one place will help you grasp their enormity. Next week, and possibly a few after that, I’ll describe some possible strategies to protect your assets and family.

Before we go on, let me give a quick plug for Over My Shoulder. We rejuvenated this service a few months ago and it’s working even better than expected. Having Patrick Watson co-edit with me has been a big help. We’ve worked together, on and off, for 30 years now so he knows how I think. Between us, we have sent subscribers tons of fascinating economic analysis from my best sources—most of which you would never see otherwise. You get both the original item and our quick-read summary.

At just $9.95/month, Over My Shoulder may be the best financial research bargain out there, if I do say so myself. Click here to learn how you can join us.

Now on with the end of the train.

Off the Tracks

Talking about global debt requires that we consider almost incomprehensibly large numbers. Our minds can’t process their enormity. How much is a trillion dollars, really? But understanding this peril forces us to try.

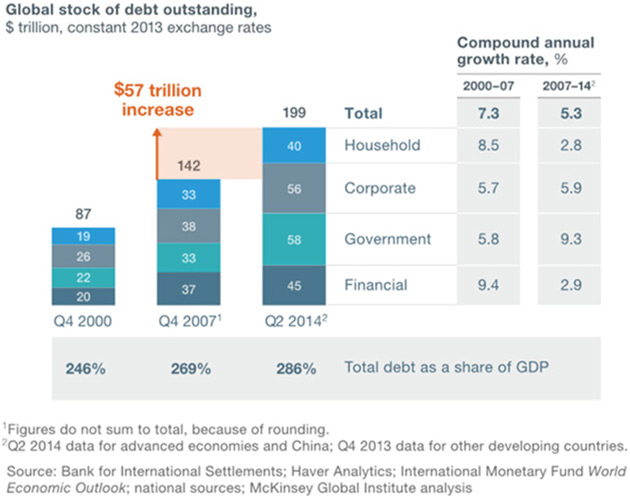

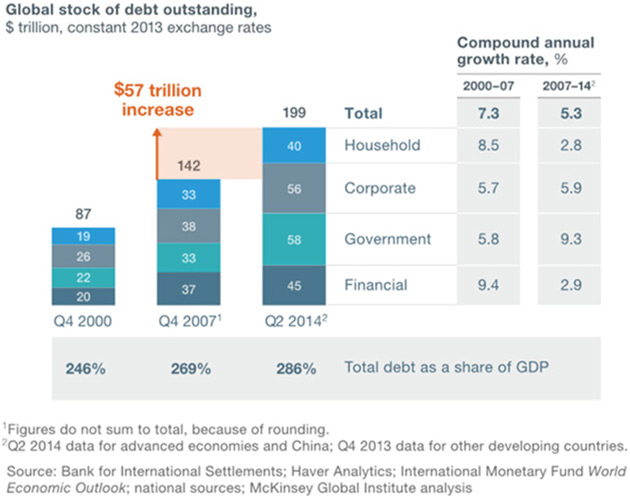

Earlier in this series, I shared a 2015 McKinsey chart that summed up global debt totals. They pegged it at $199 trillion as of Q2 2014. Note that the debt grew faster than global GDP. Everything I see suggests it will go higher at an ever-increasing rate.

Source: McKinsey Global Institute

Last month, McKinsey published a very useful online tool for visualizing global debt, based on Q2 2017 data. It shows a total of $169T, which is less than McKinsey said in 2014. Is debt shrinking? No. The new tool excludes the Financial debt category, which was $45T three years earlier. A separate Institute for International Finance report said financial debt was $59T at the end of 2017. These aren’t quite comparable numbers, but in the (very big) ballpark range we can estimate total debt was somewhere between $225T (per McKinsey) and $238T (per IIF) in mid-2017. (IIF’s latest update last week says it is now $247T).

Source: McKinsey Global Institute

That would mean world debt grew something like 13% in the three years ended 2017. If so, it would be a slowdown comparable to the 2007-2014 pace McKinsey showed in the chart above—but still faster than world GDP grew in those three years. McKinsey says global debt (ex-financial) grew from $97T in 2007 to $169T in mid-2017.

Importantly, households aren’t driving this. Governments accounted for 43% of the increase McKinsey cites and nonfinancial corporate debt was 41%. That is where I think the coming train crash will originate. Governments have more debt than corporations, but also more tools (like taxing authority) to manage it.

