Book sales and orders for the soft cover are approaching 100. Half the proceeds from the sale of my modestly priced book goes to The Wounded Warrior Project!

Dick Berkowitz, has written a booklet entitled:"A Conservative Capitalist Offers: Eleven Lessons and a Bonus Lesson for Raising America's Youth Born and Yet To Be Born."

By Dick Berkowitz - Non Expert

Dick wrote this booklet because he believes a strong country must rest on a solid family unit and that Brokaw's "Greatest Generation" has morphed into "A Confused, Dependent and Compromised Generation."

He hopes this booklet will provide a guide to alter this trend.

You can now order a .pdf version from www.brokerberko.com/book that you can download and read on your computer, or print out if you want. Cost is $5.99

In several weeks the book will be available in soft cover format at a cost of $10.99.

Booklet illustrations were by his oldest granddaughter, Emma Darvick, who lives and works in New York.

Testimonials:

Dick, I read your book this weekend. I hardly know where to start. You did an excellent job of putting into one short book a compendium of the virtues which only a relatively short time ago all Americans believed. It’s a measure of how far we have fallen that many Americans, perhaps a majority of Americans, no longer believe in what we once considered truisms. I think your father would have agreed with every word, but the party he supported no longer has such beliefs.

I would like to buy multiple copies of your booklet..

You did a great job. I know your parents would have been proud and that your family today is proud.

Mike

You wrote a great book. The brevity is one of its strong points and I know it was hard to include that in and still keep it brief. Your father in haste once wrote an overly long letter to our client, then said in the last sentence, “I’m sorry I wrote such a long letter, but I didn’t have time to write a short one.”

"Dick, I indeed marvel at how much wisdom you have been able to share with so few words. Not too unlike the experience in reading the Bible. I feel that with each read of "A Conservative Capitalist Offers:…." one will gain additional knowledge and new insights…

Regards, Larry"

Dick ,

Your book is outstanding! Due to illness, I've been unable to read it in entirety until today .Your background is often very similar to mine (e.g. Halliburton's influence was very important in my life), and your thoughts reflect very closely the the teachings that I received from my parents and granddad. I will write a more detailed statement in the near future!

All the best, Bob

Your book is outstanding! Due to illness, I've been unable to read it in entirety until today .Your background is often very similar to mine (e.g. Halliburton's influence was very important in my life), and your thoughts reflect very closely the the teachings that I received from my parents and granddad. I will write a more detailed statement in the near future!

All the best, Bob

Regarding your booklet, I have begun to read it and look forward to finishing it this weekend. Congrats on getting it published and on the great reviews. I know how much this booklet means to you and how important getting this message out to the public is.

P------

---

Are we in for inflation, deflation and/or both. You decide.

In my opinion if Obama is re-elected we are likely to have both,

If Romney is elected and he can implment most of his 5 point program I suspect we will have inflation and might be able to avoid deflation. (See 1 and 1a below.)

---

Murdoch - Obama election means Israel will be thrown under the bus and it would appear along with our State Department over Libya. (See 2 below.)

---

Tomorrow evening there will be another debate between Obama and Romney.

I have these concerns.

I have no faith Candy Crowley is trustworthy and believe her pro Liberal bias will manifest itself in some way either by selecting the type of questions from the audience or the nature of her follow up emphasis.

Second, Obama will try and rectify his indifferent first performance and the press and media are prepared to highlight how 'on' he was.

Romney has the continuing challenge of staying on track and not being thrown off by Obama's repeated efforts to paint him as a flip flopper.

Romney should tick off Obama's failed promises in the area of health care, deficits, employment and entitlements and when Obama keeps repeating lies about Romney, which Romney has already batted down time and again, he should offer to buy Obama and Biden hearing aids!.

Accusations that Romney has not fleshed out specifics should be responded to as follows:

a) You present to Congress broad brush concepts that lay out a general direction and then you negotiate the details. Romney could remind Obama of Pelosi's own comments -pass it then find out what was passed.

b) Remind the audience Obama has presented nothing specific as to any of his policies except more of the same and his own Party's Senators have not passed a budget for three years. Obama's abdication of personal responsibility reflects his own failed leadership for which he should be embarrassed.

Finally, regrading the claim that Romney is politicizing the Libyan screw up, Romney should point out either Obama has displayed incompetent executive leadership and/or lied. Perhaps it reflects his failure to attend to intelligence briefings while spending more time on the golf course.

Romney needs to display some fervor, some pique while remaining respectful and above the nastiness.

---

This from my English 'girl' friend. (See 3 below.)

---

Cyber war commentary, (See 4 below.)

---

There are many ways to destroy a nation. You can destroy from without through war. That would be difficult when it comes to the United States because of our large land mass etc,

So the next best thing is to destroy it from within and the liberals have been doing a fairly comprehensive job of accomplishing this objective.

First, you make citizens dependent upon a government incapable of continuing to finance this kind of foolishness while simultaneously you destroy the education system and fill the professorships with fuzzy thinkers,

By the time you have created a dependent population incapable of working at decent paying jobs that are no longer available because of the sorry economic outlook and have destroyed the education system you are rounding third base, so to speak. Eventually, even when good paying jobs actually reappear many of the workers will be found to be inadequately trained to cope, Then, you sit back and let the dry rot take over.

That is about where we are now and Obama's re-election will simply accelerate this sorry state of affairs.

Eventually everyone will look back and connect the dots but by then it could be too late. (See 5 below.)

---

Obama is taken aback by the response to his decision to require the military to assume a large portion of their health care costs associated with their injuries. (See 6 below.)

---

Just saw Atlas Shrugged Number 2. I enjoyed it but do not know whether it will prove a commercial success. Go and judge for yourselves.

---

Dick

------------------------------------------------------------------------------------------------------------------

1)A Little Chronic Deflation

John Mauldin

Seven Varieties of Deflation

Inflation in the U.S. has historically been a wartime phenomenon, including not only shooting wars but also the Cold War and the War on Poverty. That's when the federal government vastly overspends its income on top of a robust private economy—obviously not the case today when government stimulus isn't even offsetting private sector weakness. Deflation reigns in peacetime, and I think it is again, with the end of the Iraq engagement and as the unwinding of Afghanistan expenditures further reduce military spending.

Chronic Deflation

Few agree with my forecast of chronic deflation. They've never seen anything but inflation in their business careers or lifetimes, so they think that's the way God made the world. Few can remember much about the 1930s, the last time deflation reigned. Furthermore, we all tend to have inflation biases. When we pay higher prices, it's because of the inflation devil himself, but lower prices are a result of our smart shopping and bargaining skills. Furthermore, we don't calculate the quality-adjusted price declines that result from technological improvements in many big-ticket purchases. This is especially true since many of those items, like TVs, are bought so infrequently that we have no idea what we paid for the last one. But we sure remember the cost of gasoline on the last fill-up a week ago.

Doubts

Furthermore, many believe widespread deflation is impossible and that rampant inflation is assured in future years because of continuing high federal deficits, regardless of any long-run budget reform. And annual deficits of over $1 trillion are likely to persist in the remaining five to seven years of deleveraging, as I explain in my recent book, The Age of Deleveraging. The 2% annual real GDP growth I see persisting is well below the 3.3% needed to keep the unemployment rate stable. So to prevent high and chronically rising unemployment, any Administration and Congress—left, right or center—will be forced to spend a lot of money to create a lot of jobs.

But big federal deficits are inflationary only when they come on top of fully-employed economies and create excess demand. That's obviously not true at present when large deficits are reactions to private sector weakness that has slashed tax revenues and encouraged deficit spending. Indeed, the slack in the economy in the face of persistent trillion dollar-plus deficits measures the huge size and scope of the offsetting deleveraging in the private sector, as noted earlier.

The deleveraging, especially in the global financial sector and among U.S. consumers, will be completed in another five to seven years at the rate it is progressing. At that point, the federal deficit should fade quickly, assuming a war or other cause of oversized government spending doesn't intervene. The resumption of meaningful economic growth will reduce the pressure for economic stimuli and rising incomes and corporate profits will spur revenues. Serious work on the postwar baby-related bulge in Social Security and Medicare costs will also depress the deficit.

