---

I have written a 'booklet' and have asked my oldest granddaughter to illustrate it and her mother, an often published author in her own right, to edit same. It is entitled: " A CONSERVATIVE OFFERS SOME ELEVEN LESSONS FOR AMERICAS' YOUTH - BORN AND YET TO BE BORN!"

My granddaughter has sold several of her paintings (we own one) and is a beautiful, funky young lady. This is her web site: http://www.yandp.tv/2012/05/emma-darvick-illustrator-print-maker-avocado-lover/

---

This is for us old codgers!A MAGIC PIECE of HOLLYWOOD HISTORY that will never happen again... WOW!! WOW!! WOW!!

Around 1974, In celebration of the 50th Anniversary of MGM, almost all of the Stars of MGM (New & Old) get together for one final picture.... to never happen again. http://www.youtube.com/watch?v=FVLJpjdIhVk

---

Eviscerating our military but have no fear because Obama has assured us we are going to be just fine because sanctions and appeasement are mightier than the sword. (See 1 and 1a below.)

---

Faber see bad times ahead. (See 2 below.)

Spain before Greece? (See 2a below.)

Goldman sees deflation (See 2b below.)

Goldman sees deflation (See 2b below.)

---

No to Obamanomics! (See 3 below.)

Yes to Romneynomics! (See 3a below.)

Obama is so ideologically challenged he does not, cannot understand the damage his thinking does and policies do to the economy.

Last night Bernie Marcus was interviewed and laid out the simple case as to why the economy is not recovering, why unemployment remains on dead center and why we need to dump this Left Wing radical incompetent parading as a president.

When policies create uncertainty, as Obama's have, then you will not get capital investment because they restrain risk taking.

When you impose regulations you create strangulation. More uncertainty and cost and again why take the risk.

When you increase government growth and debt funding you compete with and crowd out capital for the private sector. Obama does not even understand something as basic as that because he is all about fairness, redistribution through government means and is anti-Capitalism.

Well Obama tried fairness as he stuffed tax money down the throats of his friends and we got Solyndra etc. He caused thousands of auto dealers to shut down and that contributed to lost employment as he sought to give unions a chunk of the nation's private corporate structure.

GM could have gone through bankruptcy and survived and been as or more productive today but Obama owed a debt to unions. He felt no such debt to the nation which was built by Capitalists who invested sweat equity, took risks and hired hard working Americans.

If by now, you do not understand why we are where we are then you need to take some basic economic courses and read some books starting with Rand and Hayek then pick up some ideas from Friedman and other free market advocates.

When we had less government intrusion we grew and prospered. Now we have more government and we retreat along with Europe. This is true in energy, education, health care and you name it.

Liberals do not understand this nor do they care because they are all about fairness, welfare, taxation and attacking Capitalism. They want to make the playing grounds level because they have all the answers.

Empirically speaking nearly everything they touch fails - Roosevelt and Wilson's Socialist policies, The Great Society and now Hope and Change which has proven to be Unmitigated Nonsense.

Neal Boortz's commencement address, which I re-posted in a previous memo, is an eye opener and if you did not read it you should because it is a wonderful response to the liberal dreamers and academics.

One day you might even buy and read my own booklet (yet unpublished but soon to be.) Though written for the young and unborn you are never too old to learn what you may not know. (See 4, 4a and 4b below.)

---

A new twist on Obama's theory of 'evolution." Based on Edward Klein's new book Michelle watches our president like a hawk for fear he will evolve into a Johnson-Kennedy-Clintonesque' womanizing president.

Obama has made a mockery out of just about everything else why not marriage? (See 5 below.)

---

Dick

1)Obama's eviscerating America's defense

By Frank J. Gaffney Jr.

Last week, President Obama told the latest graduates of the Air Force Academy that, despite massive cuts in defense spending being made by his administration, �We will maintain our military superiority in all areas � air, land, sea, space and cyber.�

This fits the meme being pushed by Team Obama as the campaign heats up. It is of a piece with the contention that the President has been so extraordinarily successful a Commander-in-Chief as to be unassailable politically with regard to his stewardship of national security and foreign policy.

As with his commitment to the newly minted Air Force officers, in the immortal words of Ira Gershwin, this narrative "ain't necessarily so."

Let's start with the promise of military superiority. Only someone completely oblivious - or indifferent - to what it takes to achieve and maintain superiority could make such a statement under present and foreseeable circumstances. The fact of the matter is that the nearly $800 billion already excised from the Pentagon budgets over the next 10 years has caused the evisceration of virtually every military modernization program previously on the books. Research and development accounts crucial to the next generation of weapons are being similarly savaged.

As a result, we will be lucky to be competitive with adversaries who are busily upgrading their forces, often in ways specifically designed to counter advantages we have. "Superiority" will, in important respects, likely be out of the question.

That is especially true if the defense budget is beset with yet the next $500 billion in cuts ordered by existing statute starting in January 2013. You might not know this train wreck is upon us from the lack of disclosure about the impact of such reductions in Defense Department planning documents. You can get a sense of the effects, however, from the Center for Security Policy's Defense Breakdown Reports (FortheCommonDefense.org). The Pentagon understandably worries about disclosing in advance ways in which this magnitude of harm would be accommodated lest a blueprint for making it so is provided.

As of this writing, unless some deus ex machina materializes like in a Greek drama too complicated to be resolved by mere mortals, the armed forces will not be spared from what the Joint Chiefs' chairman has called a "catastrophe."

Sadly, it seems increasingly unlikely that a consensus will be found during a contentious lame-duck session of Congress to negate the effects on our national security of the "sequestration" mechanism - a legislative device Secretary of Defense Leon E. Panetta has called a "doomsday machine" since it failed to compel Congress to find other ways of reducing the deficit. To be sure, leading Republicans, including House Budget Committee Chairman Paul Ryan, House Armed Services Committee Chairman Howard "Buck" McKeon and Senate Minority Whip Jon Kyl, have developed means of staving off this debacle for our armed forces. But neither Mr. Obama nor Senate Majority Leader Harry Reid want any part of them.

Some would have us take comfort in the fact that even at these reduced levels, the United States will spend more on defense than do our potential adversaries combined. Set aside uncertainties about exactly how much the Chinese and Russians are actually investing in amassing new weapons designed to kill Americans. (For example, does anyone really know how much China has spent to build 3,000 miles of hardened underground tunnels in which are concealed heavens only knows how many nuclear missiles?)