On the other hand, governments also have massive “unfunded liabilities” that don’t show in the numbers above. So, they aren’t in a great position, either.

Bottom line: There’s going to be a train wreck here. Which train will go off which track is unclear, but something will. And we’re all going to feel it.

Woes to Come

We launched this journey in my May 11 Credit-Driven Train Crash letter. I described my friend Peter Boockvar’s perceptive statement: “We no longer have business cycles, we have credit cycles.”

His point is subtle yet critical. Post-crisis growth, mild as it’s been, has been largely a function of debt, which central banks encouraged and enabled. The result was inflated asset prices without the kind of “recovery” seen in previous business cycles. Interest rates, i.e. the cost of debt, thus became critical.

With rates now moving up again, premium asset prices are losing their raison d’etreand will stabilize and eventually fall. Peter Boockvar says this, not the conventional business cycle, is what will set off recession. That’s key. Lower asset prices won’t be the result of the next recession; they will cause that recession.

I showed in that letter how companies will need to refinance about $4T of bonds in the next year, almost all of it at higher rates. This will hit debt-burdened companies that are already struggling and make it almost impossible for some to keep operating. Lenders, i.e. high-yield bond holders, will try to exit their positions all at once only to find a severe shortage of willing buyers.

The following week in Train Crash Preview, I listed the steps in which I think the crisis will unfold. They fall in four stages.

- The Beginning of Woes: Something, possibly high-yield bonds, will set off a liquidity scramble. It will spread through the already-unstable financial system and trigger a broader credit crisis.

- Lending Drought: Rising defaults will force banks to reduce lending, depriving previously stable businesses of working capital. This will reduce earnings and economic growth. The lower growth will turn into negative growth and we will enter recession.

- Political Backlash: Concurrent with the above, employers will be automating jobs as they grow desperate to cut costs. Suffering workers—who are also voters—will force higher “safety net” spending and government debt will skyrocket. A populist backlash could lead to tax increases that prolong the recession.

- The Great Reset: As this recession unfolds, the Fed and other central banks will abandon plans to reverse QE programs. I seriously think the Federal Reserve’s balance sheet assets could approach $20 trillion later in the next decade. But it won’t work because the world simply has too much debt. They will need to find some way to rationalize or “reset” the debt. Exactly how is hard to predict but it probably won’t be good for lenders, or for the holders of government promises like pensions and healthcare.

Next in High Yield Train Wreck, we dove deeper into the dream-driven high-yield bond market exemplified by this year’s nutty $702-million WeWork issue. I quoted Grant Williams, who wrote a masterful takedown of this craziness.

Ten years into the ongoing laboratory experiment being conducted by the world’s central banks, everywhere you look there are multiple examples of the kind of lunacy those policies have fomented by reducing the cost of capital to virtually zero and forcing investors to take risks they would ordinarily avoid in order to find some kind of return.

WeWork is one example of a company for whom, in the face of rapid growth, massive negative cashflows aren’t a problem, but there are plenty of others. Uber, AirBnB, SnapChat and, of course, Tesla have all captured the imagination of investors thanks to lofty dreams, articulated by charismatic CEOs—but the day things turn around and the economy begins to weaken or, God forbid, investors seek a return on their investment as opposed to settling for rolling promises of gigantic, game-changing revenues to come, it is over.

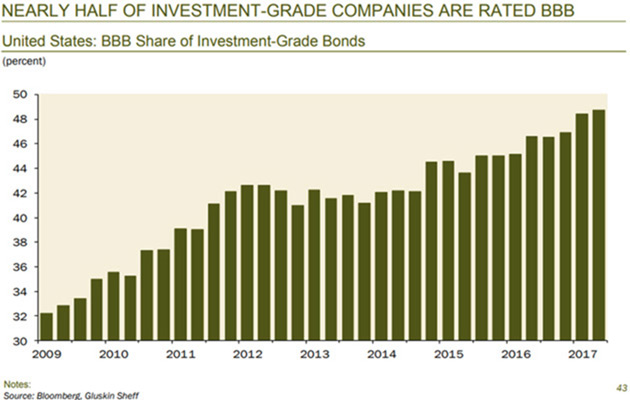

We went on to talk about the insanity of yield-hungry investors practically throwing cash at borrowers while demanding little in return. I also showed how this is not simply a junk-rated company problem, since almost half of investment-grade companies are rated BBB and could easily slip to junk status in a downturn.