Good Deflation

A decade ago in my two Deflation books, I distinguished between two types of deflation—the Good Deflation of excess supply and the Bad Deflation of deficient demand. Good Deflation is the result of important new technologies that spike productivity and output even as the economy grows rapidly. Bad Deflation results from financial crises and deep recession, which hype unemployment and depress demand.

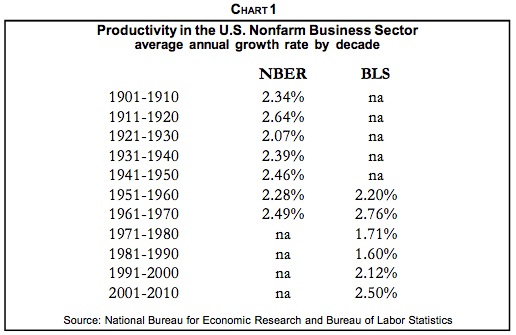

I've been forecasting chronic good deflation of excess supply because of today's convergence of many significant productivity-soaked technologies such as semiconductors, computers, the Internet, telecom and biotech that should hype output. Ditto for the globalization of production and the other deflationary forces I've been discussing since I wrote the twoDeflation books and The Age of Deleveraging. As a result of rapid productivity growth, fewer and fewer man-hours are needed to produce goods and services. The rapid productivity growth so far this decade is likely to persist (Chart 1).

While I've consistently predicted the good deflation of excess supply, I said clearly that the bad deflation of deficient demand could occur—due to severe and widespread financial crises or due to global protectionism. Both are now clear threats.

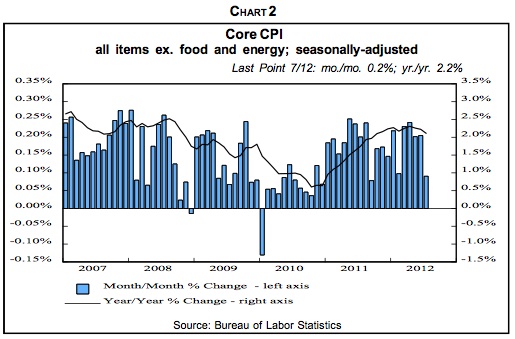

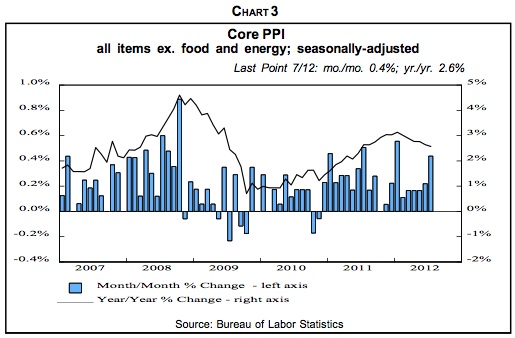

My forecast is that the unfolding global slump will initiate worldwide chronic deflation. A number of indicators point in that direction. Sure, much of the recent weakness in the PPI and CPI has been due to falling energy and food prices. Excluding these volatile items, prices are still rising but at slowing rates (Charts 2 and 3). Consumer price inflation is also falling abroad in the U.K. and the eurozone.

After China's huge stimulus program in 2009 in response to the global recession and nosedive in exports to U.S. consumers, the economy revived, but so did inflation. Double-digit food price jumps were especially troublesome in a land where many live at subsistence levels. So in response to the surge in inflation and the real estate bubble, Chinese leaders tightened economic policy, driving down CPI inflation to a 2.0% rise in August vs. a year earlier. But, in conjunction with the weakening in export growth, that is pushing China toward a hard landing of 5% to 6% economic growth, well below the 7% to 8% needed to maintain stability.

Back in the States, inflationary expectations, as measured by the spread between 10-year Treasury yields and the yield on comparable Treasury Inflation-Protected Securities are narrowing.

Other Varieties

Besides rises or falls in general price levels, which most think about when they hear "inflation" or "deflation," there are six other varieties, maybe more.

Commodity Inflation/Deflation. In the late 1960s, the mushrooming costs of the Vietnam War and the Great Society programs in an already-robust economy created a tremendous gap between supply and demand in many areas. The history of low inflation rates for goods and services, we'll call it CPI inflation for short, in the late 1950s and early 1960s, apparently created a momentum of low price advances that kept CPI inflation from exploding until about 1973. But by the early 1970s, commodity prices started to leap and spawned a self-feeding up surge. Worried that they'd run out of critical materials in a robust economy, producers started to double and triple order supplies to insure adequate inventories. That hyped demand, which squeezed supply, and prices spiked further. That spawned even more frenzied buying as many expected shortages to last forever.

At the time, even before the 1973 oil embargo, I was lucky enough to realize that what was occurring was not perennial shortages but massive inventory-building. I found a parallel in post-World War I when wartime price and wage controls were removed and wholesale prices skyrocketed about 30% in one year as double and triple ordering hyped inventories amid frenzied demand and fears of shortages. Then all those inventories arrived and sired the 1920-1921 recession, the sharpest on record, and wholesale prices collapsed. Armed with this history, I correctly forecast the 1973-1975 recession and said it would be the worst since the 1930s, which it proved to be. Arriving inventories swamped production, especially in late 1974 and early 1975, so production nosedived.

Another Commodity Bubble

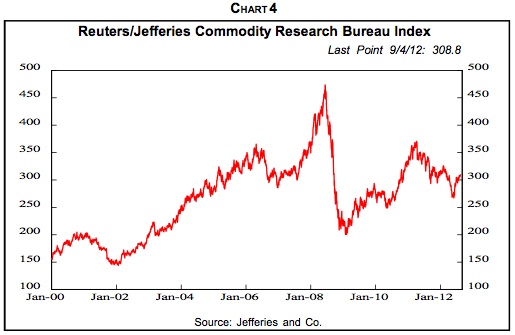

It's probably no coincidence that China's joining the World Trade Organization at the end of 2001 was followed by the commencement of another global commodity price bubble that started in early 2002 (Chart 4). And it has been a bubble, in my judgment, based on the conviction that China would continue to absorb huge shares of the world's industrial and agricultural commodities. The shift of global manufacturing toward China magnified her commodity usage as, for example, iron ore that previously was processed into steel in the U.S. or Europe was sent to China instead.

Peak Oil

Crude oil has been the darling of the commodity-shortage crowd, and when its price rose to $145 per barrel in July 2008, many became convinced that the world would soon run out of oil.

But they discounted the fact that reserves are often underestimated since oil fields produce more than original conservative estimates. Nor did they expect conventional and shale natural gas, liquefied natural gas, the oil sands in Canada, heavy oil in Venezuela and elsewhere, oil shale, coal, hydroelectric power, nuclear energy, wind, geothermic, solar, tidal, ethanol and biomass energy, fuel cells, etc. to substitute significantly for petroleum.

Recent Weakness

The weakness in commodity prices, starting in early 2011, no doubt has been anticipating both a hard landing in China and a global recession. In my view, the foundation of the decade-long commodity bubble is crumbling, and the unfolding of a hard landing in China and worldwide recession will depress commodity prices considerably, even from current levels, as disillusionment replaces investor enthusiasm.

Wage-Price Inflation/Deflation. A second variety of inflation is a particularly virulent form, wage-price inflation in which wages push up prices, which then push up wages in a self-reinforcing cycle that can get deeply and stubbornly embedded in the economy. This, too, was suffered in the 1970s and accompanied slow growth. Hence the name, stagflation. As with commodity inflation, it was spawned by excess aggregate demand resulting from huge spending and the Vietnam War and Great Society programs on top of a robust economy.

Back then, labor unions had considerable bargaining strength and membership. Furthermore, American business was relatively paternalist, with many business leaders convinced they had a moral duty to keep their employees at least abreast of inflation. Most didn't realize that, as a result, inflation was very effectively transferring their profits to labor. And also to government, which taxed underdepreciation and inventory profits. The result was a collapse in corporate profits' share of national income and a comparable rise in the share going to employee compensation from the mid-1960s until the early 1980s.

