Tax recap highlights. (See 1 below.)

+++++++++++++++++++++++++++++++++++

Iran develops missile that is undetectable. Thanks Obama for your being so trusting, weak and pro Iran.. (See 2 below.)

+++++++++++++++++++++++++++++++++

CNN and The New York Times just cannot tell the truth when it comes to Israel. In fact, they go out of their way to lie and/or distort. (See 3 below.)

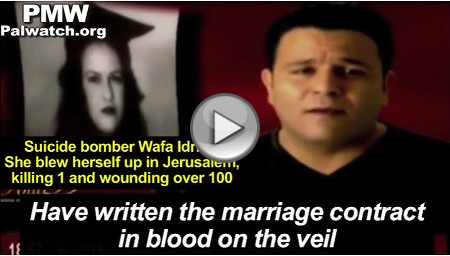

Would you like Arab marauders roaming your streets with the intent of blowing you and your fellow citizens to pieces? (See 3a below.)

+++++++++++++++++++++++++++

I have received a significant number of responses from the article I posted I said was incisive and worth a read. This is another from a dear friend, fellow memo reader and a significant force in Savannah's Music and Art Cutlture.

"Dick, The article by was indeed long and challenging - thanks for sharing. To boil it down to the essentials, modern liberalism is built on a foundation of identity politics, and now controls the university system, the federal bureaucracy, the media, the entertainment industry, and the HR departments of the Fortune 500. Either Trump will break the strangle-hold on American society, or it is game over. Whatever reservations one might have about Trump on stylistic grounds, that’s a fairly stark choice. R--"

+++++++++++++++++++++++++++++++++

Mueller assembled a team of aggressive and biased lawyers and is now paying the price for same. Whether his team broke laws or not they have cast doubt as to their own credibility and so they have shot themselves in their collective feet.

This is why government, even in pursuit of wrongdoing, can be a frightening and bullying entity because it has money, power and ability which can be used to ride roughshod over one's legitimate freedoms and rights

When you hear I am from the government and here to help be circumspect.

++++++++++++++++++++++++++++

The passage of the tax bill reveals several things to me:

First, It shows, I believe, Trump learned from his intrusions regarding the health care effort how to deal with Congress and his own Party in ways that are more productive and positive.

Second, I believe Schumer and Pelosi have led their Party into a stigmatized wall called obstruction.

Third, The mass media will continue to carry the Democrat's water bucket which contains the message portraying the bill as a tax cut for the rich but if the economy gets a boost. more people are employed, salaries rise and people have somewhat more to spend Democrats will not have any basis for receiving any credit. They will stand as a bride whose fiance (read voters) did not show up in 2018 as Democrats otherwise think.

Fourth, Trump remains on a learning curve and if the economy continues to gain momentum that will be a powerful event that can mute some of the normal mid term losses that generally occur.

Five, after watching Trump in the presidency for a year the shock will have begun to wear off so the anti-Trump message will begin to be less meaningful.

Finally, we have the Mueller investigation, which apparently will continue for 2018, and I believe that too, will begin to wear thin. That is not to say that Mueller will have nothing on his plate but I suspect it will not be a plate full of meaty indictments.

++++++++++++++++++++++++++++++++++++

.Dick

++++++++++++++++++++++++++++++++++

1)Congress is enacting the biggest tax reform law in thirty years, one that will make fundamental changes in the way you, your family and your business calculate your federal income tax bill, and the amount of federal tax you will pay. Since most of the changes will go into effect next year, there's still a narrow window of time before year-end to soften or avoid the impact of crackdowns and to best position yourself for the tax breaks that may be heading your way. Here's a quick rundown of last-minute moves you should think about making.