Growing Leverage

The week after we turned to Europe in The Italian Trigger. Unfortunately, Italy isn’t Europe’s only problem. The big Kahuna is Germany, which spent years offering generous vendor financing to the rest of the continent to entice the purchase of German goods. The result: a giant trade surplus for Germany and giant, unpayable debts for those who bought German goods.

The Euro currency union is fatally flawed because it leaves each member state to set its own fiscal policy. There are good reasons for that, but it is not sustainable indefinitely. The Eurozone must get either much more centralized or fall apart. All the Rube Goldberg contraptions the ECB and others invent are temporary fixes. They’ve worked so far. They won’t work forever.

I still think the most probable scenario is that Germany and the Netherlands (and the rest of the northern European cabal) reluctantly agree to let the European Central Bank mutualize all the sovereign debt, taking onto their balance sheet and issuing new ECB-backed debt for the entire zone. There would have to be serious constraints on running deficits after that point, but it would prevent a breakup, or at least delay it for another decade or so.

Of course, within a few years those new deficit constraints would be ignored. I said in a previous letter Germany will need to collect almost 80% of GDP in 30 years in order to be able to deliver its promised healthcare and pensions. Their inability to do that will be evident much sooner. Germany will end up becoming one of the biggest problems.

The next installment, Debt Clock Ticking, was a bit philosophical. I talked about debt letting you bring the future into the present, buying things you couldn’t afford if you had to pay for them now. But the entire world went into debt for the equivalent of tropical vacations and, having now enjoyed them, realizes it must pay the bill. The resources to do so do not yet exist. So, in the time-honored tradition of lenders everywhere, we extend and pretend. But with our ability to pretend almost gone, we’re heading to the Great Reset.

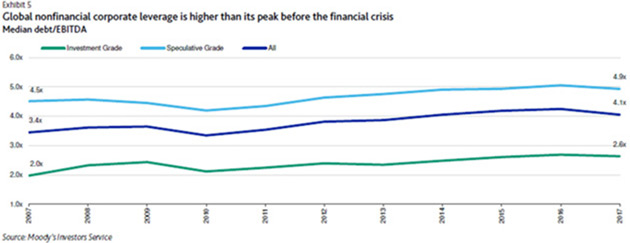

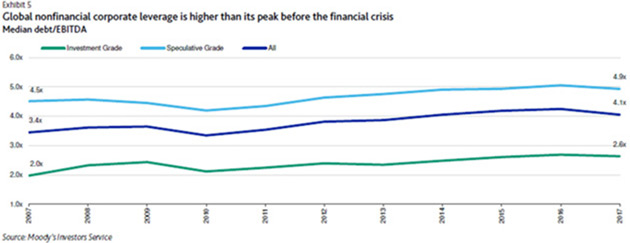

Source: Moody’s Investor’s Service

Then I reviewed some of the McKinsey and IIF numbers and described the amount of leverage that’s built up in the system. Just a decade after the Great Recession, the average non-financial business went from 3.4x leverage to 4.1x. They are now roughly 20% more leveraged than they were the last time all hell broke loose. CEOs and boards seem to have learned little from the experience—or maybe learned too much. If you believe the Fed has your back, then leveraging to the moon makes sense.