The Peak

The wage-price spiral peaked in the early 1980s as CPI inflation began a downtrend that has continued. Voters rebelled against Washington, elected Ronald Reagan and initiated an era of government retrenchment. The percentage of Americans who depend in a significant way on income from government rose from 28.7% in 1950 to 61.2% in 1980, but then fell to 53.7% in 2000. Furthermore, the Fed, under then-Chairman Paul Volcker, blasted up interest rates, and negative real borrowing costs turned to very high positive levels.

As inflation receded, American business found itself naked as the proverbial jaybird with depressed profits and intense foreign competition. In response, corporate leaders turned to restructuring with a will. That included the end of paternalism towards employees as executives realized they were in a globalized atmosphere of excess supply of almost everything. With operations and jobs moving to cheaper locations offshore and with the economy increasingly high tech and service oriented, union membership and power plummeted, especially in the private sector.

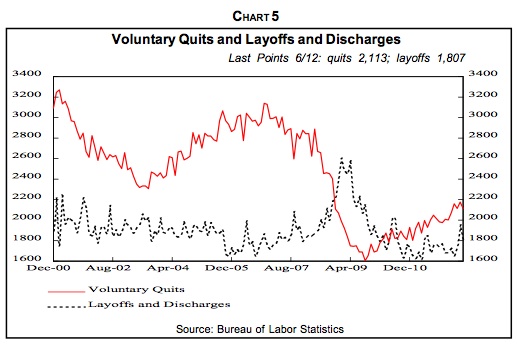

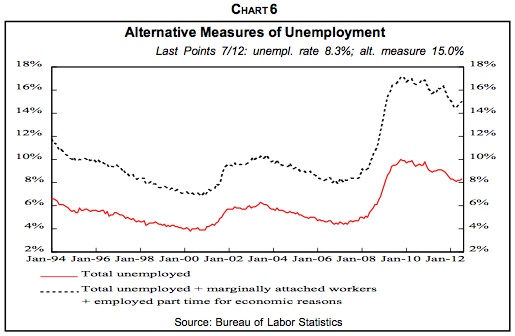

In today's unfolding deflation, the wage-price spiral has been reversed. Contrary to most forecaster expectations, but forecast in my two Deflation books, wages are actually being cut and involuntary furloughs instituted for the first time since the 1930s. In inflation, oversized wages can be cut to size by simply avoiding pay hikes while inflation erodes real compensation to the proper level. But with deflation, actual cuts in nominal pay are necessary. Note that as wage cuts and furloughs become increasingly prevalent, the layoff (Chart 5) and unemployment numbers (Chart 6) will increasingly understate the reality of the declines in labor compensation.

Financial Asset Inflation/Deflation. Perhaps the best recent example of financial asset inflation was the dot com blowoff in the late 1990s. It culminated the long secular bull market that started in 1982 and was driven by the convergence of a number of stimulative factors. CPI inflation peaked in 1980 and declined throughout the 1980s and 1990s. That pushed down interest rates and pushed up P/Es. American business restructured and productivity leaped.

A Secular Down Cycle

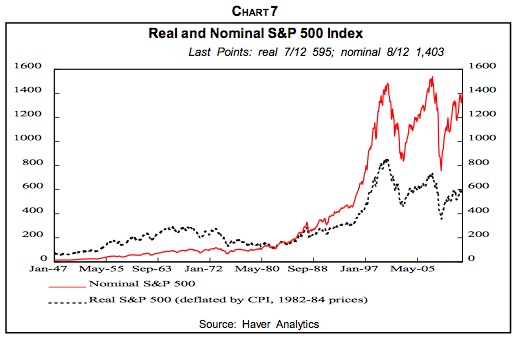

The robust economy upswing that drove the 1982-2000 secular bull market ended in 2000, as shown by basic measures of the economy's health. Stocks, which gauge economic health as well as fundamental sentiment, have been trending down since 2000 in real terms (Chart 7). At the rate that deleveraging worldwide is progressing, it will take another five to seven years to be completed with equity prices continuing weak on balance during that time. Employment also peaked out in 2000 even after accounting for lower although rising labor participation rates by older Americans. Household net worth in relation to disposable (after-tax) income has also been weak for a decade.

The Federal Reserve's Survey of Consumer Finances, just published for 2007-2010, reveals that median net worth of families fell 39% in those years from $126,400 to $77,300, largely due to the collapse in house prices. Average household income fell 11% from $88,300 to $78,500 in those years with the middle-class hit the hardest. The top 10% by net worth had a 1.4% drop in median income, the lowest quartile lost 3.7% but the second quartile was down 12.1% and the third quartile dropped 7.7%.

Households reacted to too much debt by reducing it. In 2010, 75% of households had some debt, down from 77% in 2007, according to the Fed survey. Those with credit card balances fell from 46.1% to 39.4% but late debt payments were reported by 10.8% of households, up from 7.1% in 2007. With house prices collapsing, debt as a percentage of assets climbed to 16.4% in 2010 from 14.8% in 2007. Financial strains reduced the percentage that saved in the preceding year from 56.4% in 2007 to 52% in 2010.

Nevertheless, the gigantic policy ease in Washington in response to the stock market collapse and 9/11 gave the illusion that all was well and that the growth trend had resumed. The Fed rapidly cut its target rate from 6.5% to 1% and held it there for 12 months to provide more-than ample monetary stimulus. Meanwhile, federal tax rebates and repeated tax cuts generated oceans of fiscal stimulus as did spending on homeland security, Afghanistan and then Iraq.

As a result, the speculative investment climate spawned by the dot com nonsense survived. It simply shifted from stocks to commodities, foreign currencies, emerging market equities and debt, hedge funds, private equity—and especially to housing. Homeownership additionally benefited from low mortgage rates, loose lending practices, securitization of mortgages, government programs to encourage home ownership and especially to the conviction that house prices would never fall.

Investors still believed they deserved double-digit returns each and every year, and if stocks no longer did the job, other investment vehicles would. This prolongs what I have dubbed the Great Disconnect between the real world of goods and services and the speculative world of financial assets.

Treasurys

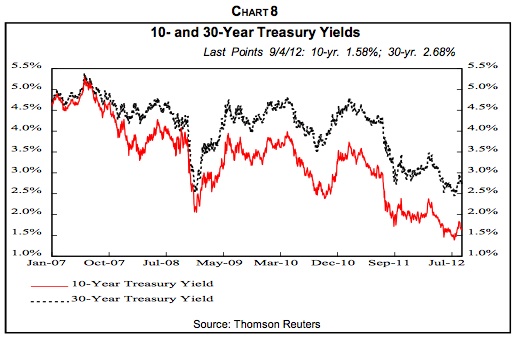

I hope you'll recall my audacious forecast of 2.5% yields on 30-year Treasury bonds and 1.5% on 10-year Treasury notes, made at the end of last year when the 30-year yield was 3.0%. Those levels were actually reached recently (Chart 8), and I now believe the yields will fall to 2.0% and 1.0%, respectively, for the same reasons that inspired my earlier forecasts. The global recession will attract money to Treasurys as will deflation and their safe-haven status. Sure, Treasurys were downgraded by Standard & Poor's last year, but in the global setting, they're the best of a bad lot.

The deflation in interest rates has spawned significant side effects. It's a zeal for yield that has pushed many individual and institutional investors further out on the risk spectrum than they may realize. Witness the rush into junk bonds and emerging country debt. Recently, investors have jumped into the government bonds of Eastern European countries such as Poland, Hungary and Turkey where yields are much higher than in developed lands. The yield on 10-year notes in Turkish lira is about 8% compared to 1.4% in Germany and 1.6% in the U.S.

The inflows of foreign money has pushed up the value of those countries' currencies, adding to foreign investor returns. And some of these economies look solid relative to the troubled eurozone—Poland avoided recession in the 2008-2009 global financial crisis. But the continuing eurozone financial woes and recession may well drag the zone's Eastern European trading partners down. And then, as foreign investors flee and their central banks cut rates, their currencies will nosedive much as occurred in Brazil.