+++++++++++++++++++++++++++Lower tax rates coming. The Tax Cuts and Jobs Act will reduce tax rates for many taxpayers, effective for the 2018 tax year. Additionally, many businesses, including those operated as passthroughs, such as partnerships, may see their tax bills cut.The general plan of action to take advantage of lower tax rates next year is to defer income into next year. Some possibilities follow:· If you are about to convert a regular IRA to a Roth IRA, postpone your move until next year. That way you'll defer income from the conversion until next year and have it taxed at lower rates.· Earlier this year, you may have already converted a regular IRA to a Roth IRA but now you question the wisdom of that move, as the tax on the conversion will be subject to a lower tax rate next year. You can unwind the conversion to the Roth IRA by doing a recharacterization—making a trustee-to-trustee transfer from the Roth to a regular IRA. This way, the original conversion to a Roth IRA will be cancelled out. But you must complete the recharacterization before year-end. Starting next year, you won't be able to use a recharacterization to unwind a regular-IRA-to-Roth-IRA conversion.· If you run a business that renders services and operates on the cash basis, the income you earn isn't taxed until your clients or patients pay. So if you hold off on billings until next year—or until so late in the year that no payment will likely be received this year—you will likely succeed in deferring income until next year.· If your business is on the accrual basis, deferral of income till next year is difficult but not impossible. For example, you might, with due regard to business considerations, be able to postpone completion of a last-minute job until 2018, or defer deliveries of merchandise until next year (if doing so won't upset your customers). Taking one or more of these steps would postpone your right to payment, and the income from the job or the merchandise, until next year. Keep in mind that the rules in this area are complex and may require a tax professional's input.· The reduction or cancellation of debt generally results in taxable income to the debtor. So if you are planning to make a deal with creditors involving debt reduction, consider postponing action until January to defer any debt cancellation income into 2018.Disappearing or reduced deductions, larger standard deduction. Beginning next year, the Tax Cuts and Jobs Act suspends or reduces many popular tax deductions in exchange for a larger standard deduction. Here's what you can do about this right now:· Individuals (as opposed to businesses) will only be able to claim an itemized deduction of up to $10,000 ($5,000 for a married taxpayer filing a separate return) for the total of (1) state and local property taxes; and (2) state and local income taxes. To avoid this limitation, pay the last installment of estimated state and local taxes for 2017 no later than Dec. 31, 2017, rather than on the 2018 due date. But don't prepay in 2017 a state income tax bill that will be imposed next year – Congress says such a prepayment won't be deductible in 2017. However, Congress only forbade prepayments for state income taxes, not property taxes, so a prepayment on or before Dec. 31, 2017, of a 2018 property tax installment is apparently OK.· The itemized deduction for charitable contributions won't be chopped. But because most other itemized deductions will be eliminated in exchange for a larger standard deduction (e.g., $24,000 for joint filers), charitable contributions after 2017 may not yield a tax benefit for many because they won't be able to itemize deductions. If you think you will fall in this category, consider accelerating some charitable giving into 2017.· The new law temporarily boosts itemized deductions for medical expenses. For 2017 and 2018 these expenses can be claimed as itemized deductions to the extent they exceed a floor equal to 7.5% of your adjusted gross income (AGI). Before the new law, the floor was 10% of AGI, except for 2017 it was 7.5% of AGI for age-65-or-older taxpayers. But keep in mind that next year many individuals will have to claim the standard deduction because many itemized deductions have been eliminated. If you won't be able to itemize deductions after this year, but will be able to do so this year, consider accelerating “discretionary” medical expenses into this year. For example, before the end of the year, get new glasses or contacts, or see if you can squeeze in expensive dental work such as an implant.Other year-end strategies. Here are some other last minute moves that can save tax dollars in view of the new tax law:· The new law substantially increases the alternative minimum tax (AMT) exemption amount, beginning next year. There may be steps you can take now to take advantage of that increase. For example, the exercise of an incentive stock option (ISO) can result in AMT complications. So, if you hold any ISOs, it may be wise to postpone exercising them until next year. And, for various deductions, e.g., depreciation and the investment interest expense deduction, the deduction will be curtailed if you are subject to the AMT. If the higher 2018 AMT exemption means you won't be subject to the 2018 AMT, it may be worthwhile, via tax elections or postponed transactions, to push such deductions into 2018.· Like-kind exchanges are a popular way to avoid current tax on the appreciation of an asset, but after Dec. 31, 2017, such swaps will be possible only if they involve real estate that isn't held primarily for sale. So if you are considering a like-kind swap of other types of property, do so before year-end. The new law says the old, far more liberal like-kind exchange rules will continue apply to exchanges of personal property if you either dispose of the relinquished property or acquire the replacement property on or before Dec. 31, 2017.· For decades, businesses have been able to deduct 50% of the cost of entertainment directly related to or associated with the active conduct of a business. For example, if you take a client to a nightclub after a business meeting, you can deduct 50% of the cost if strict substantiation requirements are met. But under the new law, for amounts paid or incurred after Dec. 31, 2017, there's no deduction for such expenses. So if you've been thinking of entertaining clients and business associates, do so before year-end.· Under current rules, alimony payments generally are an above-the line deduction for the payor and included in the income of the payee. Under the new law, alimony payments aren't deductible by the payor or includible in the income of the payee, generally effective for any divorce decree or separation agreement executed after 2017. So if you're in the middle of a divorce or separation agreement, and you'll wind up on the paying end, it would be worth your while to wrap things up before year end. On the other hand, if you'll wind up on the receiving end, it would be worth your while to wrap things up next year.· The new law suspends the deduction for moving expenses after 2017 (except for certain members of the Armed Forces), and also suspends the tax-free reimbursement of employment-related moving expenses. So if you're in the midst of a job-related move, try to incur your deductible moving expenses before year-end, or if the move is connected with a new job and you're getting reimbursed by your new employer, press for a reimbursement to be made to you before year-end.· Under current law, various employee business expenses, e.g., employee home office expenses, are deductible as itemized deductions if those expenses plus certain other expenses exceed 2% of adjusted gross income. The new law suspends the deduction for employee business expenses paid after 2017. So, we should determine whether paying additional employee business expenses in 2017 that you would otherwise pay in 2018, would provide you with an additional 2017 tax benefit. Also, now would be a good time to talk to your employer about changing your compensation arrangement—for example, your employer reimbursing you for the types of employee business expenses that you have been paying yourself up to now, and lowering your salary by an amount that approximates those expenses. In most cases, such reimbursements would not be subject to tax.