Pension Problems

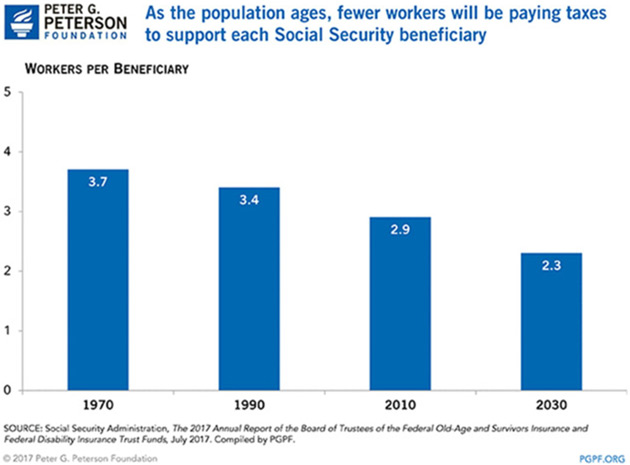

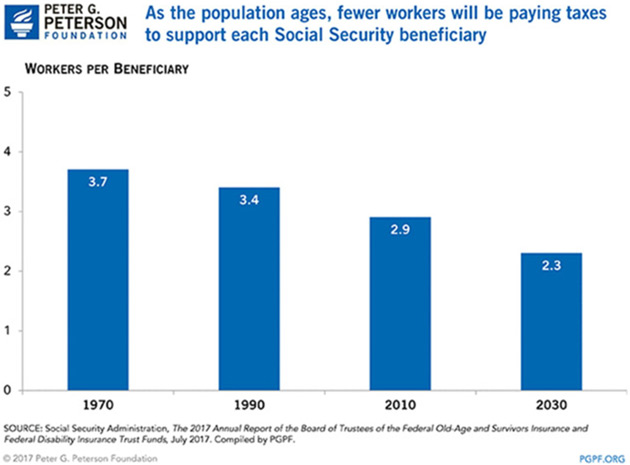

The last three letters in the series got personal for many readers as I talked about pension debt. In The Pension Train Has No Seat Belts, we looked at the demographic challenge facing US pension funds, mainly state and local government plans but also some private ones. We are asking a shrinking group of working-age people to support a growing number of retirees and that’s just not going to work.

Source: Peter G. Peterson Foundation

The promises employers made to workers are a kind of debt. They’re the borrowers, workers are the lenders… and unlike in 2008, this time it will be lenders who get hurt the most. A new report by the American Legislative Exchange Council (ALEC) shows the unfunded liabilities of state and local pension plans jumped $433 billion in the last year to more than $6 trillion. That is nearly $50,000 for every household in America.

Nor is this only a US problem, as we saw in Europe Has Train Wrecks, Too.According to the World Economic Forum, the United Kingdom alone has a $4-trillion retirement savings shortfall that will rise to $33 trillion by 2050. This in a country whose entire GDP is only about $2.6 trillion and doesn’t account for the increasingly likely disaster Brexit will be. Switzerland, Spain, and others have similarly dire outlooks, often driven by even worse demographics than we have in the US. Germany, as noted above, is simply off the rails.

Finally, in Unfunded Promises, we reached the ultimate debt problem: US government unfunded liabilities. On paper, Washington’s debt is about $21.2 trillion… but that doesn’t include the $13.2-trillion unfunded, off-the-books Social Security liability, or the $37-trillion Medicare unfunded liability. Those aren’t my numbers, by the way; they come from the Social Security and Medicare trustees and are probably understated. My friend, Boston University professor Larry Kotlikoff, thinks it should be more like $210 trillion. He has a considerable amount of published works and a book he co-authored with fellow Texan Scott Burns.

That’s not all. The federal government also has liabilities for civil service and military pensions, veteran benefits, some defaulted private pensions via PBGC, and open-ended guarantees to entities like FDIC, Fannie Mae, and more.

The budget outlook is horrible even without all that, too. The Congressional Budget Office thinks federal debt will be 200% of GDP by 2048, and that by 2041 it will take all federal tax revenue just to support Social Security, the various health care programs and pay interest. That’s before defense or anything else the government does. And that’s assuming relatively high growth and NO recessions and a rising stock market forever as we ride off into the sunset.

I wrapped up quoting my friend Dr. Woody Brock, who thinks the most likely outcome will be wealth taxes at federal, state, and local levels. I truly hope he’s wrong about that, but I fear he is not. My preferred new tax for the US would be a VAT that eliminates the Social Security tax (thus giving lower-income workers and businesses a raise) but still funds Social Security and healthcare. Other government expenditures would be funded from income taxes which could be reduced significantly, and even eliminated on incomes below $50,000. Now that’s a tax cut that would boost the economy and balance the budget.

There really are only two ways to solve this problem: massive taxes on someone, or a debt liquidation of some kind. And remember, if you are getting a retirement pension fund and/or healthcare, your benefits are part of that “debt liquidation.” Both will be painful. We have pulled forward our spending and must eventually pay for it. The time is coming. Please don’t shoot the messenger.

Let’s summarize. Global debt is over $225 trillion. By the beginning of the next decade it could be over $300 trillion. Global government unfunded liabilities are easily in the $100-trillion range today and could easily double by the end of the next decade. Debt service, pensions, and healthcare will take 20-25% of GDP in many countries (more in some of Europe).

Your mileage may and will vary by country. In some, there will be inflation and in others, deflation. We will be thinking the unthinkable and choosing policies that seem insane to even mention today. But then, think about what Japan is doing. And the ECB. Add in automation and the loss of hundreds of millions of jobs in the OECD countries. Then think about what will happen in the emerging economies.