Tangible Asset Inflation/Deflation. Booms and busts in tangible asset prices are a fourth form of inflation/deflation. The big inflation in commercial real estate in the early 1980s was spurred by very beneficial tax law changes earlier in the decade and by financial deregulation that allowed naïve savings and loans to make commercial real estate loans for the first time. But deflation set in during the decade due to overbuilding and the 1986 tax law constrictions. Bad loans mounted and the S&L industry, which had belatedly entered commercial real estate financing, went bust and had to be bailed out by taxpayers through the Resolution Trust Corp.

Nonresidential structures, along with other real estate, were hard hit by the Great Recession and remain weak as capacity remains ample and prices of commercial real estate generally persist well below the 2007 peak. The two obvious exceptions are rental apartments and medical office buildings. Returns on property investments recovered from the 2007-2009 collapse, but are now slipping.

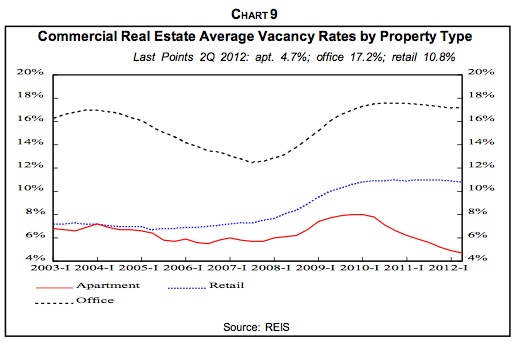

Retail vacancy rates remain high (Chart 9) due to cautious consumers and growing online sales. Rents remain about flat. Ditto for office vacancies due to weak employment and the tendency of employers to move in the partitions to pack more people into smaller office spaces. The office vacancy rate in the second quarter was 17.2%, the same as the first quarter, down slightly from the post-financial crisis peak of 17.6% in the third quarter of 2010 but well above the 2007 boom level of 13.8%. In the second quarter, office space occupancy rose just 0.12% from the previous quarter compared to 0.18% in the first quarter.

Housing Woes

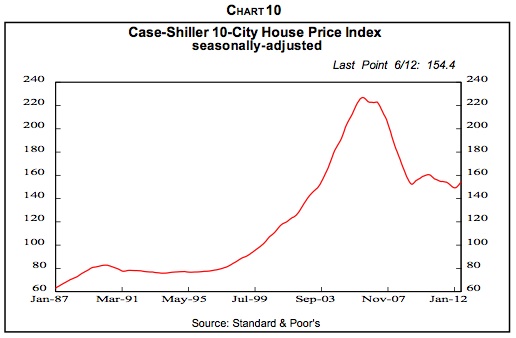

House prices have been deflating for six years, with more to go (Chart 10). The earlier housing boom was driven by ample loans and low interest rates, loose and almost non-existent lending standards, securitization of mortgages which passed seemingly creditworthy but in reality toxic assets on to often unsuspecting buyers, and most of all, by the conviction that house prices never decline.

I expect another 20% decline in single-family median house prices and, consequently, big problems in residential mortgages and related construction loans. In making the case for continuing housing weakness, I've persistently hammered home the ongoing negative effect of excess inventories on house sales, prices, new construction and just about every other aspect of residential real estate.

Spreading Effects

That further drop would have devastating effects. The average homeowner with a mortgage has already seen his equity drop from almost 50% in the early 1980s to 20.5% due to home equity withdrawal and falling prices. Another 20% price decline would push homeowner equity into single digits with few mortgagors having any appreciable equity left. It also would boost the percentage of mortgages that are under water, i.e., with mortgage principals that exceed the house's value, from the current 24% to 40%, according to my calculations. The negative effects on consumer spending would be substantial. So would the negative effects on household net worth, which already, in relation to after-tax income, is lower than in the 1950s.

Currency inflation/deflation. We all normally talk about currency devaluation or appreciation. This is, however, another type of inflation/deflation and like all the others, it has widespread ramifications. Relative currency values are influenced by differing monetary and fiscal policies, CPI inflation/deflation rates, interest rates, economic growth rates, import and export markets, safe haven attractiveness, capital and financial investment opportunities, attractiveness as trading currencies, and government interventions and jawboning, among other factors. In recent years, Japan, South Korea, China and Switzerland have all acted to keep their currencies from rising to support their exports and limit imports.

The U.S. dollar has been strong of late, resulting from its safe haven status in the global financial crisis. Furthermore, the U.S. economy, while slipping, is in better shape than almost any other—the best of the bunch. I believe the global recession will persist and the greenback will continue to serve this role. Furthermore, the greenback is likely to remain strong against other currencies for years as it continues to be the primary international trading and reserve currency. The dollar should continue to meet at least five of my six criteria for being the dominant global currency:

1. After deleveraging is complete, the U.S. will return to rapid growth in the economy and in GDP per capita, driven by robust productivity.

2. The American economy is large and likely to remain the world's biggest for decades.

3. The U.S. has deep and broad financial markets.

4. America has free and open financial markets and economy.

5. No likely substitute for the dollar on the global stage is in sight.

6. Credibility in the buck has been in decline since 1985, but may revive if long-run government deficits are addressed and consumer retrenchment and other factors shrink the foreign trade and current account deficits.

Inflation By Fiat. Way back in 1977, I developed the Inflation by Fiat concept, which gained media attention in that era of high wage-price inflation. This seventh form of inflation encompassed all those ways by which, with the stroke of a pen, Congress, the Administration and regulators raise prices.

The continual rises in the minimum wage is a case in point. So, too, are high tariffs on imported Chinese tires. Agricultural price supports keep prices above equilibrium. As a result, the producer price of sugar in the U.S. is 28 cents per pound compared to the 19 cents world price. Federal contractors are required to pay union wages, which almost always exceed nonunion pay, as noted earlier, another example of inflation by fiat.

Environmental protection regulations may improve the climate, but they increase costs that tend to be passed on in higher prices. The Administration says its new fuel-economy standards of 54.5 miles per gallon by 2025 will cost $1,800 per vehicle but industry estimates put it at $3,000. The cap and trade proposal to reduce carbon emissions is estimated to cost each American household $1,600 per year, according to the Congressional Budget Office. Pay hikes for government workers must be paid in higher taxes sooner or later, and can spill over into private wage increases—although state and local government employee pay is moving back toward private levels, as discussed earlier. Increases in Social Security taxes raise employer costs, which they try to pass on in higher selling prices.

There was some deflation by fiat in the 1980s and 1990s. One of the biggest changes was requiring welfare recipients to work or be in job-training programs. That reduced the welfare rolls from 4.7% of the population in 1980 to 2.1% in 2000, while the overall number that depended on government for meaningful income dropped from 61.2% to 53.7%. But now, as an angry nation and left-leaning Congress and Administration react to the financial collapse, Wall Street misdeeds and the worst recession since the Great Depression, the increases in government regulation and involvement in the economy have been substantial. And with them, more inflation by fiat—at least unless there is a major change of government control with the November elections.

1a)Federal Reserve Flirting With Higher Inflation

Will the U.S. Federal Reserve look the other way if inflation overruns its target?

1a)Federal Reserve Flirting With Higher Inflation

Will the U.S. Federal Reserve look the other way if inflation overruns its target?

Risking the wrath of politicians and the central bank's hard-won reputation for keeping prices stable, three top Fed officials are touting plans for boosting employment that explicitly allow for inflation to run above the Fed's 2.0-percent goal.

Investors are wondering just how high - and for how long - the Fed may allow inflation to rise to encourage borrowing, investment and hiring. In theory, more people working means higher output, which should narrow the gap between what American workers are currently producing and their potential.

"The Fed's body language clearly says they think the output gap is huge and that they're willing to take risks on inflation," said Bluford Putnam, chief economist at futures exchange operator CME Group.

The Fed reduced official interest rates to near zero almost four years ago and has since then bought some $2.3 trillion in securities to boost the economy, taking the central bank deeper into uncharted policy territory.

With the U.S. economy still recovering only slowly, last month the Fed said it would keep buying bonds until the labor market outlook improves "substantially," a move that many investors expect will boost inflation, currently running below the 2.0 percent target.

Since the announcement, the central bank's top policymakers have been busy drawing their lines in the sand.

