I have not told Dagny who is her president because I did not want to disturb her nap time or stunt her growth!

---

|

Romney has a publicly acknowledged past unlike our president whose past is mostly unknown except for what he and a ghost writer have let us in on so we know more about Tiger Woods and the Secret Service escapades than Obama's.

However, we no longer want 'smarts' in the White House just smart asses! (See 1 below.)

---

PJTV.com: "Trifecta: An Excellent Education is Possible, Just not in American Schools

Japanese kids are learning advanced math skills, while American kids fly kites. Which skill would be more useful in today’s information age? Bill Whittle, Steve Green and Scott Ott discuss the state of American schools today."

---

My former associate, Meredith Whitney, now says she is wildly bullish and gives her rationale. Is she trying to make up for having egg on her face after brilliantly calling the housing and bank debacle correctly then overstaying and worrying investors about municipal defaults that did not occur as she predicted? Time will tell. (See 2 below.)

---

Dick-------------------------------------------------------------------------------------------------------------------

1)Romney is very well-spoken, and he seems to perform just as well without a teleprompter. What’s more, even though we don’t know Obama’s grades but only his degrees, Romney’s got the same top degree, only more so. Romney is a graduate of Harvard Law who earned a simultaneous MBA from Harvard Business School, a tricky and difficult feat that not many accomplish or even attempt.

Unlike with Obama, we even know quite a bit about Romney’s grades. Take a look:

Romney graduated in 1971 [from Brigham Young] with a 3.97 grade-point average. Because he ranked at the top of his class in the College of Humanities, he was chosen to speak on graduation day…Mitt decided to attend Harvard Business School, but his father thought he should obtain a law degree, so he enrolled in a joint program at Harvard Law School. In 1975, he graduated from Harvard Law cum laude and from Harvard Business School, where he was named a Baker Scholar and was in the top 5 percent of his class.

Back in December of 2011, the NY Times spotlighted Romney’s years at Harvard Business School:

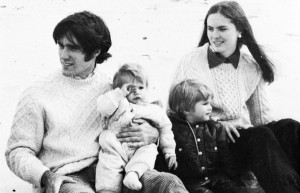

Mr. Romney recruited a murderers’ row of some of the most distinguished students in the class. “He and I said, hey, let’s handpick some superstars,” said Howard Serkin, a classmate…Mr. Romney served as a kind of team captain, the other members said, pushing and motivating the others.“He wanted to make straight A’s,” Mr. Serkin said. “He wanted our study group to be No. 1.” Sometimes Mr. Romney arrived early to run his numbers a few extra times. And if his partners were not prepared, “he was not afraid of saying: ‘You’re letting us down. We want to be the best,’ ” Mr. Serkin added…Mr. Romney was in his element. His class performances were outstanding; his peers described him as precise, convincing and charismatic. He won the high grades he craved…If Mr. Romney melded with the school intellectually, he kept some distance from it socially. He was married and a parent. In the liberal precincts of Cambridge, he and his wife, Ann Romney — pictured wearing matching sweaters at a fall 1973 business school clambake, with their two sons on their laps — seemed like they were from “out on the prairies,” Mr. Brownstein said.The future governor abstained from things many other students were doing: drinking coffee or alcohol, swearing, smoking…

I especially note this, in contrast to Obama:

Today, Mr. Romney does not speak much about his business school degree. But he remains quite attached to the star study group he put together all those years ago, faithfully attending dinners the men hold every five years…[H]e does not miss a chance to return to that setting. Mr. Romney even showed up the year he was put in charge of cleaning up the troubled 2002 Olympic games, stopping by for an hour before flying to Athens for a meeting of the International Olympic Committee…The men gathered most recently in 2009, after Mr. Romney’s unsuccessful presidential bid. His old friends asked him about the experience, and he pointed out how much simpler decisions are in business than in politics. “You end up taking into consideration things that wouldn’t be important in a business decision,” Ronald J. Naples remembers him saying.

Not an unsmart man. Not at all.

[ADDENDUM: By the way, here's that photo that appeared in the NY Times.

-----------------------------------------------------------------------------------------------------------------------------------------------

2)Whitney: 'I Am Wildly Bullish on the US'

Star Wall Street analyst Meredith Whitney says she is "wildly bullish" on the U.S., as its relatively sound economy will attract investors especially away from Europe, where a debt crisis shows no sign of abating.

While the U.S. is due to see better days, those states that have adopted more business-friendly policies such as Texas and the central plains states will particularly shine.

"I am wildly bullish on the U.S., in particular markets in the U.S. You've got a capped inflation story, you've got a hedged inflation story, you've got great growth, you've got one common law, one common language, one common currency, and I think the U.S. market looks terrific," Whitney tells CNBC.

"For an investor there is so much opportunity out there — there's opportunity from Texas all the way up to North Dakota and you can play every industry on that basis."

Policy pays, Whitney adds.

"It's the agriculture and commodities but it's also the right-to-work states, it's where businesses are moving because it's easier to operate and create jobs."

Less business-friendly states like California and Illinois won't be so fortunate, she says.

Europe, meanwhile, remains a cause of concern.

Bailouts arranged for the Greek government calmed markets up until now, yet yields are spiking in the larger Spanish economy, a sign investors are growing increasingly worried Madrid will need a bailout.

Meanwhile in France, President Nicolas Sarkozy trailed Socialist challenger François Hollande in Sunday's elections, leaving both candidates headed for a runoff in May.

Surprising voter support for far-right candidate Marine Le Pen caught markets off guard and pushed the euro down, stoking fears that patience with austerity measures and economic uncertainty under Sarkozy may be wearing thin.

A Hollande victory probably won't bode well for France.

"A 75 percent tax rate cannot be good for Europe. It means a couple of things. It means that Europe has a very, very difficult time showing growth, showing any real momentum, and that has a clear drag on the U.S. economy," Whitney says.

There is, however, a bright side, at least for the U.S.

"But it also means another thing, and I think the Fed should be more straightforward with this: It means the U.S. looks like a much more stable liquidity pool. Long-term rates will stay lower for longer and the Fed has less to worry about. The Fed doesn't maybe need to be so proactive in terms of QE3 and whatnot, because long rates stay low because there is no other place to go," Whitney says, referring to quantitative easing (QE), an extraordinary monetary policy tool.

Since the downturn the Federal Reserve has slashed benchmark interest rates to near zero. The Fed has also purchased over $2.3 trillion in assets from banks, a liquidity-inducing measure known as quantitative easing.

The Fed has carried out quantitative easing in two rounds, and at the Fed's most recent monetary policy meeting and press conference, Fed Chairman Ben Bernanke has said he cannot rule out the possibility of rolling out a third round of quantitative easing, dubbed QE3 by the markets.

"We remain entirely prepared to take additional balance sheet actions if necessary to achieve our objectives," Bernanke said at a news conference, according to CNBC. "Those tools remain very much on the table, and we will not hesitate to use them should the economy require that additional support."

For Whitney, the Fed is playing politics by not being more straightforward that the economy probably doesn't need easing.

However, since easing pumps up stock markets as a side effect, investors are enjoying buying stocks on the notion that the Fed will be there should the market and economy tank.

"I think that the Fed is as political an organization as it has ever been, so they'll do whatever it takes stabilize and pacify the markets," Whitney says. "That does not mean that that's the best policy for the overall economy."

© 2012 Moneynews. All rights reserved.

No comments:

Post a Comment