As with domestic law enforcement, the outlays involved in preserving the peace always vastly exceed the sums spent by those intent on disturbing it. Typically, the more decisively the former is resourced relative to the latter, the more likely it is that hostile parties will be dissuaded from threatening us or our interests. President Reagan dubbed this axiom "peace through strength."

History teaches that the alternative - the deliberate, systematic and sustained diminishing of our defense capabilities - only invites adversaries, who might otherwise be deterred, to act aggressively. Unfortunately, the present crop of such adversaries don't need any encouragement.

Consider just one example: Russia under Vladimir Putin. The Kremlin claims it will spend on the order of $700 billion to modernize its nuclear and conventional forces. At the same time, Mr. Obama is actively considering eliminating up to 80 percent of our deterrent and ensuring that little, if anything, is done to ensure that the remaining force remains viable, let alone superior, to new generations of Russian nuclear arms.

Mr. Obama is clearly proceeding under the influence of his favorite general, former Joint Chiefs Vice Chairman James "Hoss" Cartwright, who in a paper released on May 16 proclaimed that he believes we can safely eliminate one leg of our strategic triad and "de-alert" or shelve the weapons that would be left. Such notions are being promoted in the name of achieving "global zero" - a world without nuclear weapons. In practice, it will result in a world with many more such arms, including in all the wrong places, as friends and allies alike adjust to a denuclearizing America and the folding of its deterrent "umbrella."

Last week, one of our nation's most storied warriors, nonagenarian Maj. Gen. John Singlaub addressed a Center for Security Policy event in New York City. He spoke forcefully of the need for leadership and urged all of us to settle for nothing less. We require the real deal, now more than ever, with respect to our national security. We literally can accept no substitutes.

Frank J. Gaffney, Jr., Deputy Assistant Secretary of Defense for Nuclear Forces and Arms Control Policy in the Reagan Administration, heads the Center for Security Policy.

1a)

“Little by little, they stripped us of a lot of the people we had, key people,” Shanahan recounted recently. “By the time we were ready to get underway from the shipyard and go back to Norfolk, we didn’t have enough people. We didn’t have enough people in any of the departments, but mainly we didn’t have enough people in the engine room.”

Shanahan took the bold step of refusing to certify his ship as seaworthy. He warned his superiors long before his readiness reports. Yet when he deemed his warship not ready for combat, it came as a surprise to many in the military. Watch Captain Shanahan's story below:

1a)

America at Risk: Navy Faces Readiness Crisis Going into Combat

The year was 1979. America’s military had emerged from the Vietnam War earlier in the decade and was now facing sizable and significant budget cuts.

Capt. Tom Shanahan, commanding officer of the USS Canisteo, had just returned from the Mediterranean Sea and was now leading an overhaul of his fleet supply ship. Over the course of 10 months, the crew assigned to the Canisteo gradually disappeared, relocated by the Navy to other assignments. Those personnel cuts eventually left Shanahan with so few men that he couldn’t take his ship to sea.

“Little by little, they stripped us of a lot of the people we had, key people,” Shanahan recounted recently. “By the time we were ready to get underway from the shipyard and go back to Norfolk, we didn’t have enough people. We didn’t have enough people in any of the departments, but mainly we didn’t have enough people in the engine room.”

Shanahan took the bold step of refusing to certify his ship as seaworthy. He warned his superiors long before his readiness reports. Yet when he deemed his warship not ready for combat, it came as a surprise to many in the military. Watch Captain Shanahan's story below:

---------------------------------------------------------------------------------------------------------

2)Faber: It's a Sure Thing — Global Recession Lies Ahead

Global investors remain focused on Greece, where a messy exit from the eurozone could rattle the world economy.

However, there are bigger threats lurking on the horizon to which the world is turning a blind eye.

"As an observer of markets — whenever everyone focuses on one thing — like Greece and Europe — maybe they miss issues that are far more important — such as a meaningful slowdown in India and China," Faber tells CNBC.

Factory output in China has been weakening, Faber says, which should ring louder alarm bells than it has.

The HSBC Flash Purchasing Managers Index for China fell to 48.7 in May from 49.3 in April, the seventh straight month that the index has come in below 50, a level indicating a contracting economy.

Expect a broader reaction in the stock market as time goes on.

"There are more and more stocks that are breaking down — economic sensitive stocks and companies that cater to the high end," Faber says.

"That suggests to me the economy is likely to weaken, and the huge asset run is likely to come to an end with significant asset deflation."

"I think we could have a global recession either in Q4 or early 2013."

When asked what were the odds, Faber replies, "100 percent."

Turning to Europe, Faber says he doesn’t expect Greece to abandon the euro, at least in the near term, though such a move would offer market relief by ending agonizing uncertainty as to whether the country will stay or go.

"Although it wouldn’t be good for banks and insurance (stocks) in general I think markets are oversold and with an exit — markets will rally," Faber says.

Calls for all eurozone member nations to issue a single debt instrument, with all governments underwriting and financing the placement, have grabbed headlines lately.

The issuance of the so-called Euro Bonds would help ease debt burdens in beleaguered countries like Greece.

However, European paymaster Germany has been chilly to the idea on the grounds that it unfairly asks some countries to take on debts owed by others, would raise interest rates in healthy economies and would arguably encourage Greece and others to ramp up spending again now that Germany is shouldering more of the bailout.

Germany will likely come around and take part in such an issue, Faber says, as the alternative of Greece leaving and pressuring the larger Spain and Italy to consider following suit is too great a risk.

"What I think will happen is that Germany will show more flexibility and issue more Euro Bonds," says Faber, adding he likes dollar-denominated assets and gold for now.

Fears that the eurozone's economic woes will at least drag on the global economy at best persist.

The Paris-based Organization for Economic Co-operation and Development (OECD), a 34-member international economic organization, is forecasting global growth to come to 3.4 percent this year from 3.6 percent in 2011, though the fragile global economy could easily be blindsided.

"The global economic outlook is still cloudy," OECD Secretary General Angel Gurria told reporters recently after unveiling the organization's latest economic forecast, Reuters reports.

"At first sight the prospects for the global economy are somewhat brighter than six months ago. At closer inspection, the global economic recovery is weak, considerable downside risks remain and sizable imbalances remain to be addressed.