Minneapolis Fed President Narayana Kocherlakota says he would tolerate inflation of 2.25 percent, and John Williams of the San Francisco Fed says he's OK with 2.5 percent. The Chicago Fed's Charles Evans, considered one of the central bank's most pro-growth "doves," says he'd hold fast to low rates as long as the outlook for inflation stayed below 3 percent.

Volatility in bond markets suggests investors are adjusting their bets as to the true intentions of Fed Chairman Ben Bernanke and his core of policymakers, and whether they will be able to control inflation when the time comes.

"I wouldn't be surprised if they let it run to 3.0 percent for a quarter or two and still rationalize that by saying they still haven't seen unemployment go down like they want it to," said Mike Knebel, portfolio manager specializing in fixed income at Ferguson Wellman Capital Management in Portland, Oregon.

"Three percent still seems to be a fairly reasonable number in most people's minds - at least those of us who are old enough to remember when six percent was considered the norm," he said.

BERNANKE'S QUIET VICTORY

Inflation soared to over 14 percent in 1980 before the Fed under then-Chairman Paul Volcker finally wrestled it back down. Albeit far less severe, the last time inflation fears gripped the United States was in 2008, just before Lehman Brothers collapsed at the height of the financial crisis.

While inflation targeting has been a bedrock of central banking internationally for decades, the Fed only this year adopted an explicit target inflation but also, unlike most of its peers, is charged not only with keeping prices stable but also with maximizing employment.

In August, the Fed's preferred annual measure of inflation, the Commerce Deptartment's personal consumption price index was up just 1.5 percent for the year in August, while the more broadly watched U.S. Labor Department's consumer price index increased 1.7 percent. September's reading of the consumer price index is to be published on Tuesday and is forecast to see inflation at 1.9 percent.

Prices have generally stayed low and stable the last three years, representing a quiet victory for Bernanke amid fallout from the brutal recession in 2008 that threatened a period of deflation, which is the phenomenon of falling prices that held Japan in a slump for a decade.

After the central bank made its bold statement last month, announcing further bond buying until unemployment falls significantly, Bernanke was at pains to say that getting more Americans back to work would not come at the cost of higher inflation.

If inflation were to run above target, he told reporters, the Fed will bring it back to 2.0 percent "over time" as part of a balanced approach to achieving its two mandates of price stability and full employment.

One key indicator of inflation expectations, based on the gap between regular and inflation-protected U.S. Treasury bonds, jumped to a six-year high of 2.65 percent after the Fed's decision on Sept. 13.

That so-called "breakeven" rate, which tracks expectations for inflation 10 years from now, is currently running at about 2.47 percent, according to Reuters data.

WILLIAMS NOT BUYING

Most people see inflation as a bad thing. Higher wages mean more money in consumers' pockets, but the price of everything they want to buy rises as well, typically too quickly for earnings to keep up.

Left to rise too fast for too long, inflation also risks devaluing the currency and stanching economic growth. The fact that gold prices, which usually move opposite the U.S. dollar, remain near record highs reflects concerns about future inflation.

But many influential economists believe that higher inflation expectations translate into lower "real," or inflation-adjusted, interest rates, which could stimulate the economy, an attractive selling point for a central bank running out of policy options.

Not everyone is buying the idea, including Williams, the policy-centrist chief of the San Francisco Fed, who this week announced that inflation would need to rise to 2.5 percent before he would want to rethink the Fed's low-rate policy to boost jobs.

"You would expect inflation to fluctuate within some kind of reasonable band, so say between 1.5 percent and 2.5 percent. Even in normal situations, inflation tends to fluctuate because of various shocks and events," Williams told Reuters on Wednesday.

But acknowledging that he is not troubled by inflation of up to 2.5 percent is a far cry from purposely stoking it to bring down real interest rates, or to cut the burden of household debt, he said. Firstly, he said, the Fed does not have that kind of hair-trigger control.

"The idea that you could create 4.0 percent inflation for a few years, and then bring it back to 2.0 percent, is a dream, a false dream," Williams said in his office overlooking San Francisco Bay.

The risk of trying that approach and then failing, he said, is a costly recession, the likes of which the United States has not seen since the Fed ratcheted up interest rates by about 16 percentage points to battle raging inflation through the 1970s and early 1980s.

But even if such precise managing of inflation were possible, higher inflation expectations may not generate the benefits that modern macroeconomic theory tends to predict, Williams noted. Instead of pushing up wages and house prices and trimming the real value of household debt burdens, higher inflation might simply create greater uncertainty, curbing investment and growth, he said.

Inflation could also damage the Fed's credibility, which many cite for U.S. price stability in the first place.

TRADING THE INFLATION TARGET

Supporters of more easing say the Fed has no intention of turning a blind eye to inflation.

"I disagree with the premise that what we're doing is seeking to gin up inflation," Jeremy Stein, the Fed's newest governor and a strong backer of the Fed's recent policy easing, said on Thursday.

Intentional or not, markets appear to believe that the Fed's inflation stance has shifted, if only slightly.

The brief jump in breakeven rates suggested investors are repricing the exact meaning of the central bank's inflation target, which may be warranted "if the Fed's policy stance implies a potentially somewhat higher inflation rate in coming years," said Roberto Perli, managing director of policy research at broker dealer International Strategy and Investment Group.

Charles Plosser, the head of the Philadelphia Fed and an inflation hawk who opposed the recent round of easing, warned, however, that the central bank may be sending the wrong signals.

Some people have interpreted the Fed's statement last month, that it won't start raising interest rates as soon as a U.S. economic recovery strengthens, to mean it is willing to tolerate higher inflation in order to lower the unemployment rate, Plosser said on Thursday.

"This is another risk," he said, "to the hard-won credibility the institution has built up over many years, which, if lost, will undermine economic stability.

Intentional or not, markets appear to believe that the Fed's inflation stance has shifted, if only slightly.

The brief jump in breakeven rates suggested investors are repricing the exact meaning of the central bank's inflation target, which may be warranted "if the Fed's policy stance implies a potentially somewhat higher inflation rate in coming years," said Roberto Perli, managing director of policy research at broker dealer International Strategy and Investment Group.

Charles Plosser, the head of the Philadelphia Fed and an inflation hawk who opposed the recent round of easing, warned, however, that the central bank may be sending the wrong signals.

Some people have interpreted the Fed's statement last month, that it won't start raising interest rates as soon as a U.S. economic recovery strengthens, to mean it is willing to tolerate higher inflation in order to lower the unemployment rate, Plosser said on Thursday.

"This is another risk," he said, "to the hard-won credibility the institution has built up over many years, which, if lost, will undermine economic stability.

-------------------------------------------------------------------------------------------------------------------

2)-

Media mogul Rupert Murdoch tweeted on Saturday that it would be a “nightmare for Israel” if President Obama is re-elected to a second term.

Vice President Joe “Biden outright lied about personal relations with Bibi. Susan Rice for State real nightmare,” opined the 81-year-old Murdoch, who built the world’s largest media corporation with assets that include Fox News, The Wall Street Journal and the New York Post.

In a series of tweets on Saturday, Murdock (@rupertmurdoch) also accused the White House of “still lying about Benghazi” and charged that the Obama administration “had to know truth, or is whole admin a shambles? Biden threw CIA under bus, now WH throws State.”

Murdoch, who resigned as director of News International in July but insists that he is still at the helm, predicted that the presidential election appears to be “coming down to Ohio” where GOP presidential nominee Mitt Romney visited on Saturday.

“Huge spending by both sides, but Obama TV buying operation infinitely smarter,” Murdock observed on Twitter.

He had this advice for Romney ahead of his second debate with President Obama on Tuesday: “Next debate Romney needs to ignore personal attacks and pivot to plans for millions of jobs and real opportunity for all. Only that matters.”

Murdoch, who last year closed the News of the World tabloid after a phone-hacking scandal engulfed News Corp.'s U.K. unit, also tweeted that British Prime Minister David Cameron appears to be considering tougher privacy laws.

“Told U.K.'s Cameron receiving scumbag celebrities pushing for even more privacy laws,” he insisted. “Trust the toffs! Transparency under attack. Bad.”