But at the same time, imagine all the new companies being built and fortunes made. The opportunities. The situation, as Doug Casey once quipped, “Is hopeless, but not serious.” Not yet. Not for you and me.

Next week we’ll discuss what you can do, but not just in Thoughts from the Frontline..."

Your hopeful-about-the-future analyst,

++++++++++++++++++++++++++++++++++++++++++++

4)

Three wounded as 200 projectiles fired at Israel from Gaza Strip

By ANNA AHRONHEIM

Close to 200 projectiles were launched from the Gaza Strip toward the South since late Friday with at least 30 of them intercepted by the Iron Dome.

According to the IDF, Hamas launched 100 of the projectiles from 3 p.m onwards. The Iron Dome intercepted about 20 and another 73 fell in open areas. One rocket landed inside a kibbutz in the Sha’ar Hanegev Regional Council area and another rocket struck a courtyard of a synagogue in Sderot, without causing any injuries.

Three Israelis were wounded after a projectile hit a home in Sderot.

According to Magen David Adom, a 14-year-old girl was lightly wounded in her legs, a 15-year-old was lightly wounded with injuries to her face from broken glass and a 52-year-old man was in moderate condition after sustaining a chest wounded. All were evacuated by MDA to Barzilai Medical Center in Ashkelon.

Earlier in the day, a firefighter was lightly wounded after falling while trying to take cover from a projectile. Damage was also caused to vehicles and to a chicken coop in a community in the Eshkol Regional Council.

As a precaution, the IDF instructed residents in Gaza border communities to remain within a 15-second radius from bomb shelters or safe rooms, closed the Zikim beach on Saturday and restricted gatherings of more than 100 people in open spaces, and more than 500 people in closed spaces across the border communities.

Chief of Staff Lt.-Gen. Gadi Eisenkot held a situational assessment with the Gaza Division on Saturday, which included the participation of Southern Command head Maj.-Gen. Hertzi Halevi, Operations Directorate head Maj.-Gen. Aharon Haliva and Gaza Division commander Brig.-Gen. Yehuda Fuchs, as well as other commanders.

Earlier in the day, the IAF carried out the largest daytime operation against Hamas since Operation Protective Edge in 2014 with fighter jets hitting 40 targets across the Gaza Strip, IDF Spokesman Brig.-Gen. Ronen Manelis said.

“There are three vectors here that we see in severity and cannot allow them to continue: fire terrorism, terrorism along the fence and rocket fire. We intend to stop it,” Manelis said.

While “it’s too early to talk about a broad military operation, we have understood in recent weeks that this day will come, and once relevant conditions have been created, we will act.”

A senior IAF officer said that while “in the last few hours Hamas has chosen to fire projectiles toward communities close to the Gaza border, you can’t take it for granted they will stop there.”

He warned that Israel would respond in a tougher manner if Hamas increase their distance of rocket fire to over 10 km.

“Hamas will regret it if it goes beyond that range, but we’re prepared for such a possibility,” he said.

The daytime trikes on Saturday targeted the headquarters of the Beit Lahiya Battalion, with jets striking urban warfare training facilities, weapon storage warehouses, training compounds, command centers, offices and more.

“The battalion command’s entire infrastructure has been destroyed, vaporized, turned into a giant hole,” Manelis said. Other strikes targeted armories, including those belonging to Hamas’s naval terrorism wing.

“This attack displays the IDF’s advanced intelligence and operational capabilities and could expand as needed and in accordance with a situational assessment,” the military said.

Later on Saturday, the IAF struck a high-rise building in the al-Shati refugee camp, wounding at least two children and several other Gazans. The IDF said it had warned residents of the building in advance of the strike, which was targeted because it was being used by Hamas as an urban warfare training facility and had a tunnel underneath it for underground warfare training.

IDF Arab Media division head Maj. Avichay Adraee warned Gazans on social media to keep their distance from buildings and persons who serve “terrorists organizations.”

“This a special announcement for Gaza’s residents. You are requested to immediately remove yourselves from every facility or infrastructure that are used by terror organizations, to stay away from every person who is known as a terrorist and from every space in which terror organizations operate.

“Beware, you have been warned,” he said. “The sights of 2018 could be much more horrific than the sights of 2014.”