2a) Analyst: Spain May Leave Eurozone Before Greece

By Forrest Jones

The world is gnashing its teeth over the notion that Greece could exit the eurozone, dubbed by markets as a "Grexit."

Market observers should fret more over a "Spexit," one analyst says, as a Spanish withdrawal from the eurozone is more likely as the country is too big to bail out.

"The Spanish are a lot more likely to pull out of the euro than the Greeks, or indeed any of the peripheral countries," says Matthew Lynn of Strategy Economics on Wednesday, according to CNBC.

"They are too big to rescue, they have no political hang-ups about rupturing their relations with the European Union, they are already fed up with austerity, and there is a bigger Spanish-speaking world for them to grow into."

Greece received over $170 billion in bailout funding earlier this year from the European Commission, the European Central Bank and the International Monetary Fund, yet a Spanish bailout would cost a lot more due to the much larger size of the economy there.

Yields in Spanish bond auctions have soared as investors demand more in return for investing in the country, as concerns are building that an already financially strained government will undergo more duress propping up its banking sector and regional governments.

Plus the underlying economy is in shambles.

"One in four Spanish households now have no bread-winner. Retail sales are falling 10 percent year-on-year. Yet the prescription from Brussels and Berlin is precisely the same as it has been for every other country struggling with the euro. Endure a deep recession. Let unemployment rise. Allow wages to fall until you claw back competitiveness," Lynn tells CNBC, referring to unpopular austerity measures attached to bailout money financed indirectly by Germany or the Belgium-based European Commission.

Spanish financial institution Bankia has said it needs the euro equivalent of $24 billion in government assistance, prompting fears other banks will need bailing out as well, while the regional Catalonian government has said it needs help refinancing debts.

Meanwhile the economy remains mired in recession and unemployment approaching 25 percent.

"Without wishing to sound apocalyptic, it does feel as if Spain is gradually shuffling towards the abyss," says Chris Beauchamp, market analyst at IG Index, the Associated Press reports.

© 2012 Moneynews. All rights reserved.

2bDavid Goldman: ‘Extreme Risk’ of Deflation is Dead Ahead

Weak oil, gold and stock prices, rising demand for dollars and the likelihood of an implosion in Europe signal crippling deflation may strike the U.S. economy, says David Goldman of financial research firm Macrostrategy.

"It’s an extreme risk, though I don’t think it’s an inevitable outcome,” Goldman tells CNBC’s “The Kudlow Report."

Greece and Spain are coming under increasing financial duress as the debt crisis heats up, and should one find the strain of austerity measures and hefty debt burdens too much to endure and abandon the eurozone, a domino effect could ensue and push the continent and then the U.S. into a deflationary spiral.

"We have the first major OECD economy, namely Spain, which is going to implode to the point that, for example, bank senior debt is likely to be wiped out," Goldman says, referring to the Paris-based Organization for Economic Cooperation and Development (OECD), a 34-member international economic organization.

"That simply hasn’t happened in the postwar period to any major economy."

Should Greece or Spain decide eurozone membership is too painful, the larger France would suffer “because the French banks own the Spanish bank debt,” Goldman adds.

"There’s virtually perfect, 100 percent correlation between stock market, oil prices, gold prices, all of these things, treasury bonds," Goldman tells the network.

"It’s all moving together because people are moving out of risk."

U.S. monetary policy officials, meanwhile, are urging Europe to react and do so quickly.

"It's a grave situation indeed," Federal Reserve Bank of St. Louis President James Bullard told reporters in Japan, according to MarketWatch

The European situation "is driving U.S. and Japanese equity markets down," Bullard says.

"It has also caused a tremendous flight to safety, which has sent government bond yields here (in Japan) and the U.S. and in Germany to record lows."

Europe must focus on fixing fiscal imbalances instead of using monetary policy tools such as quantitative easing — central bank liquidity injections into the financial system designed to spur growth and hiring and steer an economy away from deflationary decline.

The U.S. could resort to quantitative easing, an unconventional monetary policy tool, should the need arise but for now, the tool should remain on hold.

"I do think our most potent weapon as a committee is to do further quantitative easing. But if we take such action, we'd be taking more risk with our balance sheet. I think right now we've got the right trade-off," Bullard says.

2bDavid Goldman: ‘Extreme Risk’ of Deflation is Dead Ahead

By Forrest Jones

Weak oil, gold and stock prices, rising demand for dollars and the likelihood of an implosion in Europe signal crippling deflation may strike the U.S. economy, says David Goldman of financial research firm Macrostrategy.

"It’s an extreme risk, though I don’t think it’s an inevitable outcome,” Goldman tells CNBC’s “The Kudlow Report."

Greece and Spain are coming under increasing financial duress as the debt crisis heats up, and should one find the strain of austerity measures and hefty debt burdens too much to endure and abandon the eurozone, a domino effect could ensue and push the continent and then the U.S. into a deflationary spiral.

"We have the first major OECD economy, namely Spain, which is going to implode to the point that, for example, bank senior debt is likely to be wiped out," Goldman says, referring to the Paris-based Organization for Economic Cooperation and Development (OECD), a 34-member international economic organization.

"That simply hasn’t happened in the postwar period to any major economy."

Should Greece or Spain decide eurozone membership is too painful, the larger France would suffer “because the French banks own the Spanish bank debt,” Goldman adds.

"There’s virtually perfect, 100 percent correlation between stock market, oil prices, gold prices, all of these things, treasury bonds," Goldman tells the network.

"It’s all moving together because people are moving out of risk."

U.S. monetary policy officials, meanwhile, are urging Europe to react and do so quickly.

"It's a grave situation indeed," Federal Reserve Bank of St. Louis President James Bullard told reporters in Japan, according to MarketWatch

The European situation "is driving U.S. and Japanese equity markets down," Bullard says.

"It has also caused a tremendous flight to safety, which has sent government bond yields here (in Japan) and the U.S. and in Germany to record lows."

Europe must focus on fixing fiscal imbalances instead of using monetary policy tools such as quantitative easing — central bank liquidity injections into the financial system designed to spur growth and hiring and steer an economy away from deflationary decline.

The U.S. could resort to quantitative easing, an unconventional monetary policy tool, should the need arise but for now, the tool should remain on hold.

"I do think our most potent weapon as a committee is to do further quantitative easing. But if we take such action, we'd be taking more risk with our balance sheet. I think right now we've got the right trade-off," Bullard says.