In a tweet about China, Murdoch first reported the country to be in “crisis” with “massive public anger at corruption. Maybe change on way. Nobody can make confident predictions.”

But he later explained: “Did not mean China in real crisis, at least yet. But big problems. Bet Xi will be very different, move slowly to improve many things.”

------------------------------------------------------------------------------------------------------------------------3)Trevor the farmer was in the fertilised egg business.

Praised by colleagues as smart, friendly and passionate about the law, Teresa Wagner was a leading candidate when two jobs came open to teach writing at the University of Iowa law school. An alumnus, she was already working part-time at its writing center and received positive reviews from students and a key committee.

Wagner

Wagner

2)-

Murdoch: 'Nightmare for Israel' If Obama Win

By Paul ScicchitanoMedia mogul Rupert Murdoch tweeted on Saturday that it would be a “nightmare for Israel” if President Obama is re-elected to a second term.

Vice President Joe “Biden outright lied about personal relations with Bibi. Susan Rice for State real nightmare,” opined the 81-year-old Murdoch, who built the world’s largest media corporation with assets that include Fox News, The Wall Street Journal and the New York Post.

In a series of tweets on Saturday, Murdock (@rupertmurdoch) also accused the White House of “still lying about Benghazi” and charged that the Obama administration “had to know truth, or is whole admin a shambles? Biden threw CIA under bus, now WH throws State.”

Murdoch, who resigned as director of News International in July but insists that he is still at the helm, predicted that the presidential election appears to be “coming down to Ohio” where GOP presidential nominee Mitt Romney visited on Saturday.

“Huge spending by both sides, but Obama TV buying operation infinitely smarter,” Murdock observed on Twitter.

He had this advice for Romney ahead of his second debate with President Obama on Tuesday: “Next debate Romney needs to ignore personal attacks and pivot to plans for millions of jobs and real opportunity for all. Only that matters.”

Murdoch, who last year closed the News of the World tabloid after a phone-hacking scandal engulfed News Corp.'s U.K. unit, also tweeted that British Prime Minister David Cameron appears to be considering tougher privacy laws.

“Told U.K.'s Cameron receiving scumbag celebrities pushing for even more privacy laws,” he insisted. “Trust the toffs! Transparency under attack. Bad.”

In a tweet about China, Murdoch first reported the country to be in “crisis” with “massive public anger at corruption. Maybe change on way. Nobody can make confident predictions.”

But he later explained: “Did not mean China in real crisis, at least yet. But big problems. Bet Xi will be very different, move slowly to improve many things.”

------------------------------------------------------------------------------------------------------------------------3)Trevor the farmer was in the fertilised egg business.

He had several hundred young layers (hens), called 'pullets' and eight or

ten roosters, whose job was to fertilise the eggs. The farmer kept records

and any rooster that didn't perform went into the soup pot and was replaced.

That took an awful lot of his time so he bought a set of tiny bells and

attached them to his roosters. Each bell had a different tone so Trevor

could tell from a distance, which rooster was performing. Now he could sit

on the porch and fill out an efficiency report simply by listening to the bells.

ten roosters, whose job was to fertilise the eggs. The farmer kept records

and any rooster that didn't perform went into the soup pot and was replaced.

That took an awful lot of his time so he bought a set of tiny bells and

attached them to his roosters. Each bell had a different tone so Trevor

could tell from a distance, which rooster was performing. Now he could sit

on the porch and fill out an efficiency report simply by listening to the bells.

The farmer's favourite rooster was old Dave, and a very fine specimen he

was too. But on this particular morning Trevor noticed old Dave's bell hadn't

rung at all! Trevor went to investigate. The other roosters were chasing pullets,

bells-a-ringing. The pullets, hearing the roosters coming, would run for cover.

But to farmer Trevor's amazement, Dave had his bell in his beak, so it couldn't

ring. He'd sneak up on a pullet, do his job and walk on to the next one.

Trevor was so proud of Dave, he entered him in the Surrey County Show

and Dave became an overnight sensation among the judges. The result was the

judges not only awarded Dave the No Bell Piece Prize but they also awarded

him the Pullet Surprise as well.

Clearly Dave was a Pulletician in the making: Who else but a Pulletician could figure

out how to win two of the most highly coveted awards on our planet by being the

best at sneaking up on the populace and screwing them when they weren't

paying attention.

was too. But on this particular morning Trevor noticed old Dave's bell hadn't

rung at all! Trevor went to investigate. The other roosters were chasing pullets,

bells-a-ringing. The pullets, hearing the roosters coming, would run for cover.

But to farmer Trevor's amazement, Dave had his bell in his beak, so it couldn't

ring. He'd sneak up on a pullet, do his job and walk on to the next one.

Trevor was so proud of Dave, he entered him in the Surrey County Show

and Dave became an overnight sensation among the judges. The result was the

judges not only awarded Dave the No Bell Piece Prize but they also awarded

him the Pullet Surprise as well.

Clearly Dave was a Pulletician in the making: Who else but a Pulletician could figure

out how to win two of the most highly coveted awards on our planet by being the

best at sneaking up on the populace and screwing them when they weren't

paying attention.

Do you perhaps know of a Pulletician called Dave?

----------------------------------------------------------------------------------------------------

4)Iran's Cyber Warfare

Gabi Siboni and Sami Kronenfeld - INSS, October 15th, 2012

The recent statement by US Secretary of Defense Leon Panetta about the need to confront Iranian cyber warfare waged against American targets highlights developments of the last two years regarding Iran's extended activity to construct defensive and offensive cyberspace capabilities. Apparently underway is a large cyberspace campaign by Iran, both to attack various targets in retaliation for the sanctions imposed against it and to repel the cyber attacks directed at it.

Iran is working to develop and implement a strategy to operate in cyberspace. The approach by Supreme Leader Khamenei to opportunities and risks inherent in cyberspace, reflected in his March 2012 announcement on the establishment of the Supreme Cyber Council, shows how central the issue is in Iran. Defensively, Iran is working to realize two main goals: first, to create a “technological envelope” that will protect critical infrastructures and sensitive information against cyberspace attacks such as the Stuxnet virus, which damaged the Iranian uranium enrichment program, and second, to stop and foil cyberspace activity by opposition elements and opponents to the regime, for whom cyberspace is a key platform for communicating, distributing information, and organizing anti-regime activities. The Iranian program to create a separate, independent communications network is particularly important in this context.

Offensively, the cyberspace strategy is part of the doctrine of asymmetrical warfare, a central principle in the Iranian concept of the use of force. Cyberspace warfare, like other classical asymmetrical tactics such as terrorism and guerilla warfare, is viewed by Iran as an effective tool to inflict serious damage on an enemy with military and technological superiority. In a case of escalation between Iran and the West, Iran will likely aim to launch a cyber attack against critical infrastructures in the United States and its allies, including energy infrastructures, financial institutions, transportation systems, and others.

In order to realize the goals of its strategy, Iran has allocated about $1 billion to develop and acquire technology and recruit and train experts. The country has an extensive network of educational and academic research institutions dealing with information technology, computer engineering, electronic engineering, and math. In addition, the government operates its own institute – the Iran Telecommunications Research Center, the research and professional branch of the Information and Communications Ministry. The institute trains and operates advanced research teams in various fields, including information security. Another government body is the Technology Cooperation Officer, which belongs to the president’s bureau, and initiates information technology research projects. This body has been identified by the European Union and others in the West as involved in the Iranian nuclear program.

The Iranian cyberspace system comprises a large number of cyber organizations, formally related to various establishment institutions and involved in numerous fields. One central organization with a primarily defensive orientation is the Cyber Defense Command, operating under Iran’s Passive Defensive Organization, affiliated with the General Staff of the Armed Forces. Alongside military personnel, this cyberspace organization includes representatives of government ministries, such as the ministries of communications, defense, intelligence, and industry, and its main goal is to develop a defensive doctrine against cyberspace threats. Another cyberspace body of a defensive nature is the MAHER Information Security Center, operating under the aegis of the communications and information technology ministry. The center is in charge of operating rapid response teams in case of emergencies and cyber attacks. Iran also has a Committee for Identifying Unauthorized Sites and FETA, the police cyberspace unit, which in addition to dealing with internet crime also monitors and controls Iranian internet usage, with emphasis on internet cafés throughout the country that allow relatively anonymous web surfing.