2)Iran Unveils Ballistic Missile Undetectable By Radar

By Clarion Porject

Iran officially introduced a new ballistic missile the Islamic Republic says is not detectable by radar. Ballistic missiles can be used to deliver nuclear warheads.

The missile, dubbed the Zulfiqar, was unveiled December 17, at the Amirkabir University of Technology in Tehran, according to the Iranian Fars News Agency.

According to Shiite tradition, the Zulfiqar was the legendary sword of Ali ibn Abi Talib given to him by Islam’s prophet Mohammed, his cousin and son-in-law. Ali was also the fourth caliph of Islam and the first imam of Shiite Islam. According to tradition, the sword was given to Mohammed by the angel Gabriel.

The missile’s range is reportedly between 435-466 miles (700-750 kilometers) and uses solid, conventional fuels. It is 29 feet (8.86 meters) long with a two-foot diameter (61 centimeters) and weighs 992 pounds (450 kilograms).

The missile is part of the generation of Fateh missiles, which Iran claims are highly accurate and can negate electronic waves used to divert missiles from their targets.

The missile was used by the Revolutionary Guards to destroy ISIS sites in Deir ez-Zor in Syria in June.

+++++++++++++++++++++++++++++++++++++++++++++

3)

| VIDEO: CNN: Twisting Facts and Emotions to Demonize Israel | |||||||||||

| Did Israel destroy Jaffa? Evict all the Palestinians? Shoot a woman's son in cold blood? Drive a man out of his home? Dramatic speech, emotional language, and twisted facts substitute for professional journalism. CNN what were you thinking? | |||||||||||

+ Watch here

|

No comments:

Post a Comment