-----------------------------------------------------------------------------------------------------------

3) A No Confidence Vote For Obamanomics

INVESTOR'S BUSINESS DAILY

Economy: Consumer confidence took a "surprise" tumble in May, as home prices

hit 10-year lows. Tell us again why economists keep calling bad economic

news about Obama's so-called recovery "unexpected"?

Analysts had predicted the Conference Board's Consumer Confidence Index

would climb to 70 in May. Instead it dropped more than four points to 64.9,

the biggest drop since last fall.

It's the latest in another round of disappointing numbers. Just a few weeks

ago, new jobs came in "unexpectedly" low. And before that, GDP data

disappointed.

Underperforming economic indicators have been so common under Obama that the

only mystery is why the experts keep getting caught off guard.

In the case of the Consumer Confidence Index, the current number - bad as it

is - doesn't even tell the whole story.

First, it's worth noting the index has fallen for three months. Even if it

had hit forecasts, it would still be well below 90, which signals a healthy

economy.

The current reading is worse when you realize that under President Bush -

you know, the guy who Obama says ruined the economy - confidence averaged

88.

That's despite two recessions, a terrorist massacre and two long wars.

Throughout Obama's "recovery," the index has averaged 57.

To really get a sense of how dismal Obama's confidence ratings have been,

you need to compare them to those during the Reagan recovery (for a visual

display, see chart).

The 1981-82 recession lasted almost as long as the last one - 16 months vs.

18 months - and pushed unemployment higher. Yet confidence roared back as

Reagan's economic policies powered a strong and sustained recovery, with the

index topping 100 most months.

What reason do people have to feel confident today?

Almost three years into the recovery, unemployment is still above 8%,

household incomes are down more than 5%, gasoline prices remain at historic

highs, and the economy can only eke out meager gains.

On top of this, we learned this week that housing prices are back at their

mid-2002 levels. So, naturally, Obama's again making excuses and shifting

blame.

It's the fault of the long recession, he says. The economy is still facing

"head winds." The GOP is "standing in the way" of his new stimulus spending

plans and creating "uncertainty" with its calls for more spending cuts in

exchange for another debt ceiling increase.

The real reason the economy is so vulnerable to "head winds" is because

Obama's recovery has been so lousy. That has nothing to do with the

recession, since deep recessions are typically followed by even more

powerful recoveries.

Indeed, the only reason the economy continues to struggle for breath is

because Obama continues to choke off its air supply. Even now, he has no

clue how his policy prescriptions of vast new federal spending, gargantuan

debt, massive regulation, a government health care takeover, and endless

bashing of businessmen, profits and the "rich" are hampering growth.

Still, we are confident of one thing. The economy will come roaring back to

life once all that stops.

Economy: Consumer confidence took a "surprise" tumble in May, as home prices

hit 10-year lows. Tell us again why economists keep calling bad economic

news about Obama's so-called recovery "unexpected"?

Analysts had predicted the Conference Board's Consumer Confidence Index

would climb to 70 in May. Instead it dropped more than four points to 64.9,

the biggest drop since last fall.

It's the latest in another round of disappointing numbers. Just a few weeks

ago, new jobs came in "unexpectedly" low. And before that, GDP data

disappointed.

Underperforming economic indicators have been so common under Obama that the

only mystery is why the experts keep getting caught off guard.

In the case of the Consumer Confidence Index, the current number - bad as it

is - doesn't even tell the whole story.

First, it's worth noting the index has fallen for three months. Even if it

had hit forecasts, it would still be well below 90, which signals a healthy

economy.

The current reading is worse when you realize that under President Bush -

you know, the guy who Obama says ruined the economy - confidence averaged

88.

That's despite two recessions, a terrorist massacre and two long wars.

Throughout Obama's "recovery," the index has averaged 57.

To really get a sense of how dismal Obama's confidence ratings have been,

you need to compare them to those during the Reagan recovery (for a visual

display, see chart).

The 1981-82 recession lasted almost as long as the last one - 16 months vs.

18 months - and pushed unemployment higher. Yet confidence roared back as

Reagan's economic policies powered a strong and sustained recovery, with the

index topping 100 most months.

What reason do people have to feel confident today?

Almost three years into the recovery, unemployment is still above 8%,

household incomes are down more than 5%, gasoline prices remain at historic

highs, and the economy can only eke out meager gains.

On top of this, we learned this week that housing prices are back at their

mid-2002 levels. So, naturally, Obama's again making excuses and shifting

blame.

It's the fault of the long recession, he says. The economy is still facing

"head winds." The GOP is "standing in the way" of his new stimulus spending

plans and creating "uncertainty" with its calls for more spending cuts in

exchange for another debt ceiling increase.

The real reason the economy is so vulnerable to "head winds" is because

Obama's recovery has been so lousy. That has nothing to do with the

recession, since deep recessions are typically followed by even more

powerful recoveries.

Indeed, the only reason the economy continues to struggle for breath is

because Obama continues to choke off its air supply. Even now, he has no

clue how his policy prescriptions of vast new federal spending, gargantuan

debt, massive regulation, a government health care takeover, and endless

bashing of businessmen, profits and the "rich" are hampering growth.

Still, we are confident of one thing. The economy will come roaring back to

life once all that stops.

3a)Romney's Historic Opportunity: Low-Cost Energy Fuels Economic Recovery

Energy, the lifeblood of the economy, is the Achilles heel of President Barack Obama. Mitt Romney can win the November election if he concentrates his campaign on a sensible energy policy.

Mr. Romney will have to make a case not merely against Mr. Obama's failings but also for why he has the better plan to restore prosperity.

As a presumed candidate for the U.S. presidency, Romney should spell out now a coherent policy of low-cost and secure energy that would boost the U.S. economy, ensure jobs and prosperity, and raise people up from poverty. Fundamentally, he and his surrogates must educate and inspire the public.

He should pledge specific goals: lower gasoline prices, cheaper household electricity, cheaper fertilizer for farmers and lower food prices for everybody, cheaper transport fuels for aviation and for the trucking industry, lower raw material costs for the chemical industry. He should also indicate the kind of people who would be part of his team, who would fill the crucial posts and carry out these policies. His running mate should have a record of endorsing these goals.