The picture is less clear regarding Iran’s offensive cyberspace capabilities. Clearly the capabilities of the Revolutionary Guards make Iran one of the most advanced nations in the field of cyberspace warfare, with capabilities, inter alia, to install malicious code in counterfeit computer software, develop capabilities to block computer communications networks, develop viruses and tools for penetrating computers to gather intelligence, and develop tools with delayed action mechanisms or mechanisms connected to control servers. There is also evidence of links between the Revolutionary Guards and hacker groups in Iran and abroad that operate against the enemies of the regime at home and around the world. The use of outsourcing allows the Revolutionary Guards and Iran to maintain distance and deniability about Iran’s involvement in cyberspace warfare and cyber crime. A prominent hacker group linked to the Revolutionary Guards is the Ashiyane Digital Security Team, whose members are motivated by an ideology supporting the Iranian regime and the Islamic Revolution and who target the enemies of the regime for attack. The Basij, subordinate to the Revolutionary Guards, also became active in cyberspace when in 2010 established the Basij Cyberspace Council. The activities of the Basij focus primarily on creating pro-Iranian propaganda in cyberspace, and the organization works on developing more advanced cyberspace capabilities and using Revolutionary Guards cyberspace operatives to train hackers in high offensive capabilities.

Iran is already active offensively, as evidenced by several events in recent years. In 2011 there were two attacks on companies providing security permissions; most prominent was the attack from June to August 2011 on DigiNotar in the Netherlands, whose databases – the major source of SSL permissions in Holland – were attacked. During those months, certificates for authenticating websites, including the certificate authenticating the google.com domain, were stolen; the latter item allowed attackers to pose as Google and redirect Gmail servers. In fact, the attack allowed Iran to penetrate more than 300,000 computers, primarily in Iran, and seems to have been designed to monitor users at home for internal security purposes.

In September 2012, a number of financial institutions in the United States came under attack, including sites belonging to the Bank of America, Morgan Chase, and CitiGroup. According to American analysts, the most destructive attack occurred in August 2012 on the computers of the Saudi Arabian oil company Aramco and the Qatari gas company RasGas. The attack was carried out by means of a computer virus called Shamoo, which spread through company servers and destroyed information stored in them. A group called the Cutting Sword of Justice took responsibility for the attack and claimed it was aimed at the main source of income of Saudi Arabia, which was accused of committing crimes in Syria and Bahrain.

The development of Iran’s cyberspace capabilities and the most recent attacks should concern the United States as well as Israel. The success of the attack on Aramco computers is of concern because the standard defensive systems proved insufficient against the focused and anonymous attacks. It is therefore necessary to develop tools that can deal with such threats. One of the directions being developed involves identification, blocking, and neutralization of unusual behavior in computers under attack. Such tools could neutralize threats even after the malicious code managed to penetrate the targeted computer. The attack on Aramco was designed more to destroy information indiscriminately in tens of thousands of company computers and less (if at all) to gather intelligence. If intelligence gathering in cyberspace can be considered legitimate in some cases, a large scale attack such as the one by Iran against a civilian target marks a transition by Iran to retaliatory action. Secretary Panetta’s recent statement on the need to close accounts with those responsible for this attack demonstrates this, but what ultimately counts is the test of action and not of words.

The focus of Iran’s cyberspace activity directed against Israel and other countries in the West requires appropriate defensive arrangements, beginning with an up-to-date doctrine of cyberspace defense. The attackers’ sophistication requires intelligence-based defenses as well as the generic ones. In light of developments in Iran, the State of Israel must place the issue of Iranian cyberspace activity among its highest intelligence priorities, in order to identify advance preparations and foil attacks before they are underway. Similar to the Iranian nuclear program, the challenge is not Israel's alone, rather that of many other states in the West as well as the Gulf states. It is therefore necessary to initiate broad interstate cooperation to gather intelligence and foil Iranian cyber activity.

Dr. Gabi Siboni is the head of the Cyber Warfare Program at INSS. Sami Kronenfeld is an intern in the program. This essay is shortened version of a forthcoming article on Iran’s cyberspace capabilities, to be published in the December issue of Military and Strategic Affairs.

-------------------------------------------------------------------------------------------------------------------------------------

5

LAW SCHOOL SHOWDOWN OVER LIBERAL BIAS

Associated Press

Praised by colleagues as smart, friendly and passionate about the law, Teresa Wagner was a leading candidate when two jobs came open to teach writing at the University of Iowa law school. An alumnus, she was already working part-time at its writing center and received positive reviews from students and a key committee.

Wagner

Wagner

But after she interviewed with the faculty in 2007, one job went to someone without teaching experience and the other wasn't filled. She was passed over for other jobs in the coming years. She now says she was blackballed because of her legal work against abortion rights and will take her complaint to a jury this week in a case that is being closely watched in higher education because of longstanding allegations of political bias at left-leaning law schools.

Conservatives have maintained for years that they are passed over for jobs and promotions at law schools because of their views, but formal challenges have been rare, in part because of the difficulty of proving discrimination. Wagner's case is considered the first of its kind.

"This will put a spotlight on a terrible injustice that is being perpetrated throughout American higher education," said Peter Wood, president of the National Association of Scholars, who says he routinely hears from rejected conservative professors. "What makes Teresa Wagner's case so extraordinary is she came up with the documentary evidence of what was really going on."

But some scholars worry that challenges like Wagner's could force law schools to begin openly considering the political views of job applicants, opening the way for more lawsuits and court interference in hiring.

At a federal trial that starts Monday in Davenport, Wagner will argue that the law school faculty blocked her appointment because she had opposed abortion rights, gay marriage and euthanasia while working as a lawyer for the Family Research Council and the National Right to Life Committee in Washington.

Wagner says the opposition to her was led by professor Randall Bezanson, a law clerk for Justice Harry Blackmun when he wrote the landmark Roe vs. Wade decision that legalized abortion in 1973 _ an opinion Wagner spent her earlier career opposing. She says 46 of 50 faculty members who considered her appointment were Democrats, while one was Republican. Wagner will offer as evidence an e-mail from a school official who backed her candidacy warning the dean that some opposed her "because they so despise her politics (and especially her activism about it)."

Wagner declined an interview request before trial, but told Fox News in April that liberals were protective of prestigious faculty appointments. "Republicans need not apply," she said.

Lawyers representing the law school will argue that Wagner was passed over after botching an answer during a 2007 job interview with the faculty, a claim her attorney calls a pretext.

A number of studies in recent years have examined party affiliation, ideology and donations to candidates and concluded that law professors are overwhelmingly left-leaning.

Many law schools recruit conservative scholars to join their faculty and top law schools pride themselves on having prominent representatives of different perspectives. Some law schools, especially those affiliated with the Catholic church and other religions, also lean strongly conservative. Still, many liberals concede they outnumber their colleagues on faculties around the country but say reasons such as career choices may explain the disparity, not discrimination in hiring.

Walter Olson, senior fellow at the Cato Institute, a libertarian think tank, said business conservatives with expertise in regulatory and antitrust law are well-represented on faculties. But he said he would be hard-pressed to name any professor at a non-religious school who opposed the Roe decision before winning tenure.

As a lawyer for conservative groups, Wagner wrote papers and books and filed court briefs on behalf of conservative social causes after graduating from law school in 1993.

She moved back to Iowa City with her husband and four children in 2006 to raise their family. She says she had the necessary experience for the law school openings because she had taught writing at George Mason law school in Virginia and an ethics class at Notre Dame. In 2002, she'd turned down a job offer from Ave Marie Law School, a conservative Catholic institution then located in Ann Arbor, Mich.

"I thought she was going to be dynamic in the classroom," said Ave Marie dean emeritus Bernard Dobranski. "She was very lively and vivacious."

But Wagner says an associate Iowa dean told her to conceal her connection to Ave Maria during the interview because it would be viewed negatively. Before professors voted on whether to recommend her hiring, she claims Bezanson spoke in opposition.