The large-scale daytime operation came several hours after the IAF struck several Hamas targets, including two offensive terrorist tunnels in northern and southern Gaza, as well as several targets in military compounds where Hamas assembles incendiary balloons and a Hamas training camp.

“The IDF retaliated to the terror attacks that were committed during the violent riots on the Gaza border fence on Friday and the ongoing balloon terrorism,” the army said.

As IAF jets struck targets in Gaza, Hamas launched 31 projectiles toward the South with six of them intercepted by the Iron Dome.

According to official Palestinian news agency WAFA, IAF jets struck sites across the entire Gaza Strip, causing significant damage and lightly wounded one Palestinian in northern Gaza overnight.

The IDF said Hamas, which is responsible for all violence emanating from Gaza, “continues with its terrorism, acts against troops and against security infrastructures attempting to hurt Israel’s citizens.”

The military accused Hamas of “sabotaging the humanitarian efforts” and of using Gazan civilians as human shields, and continues to endanger them by carrying out terrorist attacks against Israel.

The terrorist group, which has ruled Gaza since 2007, “is responsible for the events transpiring in the Gaza Strip and emanating from it and will bear the consequences for its actions against Israeli civilians and Israeli sovereignty. The IDF views Hamas’s terror activity with great severity and is prepared for a wide variety of scenarios,” the army said.

The overnight strikes came after violent clashes took place along the security fence separating Israel and Gaza on Friday. During the clashes, an IDF major was moderately wounded by a grenade thrown at him and his troops by Palestinians rioters near the old Karni crossing near Kibbutz Nahal Oz. He was hit by shrapnel in his upper body and airlifted to the Soroka University Medical Center in Beersheba in stable condition.

In response, the troops opened fire toward the Palestinians who threw the grenade, with one hit identified.

The IDF is investigating the incident, which is one of the most serious to have occurred since the weekly demonstrations began on March 30, as part of what organizers have called the “Great March of Return.”

Palestinian demonstrators have launched hundreds of kites, balloons and helium-filled condoms with incendiary and explosive devices on a daily basis into Israel, sparking fires that have destroyed thousands of acres of farmland, parks and forests. Hamas has said the protests, which also demand an end to a grinding Israeli and Egyptian blockade on Gaza, will continue until their demands are met.

According to WAFA, two Palestinian youth were killed on Friday and another 200 were wounded. The two fatalities were identified as Muhammad Nasser Shurrab, 20, from Khan Yunis and 15-year-old Othman Rami Halles.

Gaza’s Health Ministry said their deaths bring the total killed by Israel since the start of the border protests to 139.

According to the IDF, Hamas launched 100 of the projectiles from 3 p.m onwards. The Iron Dome intercepted about 20 and another 73 fell in open areas. One rocket landed inside a kibbutz in the Sha’ar Hanegev Regional Council area and another rocket struck a courtyard of a synagogue in Sderot, without causing any injuries.

Three Israelis were wounded after a projectile hit a home in Sderot.

According to Magen David Adom, a 14-year-old girl was lightly wounded in her legs, a 15-year-old was lightly wounded with injuries to her face from broken glass and a 52-year-old man was in moderate condition after sustaining a chest wounded. All were evacuated by MDA to Barzilai Medical Center in Ashkelon.

Earlier in the day, a firefighter was lightly wounded after falling while trying to take cover from a projectile. Damage was also caused to vehicles and to a chicken coop in a community in the Eshkol Regional Council.

As a precaution, the IDF instructed residents in Gaza border communities to remain within a 15-second radius from bomb shelters or safe rooms, closed the Zikim beach on Saturday and restricted gatherings of more than 100 people in open spaces, and more than 500 people in closed spaces across the border communities.

Chief of Staff Lt.-Gen. Gadi Eisenkot held a situational assessment with the Gaza Division on Saturday, which included the participation of Southern Command head Maj.-Gen. Hertzi Halevi, Operations Directorate head Maj.-Gen. Aharon Haliva and Gaza Division commander Brig.-Gen. Yehuda Fuchs, as well as other commanders.

Earlier in the day, the IAF carried out the largest daytime operation against Hamas since Operation Protective Edge in 2014 with fighter jets hitting 40 targets across the Gaza Strip, IDF Spokesman Brig.-Gen. Ronen Manelis said.

“There are three vectors here that we see in severity and cannot allow them to continue: fire terrorism, terrorism along the fence and rocket fire. We intend to stop it,” Manelis said.