Obama has made it easy for Romney

It's a winning situation for Romney; Obama has already provided him most of the ammunition:

*Under Obama, the price of gasoline has more than doubled, from $1.80 (U.S. average), and is approaching $5 a gallon. His secretary of energy, Dr. Chu, wanted the price to rise to "European levels of $8 to $10." The rise in gas prices is really hurting the middle class, and particularly the two-car couples who must commute to work. Yet everything Obama has done or is doing is making the situation worse.

*He has vetoed the Keystone pipeline, which would have brought increasing amounts of oil from Canada to Gulf-Coast refineries, created "shovel-ready" jobs, and improved energy security.

*He has kept much federal land off-limits for oil and gas production -- particularly in Alaska and offshore. The Alaska pipeline is in danger of running dry. Even where exploration is permitted, drilling permits are hard to obtain because of bureaucratic opposition.

*To Obama, oil is a "fuel of the past" -- not so to millions of drivers. He's looking to put algae in their gas tanks -- the latest bio-fuel scheme! In his 2008 campaign, Obama promised that under his regime, electricity prices would "skyrocket." He seems to have kept his promise -- with help from the misguided "Renewable Electricity Standard," which mandates utilities to buy costly "green" energy from solar/wind projects and effectively become tax-collectors. He also promised that potential builders of coal-fired power plants would go "bankrupt." That too would happen, thanks to extreme, onerous EPA regulation.

*The latest EPA plan would stop the construction of new coal-fired power plants by setting impossible-to-obtain emission limits for carbon dioxide. True, the EPA has made exceptions if the power plant can capture and sequester the emitted CO2, but the technology to do this is not available, and its cost would be prohibitive anyway.

*It seems likely that, if Obama is re-elected, his EPA will use the CO2 excuse to close down also existing coal-fired plants -- and may not permit the construction of any fossil-fueled power plants, including even those fired by natural gas, which emits only about half as much CO2 as coal. The Calif PUC has already banned gas plants (on April 19, 2012) in order to reach its unrealistic goal of 33% green electricity.

*One can see the signs of impending EPA efforts to stop the exploitation of shale gas by horizontal drilling, using the claim that "fracking" causes water pollution.

The only explanation for this irrational behavior: the Obama administration, from top to bottom, seems possessed by pathological fear of catastrophic global warming and obsessed with the idea that no matter what happens to the economy or jobs, it must stop the emission of CO2.

The starkest illustration of this came in his [Obama's] answers to questions about climate change in which he promised to make this article of faith for the left a central issue in the coming campaign. This may play well for the readers of Rolling Stone. But given the growing skepticism among ordinary Americans about the ideological cant on the issue that has spewed forth from the mainstream media and the White House, it may not help Obama with independents and the working class voters he needs as badly in November as the educated elites who bludgeoned him into halting the building of the Keystone XL pipeline. This conflict illustrates the contradiction at the core of the president's campaign. [Commentary Magazine 4-26-12]

The situation is tailor-made for Romney to launch an aggressive campaign to counter current energy policy -- and the even worse one that is likely to be put in place if Obama is re-elected.

What Romney must do to win the November election

Romney has to make it quite clear to potential voters why low-cost energy is absolutely essential for economic recovery, for producing jobs, and for increasing average income -- especially for the middle-class family, which is now spending too much of its budget on energy essentials. Romney should hold out the entirely realistic prospect of U.S. energy independence -- often promised, but never before achieved -- or even of the U.S. becoming an energy exporter.

What Romney must do to win the November election

Romney has to make it quite clear to potential voters why low-cost energy is absolutely essential for economic recovery, for producing jobs, and for increasing average income -- especially for the middle-class family, which is now spending too much of its budget on energy essentials. Romney should hold out the entirely realistic prospect of U.S. energy independence -- often promised, but never before achieved -- or even of the U.S. becoming an energy exporter.

*Romney can confidently promise to reduce the price of gasoline to $2.50 a gallon or less, with a gracious tip of the hat to Newt Gingrich, who had proposed such a goal in one of his campaign speeches. To accomplish this, the world price of oil would have to fall below $60 a barrel from its present price of $110.

*But this bright energy promise is entirely possible due to the low price of natural gas, which has fallen to $2 from its 2008 peak of $13 per mcf (1,000 cubic feet) -- and is still trending downward. All that Romney has to do is remove to the largest extent possible existing regulatory roadblocks.

It is essential to recognize three important economic facts:

*Since many of the newly drilled wells also produce high-value oil and NGL (natural gas liquids), natural gas becomes a byproduct that can be profitably sold at even lower prices.

*Natural gas currently sells for less than 15% of the average price of crude oil, on an energy/BTU basis. This means that it pays to replace oil-based fuels, such as diesel and gasoline, with either liquefied natural gas (LNG) or compressed natural gas (CNG). This may be the most economical and the quickest replacement for heavy road-vehicles, earthmovers, diesel-electric trains, buses, and fleet vehicles.

*It also becomes profitable to convert natural gas directly to gasoline or diesel by chemical processing in plants that are very similar to refineries. Forget about methanol, hydrogen, and other exotics. Such direct conversion would use the existing infrastructure; it is commercially feasible, the technology is proven, and the profit potential is evident -- even if the conversion efficiency is only modest -- say, 50%.

Thanks to cheap natural gas, Romney's promise for lower gasoline prices is easily fulfilled: with reduced demand and increased supply globally, the world price of oil will decline, and so will the price of transportation fuel. So by satisfying transportation needs for fuel, it should be possible to reduce, rather quickly, oil imports from overseas; at present, 60% of all imports (in $) are for oil. At the same time, oil production can be increased domestically and throughout North America. The U.S. is on its way to become not only energy-independent, but also an exporter of motor fuels -- with a huge improvement in its balance of payments.

Billionaire oilman Harold Hamm, CEO of Continental Resources and discoverer of the prolific Bakken fields of the northern Great Plains, complains about current energy policy that's holding back development. "President Obama is riding the wrong horse on energy," he adds in an interview with Stephen Moore. We can't come anywhere near the scale of energy production to achieve energy independence by pouring tax dollars into "green energy" sources like wind and solar. It has to come from oil and gas. Hamm is an energy advisor to Romney. Similarly, Governor Bob McDonnell, intent on making Virginia the energy capital of the East Coast by developing offshore oil and gas, complains, in a WSJ op-ed, that Obama's words are "worlds apart from his actions."