In a deposition, Bezanson said that he "picked up someone saying she was conservative" during discussions but denied that was the driving factor in his opposition. "However anybody voted, nobody is ever stupid enough to say anything about that in a faculty meeting," said Bezanson, an expert on free speech.

The law school says Wagner told them she would not teach legal analysis, which professors found unacceptable since it was in the job description.

Professor Michael Vitiello, of University of the Pacific law school in Sacramento, has argued that claims of liberal bias at law schools are overblown. He said Wagner's case posed intriguing questions about whether political views should be considered in hiring decisions.

"There is something very interesting, seeing conservatives suing on job discrimination claims because suddenly they are portraying themselves as victims," he said. "This case is filled with all sorts of ironies."

Olson, of the Cato Institute and author of a book on legal academia, said the jury's decision "could shake up lots of hiring practices. If they say state universities are under scrutiny to make sure they are not discriminating against viewpoints, then a lot of people can sue, a lot of cases are going to be pretty good and the universities are going to have someone looking over their shoulder."

Conservatives have maintained for years that they are passed over for jobs and promotions at law schools because of their views, but formal challenges have been rare, in part because of the difficulty of proving discrimination. Wagner's case is considered the first of its kind.

"This will put a spotlight on a terrible injustice that is being perpetrated throughout American higher education," said Peter Wood, president of the National Association of Scholars, who says he routinely hears from rejected conservative professors. "What makes Teresa Wagner's case so extraordinary is she came up with the documentary evidence of what was really going on."

But some scholars worry that challenges like Wagner's could force law schools to begin openly considering the political views of job applicants, opening the way for more lawsuits and court interference in hiring.

At a federal trial that starts Monday in Davenport, Wagner will argue that the law school faculty blocked her appointment because she had opposed abortion rights, gay marriage and euthanasia while working as a lawyer for the Family Research Council and the National Right to Life Committee in Washington.

Wagner says the opposition to her was led by professor Randall Bezanson, a law clerk for Justice Harry Blackmun when he wrote the landmark Roe vs. Wade decision that legalized abortion in 1973 _ an opinion Wagner spent her earlier career opposing. She says 46 of 50 faculty members who considered her appointment were Democrats, while one was Republican. Wagner will offer as evidence an e-mail from a school official who backed her candidacy warning the dean that some opposed her "because they so despise her politics (and especially her activism about it)."

Wagner declined an interview request before trial, but told Fox News in April that liberals were protective of prestigious faculty appointments. "Republicans need not apply," she said.

Lawyers representing the law school will argue that Wagner was passed over after botching an answer during a 2007 job interview with the faculty, a claim her attorney calls a pretext.

A number of studies in recent years have examined party affiliation, ideology and donations to candidates and concluded that law professors are overwhelmingly left-leaning.

Many law schools recruit conservative scholars to join their faculty and top law schools pride themselves on having prominent representatives of different perspectives. Some law schools, especially those affiliated with the Catholic church and other religions, also lean strongly conservative. Still, many liberals concede they outnumber their colleagues on faculties around the country but say reasons such as career choices may explain the disparity, not discrimination in hiring.

Walter Olson, senior fellow at the Cato Institute, a libertarian think tank, said business conservatives with expertise in regulatory and antitrust law are well-represented on faculties. But he said he would be hard-pressed to name any professor at a non-religious school who opposed the Roe decision before winning tenure.

As a lawyer for conservative groups, Wagner wrote papers and books and filed court briefs on behalf of conservative social causes after graduating from law school in 1993.

She moved back to Iowa City with her husband and four children in 2006 to raise their family. She says she had the necessary experience for the law school openings because she had taught writing at George Mason law school in Virginia and an ethics class at Notre Dame. In 2002, she'd turned down a job offer from Ave Marie Law School, a conservative Catholic institution then located in Ann Arbor, Mich.

"I thought she was going to be dynamic in the classroom," said Ave Marie dean emeritus Bernard Dobranski. "She was very lively and vivacious."

But Wagner says an associate Iowa dean told her to conceal her connection to Ave Maria during the interview because it would be viewed negatively. Before professors voted on whether to recommend her hiring, she claims Bezanson spoke in opposition.

In a deposition, Bezanson said that he "picked up someone saying she was conservative" during discussions but denied that was the driving factor in his opposition. "However anybody voted, nobody is ever stupid enough to say anything about that in a faculty meeting," said Bezanson, an expert on free speech.

The law school says Wagner told them she would not teach legal analysis, which professors found unacceptable since it was in the job description.

Professor Michael Vitiello, of University of the Pacific law school in Sacramento, has argued that claims of liberal bias at law schools are overblown. He said Wagner's case posed intriguing questions about whether political views should be considered in hiring decisions.

"There is something very interesting, seeing conservatives suing on job discrimination claims because suddenly they are portraying themselves as victims," he said. "This case is filled with all sorts of ironies."

Olson, of the Cato Institute and author of a book on legal academia, said the jury's decision "could shake up lots of hiring practices. If they say state universities are under scrutiny to make sure they are not discriminating against viewpoints, then a lot of people can sue, a lot of cases are going to be pretty good and the universities are going to have someone looking over their shoulder."

5a)

UNIVERSITY OFFICIAL 'VILLIANIZED' FOR CONSERVATIVE OPINION

By Charlie Butts

Conservatives are calling foul against a Maryland university for disciplining one of its employees because she signed a petition to let voters decide the homosexual "marriage" issue.

Family Research Council (FRC) spokesman J.P. Duffy explains that Gallaudet University has placed its chief diversity officer, Dr. Angela McCaskill, on paid leave because she signed the petition to put the issue on the Maryland ballot.

"Up until just a few years ago, I think a decision punishing any employee for engaging in the democratic process would have actually been jaw-dropping," he suggests.

"But unfortunately, what we're seeing here is this discriminatory action I think reflects really a troubling nationwide trend of voter intimidation and bullying tactics against those who believe in marriage as the union of one man and one woman."

FRC says it is time for those with traditional values to say "enough is enough."

"First of all, we are calling on the university to fully reinstate Dr. McCaskill, and we've launched a national petition asking people to sign … that would call on the university to reinstate her," Duffy reports. "And secondly, we're calling on the board of the university to fire the president of that university for engaging in this kind of misconduct."

The FRC spokesman adds that McCaskill, a Gallaudet alumnus, is a "very distinguished and highly regarded senior university official," and his organization feels the action taken against her "is beyond the pale."

The petition McCaskill signed was successful, which means Maryland voters will decide in the November election whether to reject a bill passed by lawmakers that legalizes same-sex "marriage."

"This is one of those things where because she simply signed the petition, already she is being victimized, and she has been suspended from her position right now," Derek McCoy of the Maryland Marriage Alliance notes.

"We just see that this is another one of those tacks where if somebody voices their opinion on marriage, they get villainized and also ostracized out of society and [told]You can't do that; you can't support marriage being between one man and one woman."

McCoy reminds the school that McCaskill has a constitutionally protected right to free speech and free expression.

"This is not an issue or a referendum even on her job performance and how she's actually conducted herself on her job performance," he notes. "Obviously, she's been there for 23 years. She's the first PHD graduate from Gallaudet University who's deaf and is an African-American woman, and I think it says something about her, her character, about what she's been before."

--------------------------------------------------------------------------------------------------------------------------------------------

6)

-

-----------------------------------------------------------------------------------------------------------------------------------

the federal government of treatment for injuries to military personnel received during their tours on active duty. The President admitted that he was puzzled by the magnitude of the opposition to his proposal.

"Look, it's an all volunteer force," Obama complained. "Nobody made these guys go to war. They had to have known and accepted the risks. Now they whine about bearing the costs of their choice? It doesn't compute.." "I thought these were people who were proud to sacrifice for their country, "Obama continued "I wasn't asking for blood, just money. With the country facing the worst financial crisis in its history, I'd have thought that the patriotic thing to do would be to try to help reduce the nation's deficit..I guess I underestimated the selfishness of some of my fellow Americans.

No comments:

Post a Comment