While “it’s too early to talk about a broad military operation, we have understood in recent weeks that this day will come, and once relevant conditions have been created, we will act.”

A senior IAF officer said that while “in the last few hours Hamas has chosen to fire projectiles toward communities close to the Gaza border, you can’t take it for granted they will stop there.”

He warned that Israel would respond in a tougher manner if Hamas increase their distance of rocket fire to over 10 km.

“Hamas will regret it if it goes beyond that range, but we’re prepared for such a possibility,” he said.

The daytime trikes on Saturday targeted the headquarters of the Beit Lahiya Battalion, with jets striking urban warfare training facilities, weapon storage warehouses, training compounds, command centers, offices and more.

“The battalion command’s entire infrastructure has been destroyed, vaporized, turned into a giant hole,” Manelis said. Other strikes targeted armories, including those belonging to Hamas’s naval terrorism wing.

“This attack displays the IDF’s advanced intelligence and operational capabilities and could expand as needed and in accordance with a situational assessment,” the military said.

Later on Saturday, the IAF struck a high-rise building in the al-Shati refugee camp, wounding at least two children and several other Gazans. The IDF said it had warned residents of the building in advance of the strike, which was targeted because it was being used by Hamas as an urban warfare training facility and had a tunnel underneath it for underground warfare training.

IDF Arab Media division head Maj. Avichay Adraee warned Gazans on social media to keep their distance from buildings and persons who serve “terrorists organizations.”

“This a special announcement for Gaza’s residents. You are requested to immediately remove yourselves from every facility or infrastructure that are used by terror organizations, to stay away from every person who is known as a terrorist and from every space in which terror organizations operate.

“Beware, you have been warned,” he said. “The sights of 2018 could be much more horrific than the sights of 2014.”

The large-scale daytime operation came several hours after the IAF struck several Hamas targets, including two offensive terrorist tunnels in northern and southern Gaza, as well as several targets in military compounds where Hamas assembles incendiary balloons and a Hamas training camp.

“The IDF retaliated to the terror attacks that were committed during the violent riots on the Gaza border fence on Friday and the ongoing balloon terrorism,” the army said.

As IAF jets struck targets in Gaza, Hamas launched 31 projectiles toward the South with six of them intercepted by the Iron Dome.

According to official Palestinian news agency WAFA, IAF jets struck sites across the entire Gaza Strip, causing significant damage and lightly wounded one Palestinian in northern Gaza overnight.

The IDF said Hamas, which is responsible for all violence emanating from Gaza, “continues with its terrorism, acts against troops and against security infrastructures attempting to hurt Israel’s citizens.”

The military accused Hamas of “sabotaging the humanitarian efforts” and of using Gazan civilians as human shields, and continues to endanger them by carrying out terrorist attacks against Israel.

The terrorist group, which has ruled Gaza since 2007, “is responsible for the events transpiring in the Gaza Strip and emanating from it and will bear the consequences for its actions against Israeli civilians and Israeli sovereignty. The IDF views Hamas’s terror activity with great severity and is prepared for a wide variety of scenarios,” the army said.

The overnight strikes came after violent clashes took place along the security fence separating Israel and Gaza on Friday. During the clashes, an IDF major was moderately wounded by a grenade thrown at him and his troops by Palestinians rioters near the old Karni crossing near Kibbutz Nahal Oz. He was hit by shrapnel in his upper body and airlifted to the Soroka University Medical Center in Beersheba in stable condition.

In response, the troops opened fire toward the Palestinians who threw the grenade, with one hit identified.

The IDF is investigating the incident, which is one of the most serious to have occurred since the weekly demonstrations began on March 30, as part of what organizers have called the “Great March of Return.”

Palestinian demonstrators have launched hundreds of kites, balloons and helium-filled condoms with incendiary and explosive devices on a daily basis into Israel, sparking fires that have destroyed thousands of acres of farmland, parks and forests. Hamas has said the protests, which also demand an end to a grinding Israeli and Egyptian blockade on Gaza, will continue until their demands are met.

According to WAFA, two Palestinian youth were killed on Friday and another 200 were wounded. The two fatalities were identified as Muhammad Nasser Shurrab, 20, from Khan Yunis and 15-year-old Othman Rami Halles.

Gaza’s Health Ministry said their deaths bring the total killed by Israel since the start of the border protests to 139.

++++++++++++++++++++++++++++++++++++++++++++