Another promise Romney can confidently make is that he will cut the price of electricity in half -- or even lower. This promise can be fulfilled not only by the low price of natural gas but also by the much higher efficiency of gas-fired power plants that can easily reach 60% or more, compared to the present 35%-40% for nuclear or coal-fired plants. Higher efficiencies reduce not only the cost of fuel (per kilowatt-hour), but effectively lower the capital cost (per kilowatt).

Efficiencies can be raised even higher with "distributed" electric generation, if such gas-fired power plants are located in urban centers where co-generation becomes an attractive possibility. This would use the low-temperature heat that is normally discharged into the environment (and wasted) to provide hot water for space heating and many other applications of an urban area: snow and ice removal, laundry, and even cooling and water desalination. Again, this is proven technology, and the economics may be very favorable. Distributed generation also improves security (against terrorism) and simplifies the disposal of waste heat.

Low-cost natural gas can also provide the basic raw material for cheap fertilizer for farmers, thus lowering food prices, and feedstock for chemical plants for cheaper plastics and other basic materials. Industries can now return to the United States and provide jobs locally -- instead of operating offshore, where natural gas has been cheap.

With the exploitation of the enormous gas-hydrate resource in the offing, once the technology is developed, the future could not look brighter. Somehow, Romney must convey this optimistic outlook to the voting public.

"Natural gas is a feedstock in basically every industrial process," and the price of gas in the U.S. is a fraction of what it is in Europe or Asia. "This country has an incredible advantage headed its way as Asian labor costs rise, as the cost to transport goods from Asia to the U.S. rises, as oil prices rise, as American labor costs have stagnated or gone down in the last 10 years. We have a really wonderful opportunity to kick off an industrial renaissance in the U.S." (Aubrey McClendon, CEO of Chesapeake Energy, WSJ 4-26-12)

Slaying the "Green Dragon"

Romney should speak out on the "hoax" (to use Senator Inhofe's term) of climate catastrophes from rising CO2 levels. He should also make it clear that there is no need for large-scale wind energy or solar electricity -- and even the construction of nuclear plants can be postponed. Many environmentalists will be relieved to avoid covering the landscape with solar mirrors, windmills, and -- yes -- hundreds of miles of electric transmission lines and towers.

In his book Throw Them All Out, Peter Schweizer reports that 80% of the Department of Energy's multi-billion green loans, loan guarantees, and grants went to Obama backers. Romney should proclaim that there will be no more Solyndras or other boondoggles, and no need for government subsidies for "green energy" or for crony capitalism. The marketplace will decide the future of novel technologies, such as electric cars, solar devices, etc. Many Washington lobbyists will lose their cushy jobs.

There's absolutely no need for bio-fuels, either. Yes, that includes algae as well as ethanol, which is now consuming some 40% of the U.S. corn crop. The world price of corn has tripled in the past five years -- even as the EPA plans to increase the ethanol percentage of motor fuels from 10% to 15%! True environmentalists are well aware of the many drawbacks of bio-fuels, among them the damage they do to croplands and forests in the U.S. and overseas and to the vast areas they require that could be devoted to natural habitats.

Finally, Romney should make it clear that if elected, he will appoint a secretary of energy, secretary of interior, administrator of NOAA, and administrator of the EPA who share his convictions about energy. Above all, he should recruit a White House staff, including a science advisor, who will bring the promise of low-cost, secure energy to the American economy.

Perhaps the WSJ (April 27) said it all: "Did you like the past four years? Good, you can get four more."

S. Fred Singer is professor emeritus at the University of Virginia and director of the Science & Environmental Policy Project. His specialty is atmospheric and space physics. An expert in remote sensing and satellites, he served as the founding director of the US Weather Satellite Service and, more recently, as vice chair of the US National Advisory Committee on Oceans & Atmosphere. He is a senior fellow of the Heartland Institute and the Independent Institute. Though a physicist, he has taught economics to engineers and written a monograph on the world price of oil. He has also held several government positions and served as an adviser to Treasury Secretary Wm. Simon. He co-authored NY Times bestseller Unstoppable Global Warming: Every 1500 years. In 2007, he founded and has chaired the NIPCC (Nongovernmental International Panel on Climate Change), which has released several scientific reports (see www.NIPCC.org).

---------------------------------------------------------------------------------------------------------------------------------

4)Car Battery Start-Ups Fizzle

Armed With $1.26 Billion in U.S. Grants, Firms Opened Nine Factories; Jobs and Production Lag Goals

By MIKE RAMSEY

Since 2009, the Obama administration has awarded more than $1 billion to American companies to make advanced batteries for electric vehicles. Halfway to a six-year goal of producing one million electric and plug-in hybrid vehicles, auto makers are barely at 50,000 cars.

The money funded nine battery plants—scattered across the U.S. from Michigan to Pennsylvania and Florida—that have few customers, operate well below capacity and, so far, have created less than a third of the jobs promised by 2015. Customers including start-up Fisker Automotive Inc. and auto makers like General Motors Co.GM -0.31% that urged the funding have struggled to produce and sell battery-powered cars, though they insist a market is coming.

President Obama heralded the "birth of an entire new industry" during the ceremonial opening of A123 Systems Inc.'s AONE -9.65% production plant in 2010. The president's 2013 budget proposal asks for an increase in tax credits to car buyers to amp sales.

Getting to that electric-car nirvana is proving more difficult. A123 is scrambling to stanch losses and raise new money to stabilize its finances. Rival Johnson Controls Inc.JCI -1.21% used government grants to build a battery plant in Holland, Mich., but that facility is nearly idled now after its main customer went bankrupt. Korea's LG Chem built a plant in Michigan to supply General Motors, but that plant, which employs 220 people, hasn't yet begun production, a company spokesman confirmed.

What happened? The U.S. provided grants that tied the battery makers to aggressive timetables, requiring each to achieve production and staffing targets that would supply tens of thousands of vehicles a year. But those production timetables weren't linked to market demand, leading to a shakeout among suppliers.

The mismatch between production and market demand has resulted in one casualty. Ener1 Inc., a battery maker that built a plant in Indianapolis with $54.9 million of a $118 million government grant, sought bankruptcy protection earlier this year. It has since exited Chapter 11 and its plant is operating, a spokesman said, albeit with 250 workers, well short of the 1,700 originally envisioned in 2009.

The Department of Energy, which oversees the administration's advanced battery grants, says it is too early to judge the effort, and believes it will bear fruit when electric cars become a regular sight on American highways.

"We are trying to build the infrastructure for the American battery industry," said David Sandalow, the acting undersecretary of energy, in an interview. "Short-term trends can be important, but let's keep our eye on the medium and long term." The White House deferred comments to the DOE.

Mr. Sandalow said that one or more bankruptcies among companies developing a new technology isn't uncommon or indicative that there isn't promise.

Short-Circuit

Only two companies met hiring goals, jobs pledged/hired.

- A123 SYSTEMS: 3,000/800

- LG CHEM: 300/200

- JOHNSON CONTROLS: 320/95

- SAFT AMERICA: 280/160

- DOW KOKAM: 320/90

- EXIDE: 250/60

- GENERAL MOTORS: 100/100

- ENER1: 1,700/250

- EAST PENN. MFG. 150/225

Source: the companies

Part of the problem was that strict timetables left little room for the market to mature. A123's $249 million matching grant required it to build facilities that could make at least 500 megawat-hours of lithium-ion battery capacity a year by this November—the equivalent of supplying 21,000 Nissan Leaf electric-cars. Nissan Motor Co.7201.TO -1.17% has sold about 12,000 Leafs in the U.S. since the end of 2010.

A123's grant set out a specific sequence for the hiring of engineers and ordering of equipment. The company was required to report on each step to the DOE, according to its August 2009 grant. All funds were expected to be used by Nov. 30. In April, A123, which had to recall some of its batteries, was given a two-year extension.

A123, which has been trying to raise cash through a private debt offering, said in a regulatory filing Wednesday that its losses and cash burn "raise substantial doubt on the company's ability to continue as a going concern."

"The goals that were tied to the grants said you have to ramp up this quickly, and those goals were overly optimistic," said John Gartner, an analyst who follows the electric-vehicle market for Boulder, Colo.-based Pike Research. "The market was never going to develop it as quickly as the DOE expected. It's kind of out of alignment with reality. The whole goal of 1 million electric vehicles [by 2015], there is just no way that is going to happen."

Carter Driscoll, an analyst who specializes in researching alternative energy companies for CapStone Investments, blames the administration's insistence on quickly setting up and staffing these operations for the current troubles. "It was about making jobs in certain areas. It wasn't market driven. There is going to be a [jobs] fallback," said Mr. Driscoll.

Some battery makers say they knew there wouldn't be enough demand for all the grant recipients to thrive early on. "We anticipated that this thing was going to be slow," said Alex Molinaroli, president of Johnson Controls' battery division. Consolidation among the fledgling battery makers, he said, "has to happen."

But while Johnson Controls' advanced battery plant isn't profitable, and Mr. Molinaroli doubts any of the new U.S. battery plants are, he said other countries, including China, are ramping up advanced battery production in anticipation that electric vehicles will eventually take off.

The U.S. would have been left out of the emerging market, he said. Without the money from the U.S. government, "we would have built this plant. We just would have built it somewhere else," Mr. Molinaroli said.

All told, the administration awarded $1.26 billion in matching grants toward the construction of these plants with the promise of creating more than 6,400 jobs. To date, the companies have spent about two-thirds of the total and have hired about 2,000 workers.

Bryan Hansel, chief executive of Smith Electric Vehicles Inc., a Kansas City, Mo., maker of electric delivery vans that use A123 batteries, said battery manufacturing capacity is "overbuilt substantially" right now, and suggested battery makers will struggle during the next two years.

But he also sees a "silver lining," noting that the construction of the battery plants "did give confidence to auto companies to move forward with electric vehicles."

Auto makers say they aren't backing off plans to produce electric cars despite sluggish sales so far. Nissan has sold a little more than 2,100 Leaf electric cars through the first four months of this year, though it expects to sell 20,000 by year-end.

GM once hoped to sell 45,000 Chevrolet Volts this year, but has said it would no longer stick to that outlook. In the first four months of this year, GM has sold about 5,700 Volts. Ford Motor Co. F -0.75% also is introducing plug-in electric models this year, but executives have played down sales expectations, focusing instead on the fact that it didn't cost much to build them. Its so-called EV cars are versions of gasoline-engine models.

Likewise, Toyota Motor Corp.7203.TO -1.14% is releasing three plug-in vehicles in the U.S., but executives have been openly skeptical about demand and say they expect to sell about only 15,000 a year. It sold 1,700 plug-ins and nearly 24,000 Prius hybrids in April.

Nissan has said it plans to sell up to 150,000 Leafs a year after 2013 and borrowed $1.3 billion from the Department of Energy to build a battery plant and manufacturing line in Smyrna, Tenn. Its battery plant, which will be finished in September, will be capable of making 200,000 battery packs a year—more than all other battery plants in the U.S.

"Anyone trying to write the obituary for electric cars is doing it too soon," said David Reuter, a Nissan spokesman. "We expect demand to continue to grow.

4a)U.S. Economic Momentum Slows

By ERIC MORATH And TOM BARKLEY

The number of Americans applying for unemployment benefits rose for the fourth straight week while first-quarter growth was revised lower, the latest signs that the economy is losing momentum.

A separate report showed private businesses hired at a very modest pace this month, further indication that overall employment growth will be tepid when the government releases its broadest reading of the labor market on Friday.

Initial jobless claims rose by 10,000 to seasonally adjusted 383,000 in the week ended May 26, the Labor Department said Thursday. It was the biggest jump in claims since the first week of April and above expectations of economists surveyed by Dow Jones Newswires for 370,000 new claims."While the recovery has remained largely on track, it continues to struggle to generate sufficient positive momentum to make any meaningful progress in absorbing the significant amount of slack," said Millan Mulraine, an analyst with TD Securities USA.

Claims for the week ended May 19 were upwardly revised to 373,000 from the initially reported 370,000.

The four consecutive weeks of increased unemployment applications lowers hopes that May's payroll reading will be a significant improvement from the 115,000 jobs added in April. Generally, declining layoffs coincides with increased hiring.

"The labor market has stabilized but no longer appears to be strengthening," said Steven A. Wood, chief economist with Insight Economics LLC.

Economists predict the economy added 155,000 jobs in May and forecast the unemployment rate to remain unchanged at 8.1%.

Reinforcing expectations for lackluster growth, U.S. private-sector jobs increased by only 133,000 in May, according to a report from payroll processor Automatic Data Processing Inc. and consultancy Macroeconomic Advisers.

The gain was below economists' expectations of 150,000 and only slightly above April's revised figure of 113,000.

Separately, a Commerce Department report showed the economy slowed more than initially thought in the first quarter.

Gross domestic product, the broadest measure of all the goods and services produced in an economy, increased at a 1.9% annual rate from January through March. A month ago, Commerce estimated a 2.2% gain.

The economy has cooled off since expanding at the fastest pace in a year and a half in the final quarter of 2011, with a 3.0% growth rate. But the fourth-quarter acceleration was driven partly by companies aggressively restocking inventories to catch up with demand.

Thursday's report showed the inventory buildup was even less than expected in the first quarter, with the contribution to GDP falling to just 0.2 percentage point from 0.6 percentage point.

Consumer spending was also slightly weaker than expected, rising 2.7% instead of 2.9% as initially thought. Still, that marked the biggest gain in consumption since the fourth quarter of 2010. Declining government spending also dragged on growth.

In a positive sign, companies registered their biggest quarterly gain in profits since the end of 2009. Corporate profits--after tax and unadjusted for inventories and capital consumption--increased at an 11.7% annual rate from the previous quarter. Profits were up 14.8% year on year in the first quarter, Commerce said.

"That consumer and business spending are now the main growth drivers...is an encouraging sign, but policymakers will remain wary that the economy is vulnerable to negative shocks," said Peter Newland, an analyst with Barclays Bank PLC.

—Kathleen Madigan, Jeffrey Sparshott and Andrew Ackerman contributed to this article.4b)Reality Check: Entitlement Spending Dwarfs Wars Since 2001

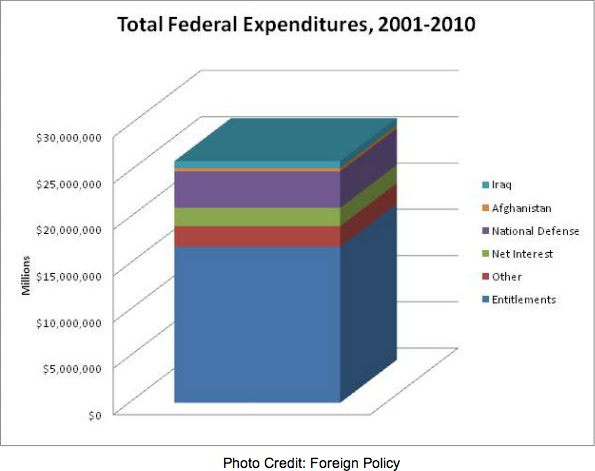

Some bad news for the vehement anti-war set: they've lost the spending argument. A new chart reveals that in the last decade, spending on national security, Iraq, and Afghanistan combined paled in comparison to entitlement spending -- 19% to 65%, respectively. Over to you, infographic:

"About 65 percent of federal expenditures over the last ten years have gone towards entitlements,"Paul Miller writes. "By comparison, about 15 percent has gone towards national defense, excluding the wars in Iraq and Afghanistan. Iraq has cost three percent, and only about one percent has gone towards the war in Afghanistan (including the cost of ongoing military operations and all reconstruction and stabilization assistance combined), according to my analysis of figures from OMB."In other words, Miller says, "Afghanistan is the second-cheapest major war in U.S. history as a percentage of GDP, according to the Congressional Research Service."

And of course, it's worth noting that war spending is about to decline, as our efforts abroad wind down, but entitlement spending will only grow as more people retire. For all President Obama's talk of a cheaper, "leaner" military, that's clearly not the area in need of a trimming.

----------------------------------------------------------------------------------------------------------------------------------5)Dear Mr. Obama,

I learned that you have 'evolving' views on marriage. Just so I am in full understanding, you are saying you no longer believe that marriage is a sacred union between a man and a woman. If it is now open to interpretation then what is it?

At the San Francisco Marriage Counter .........

"Next."

"Good morning. We want to apply for a marriage license."

"Names?"

"Tim and Jim Jones."

"Jones?? Are you related?? I see a resemblance."

"Yes, we're brothers."

"Brothers?? You can't get married."

"Why not?? Aren't you giving marriage licenses to same gender couples?"

"Yes, thousands. But we haven't had any siblings. That's incest!"

"Incest?" No, we are not gay."

"Not gay?? Then why do you want to get married?"

"For the financial benefits, of course. And we do love each other. Besides, we don't have any other prospects."

"But we're issuing marriage licenses to gay and lesbian couples who've been denied equal protection under the law. If you are not gay, you can get married to a woman."

"Wait a minute. A gay man has the same right to marry a woman as I have. But just because I'm straight doesn't mean I want to marry a woman. I want to marry Jim."

"And I want to marry Tim, Are you going to discriminate against us just because we are not gay?"

"All right, all right. I'll give you your license. Next."

"Hi. We are here to get married."

"Names?"

"John Smith, Jane James, Robert Green, and June Johnson."

"Who wants to marry whom?"

"We all want to marry each other."

"But there are four of you!"

"That's right. You see, we're all bisexual. I love Jane and Robert, Jane loves me and June, June loves Robert and Jane, and Robert loves June and me. All of us getting married together is the only way that we can express our sexual preferences in a marital relationship."

"But we've only been granting licenses to gay and lesbian couples."

"So you're discriminating against bisexuals!"

"No, it's just that, well, the traditional idea of marriage is that it's just for couples."

"Since when are you standing on tradition?"

"Well, I mean, you have to draw the line somewhere."

"Who says?? There's no logical reason to limit marriage to couples.

The more the better. Besides, we demand our rights! The mayor says the constitution guarantees equal protection under the law. Give us a marriage license!"

"All right, all right. Next."

"Hello, I'd like a marriage license."

"In what names?"

"David Deets."

"And the other man?"

"That's all. I want to marry myself."

"Marry yourself?? What do you mean?"

"Well, my psychiatrist says I have a dual personality, so I want to marry the two together. Maybe I can file a joint income-tax return."

"That does it!? I quit!!? You people are making a mockery of marriage!!"

So Mr. Obama, exactly how evolved are you???

------------------------------------------------------------------------------------------------------------------------------------

![[BATTERY]](http://si.wsj.net/public/resources/images/MK-BU624_BATTER_DV_20120529171745.jpg) Fabrizio Costantini for the Wall Street Journal

Fabrizio Costantini for the Wall Street Journal

No comments:

Post a Comment